Loss ratios for property insurance, such as. The remaining 40% of your premium dollar is spent on “expenses” such as claims handling, insurance company filing fees, taxes, overhead, agent commissions, and attorney fees.

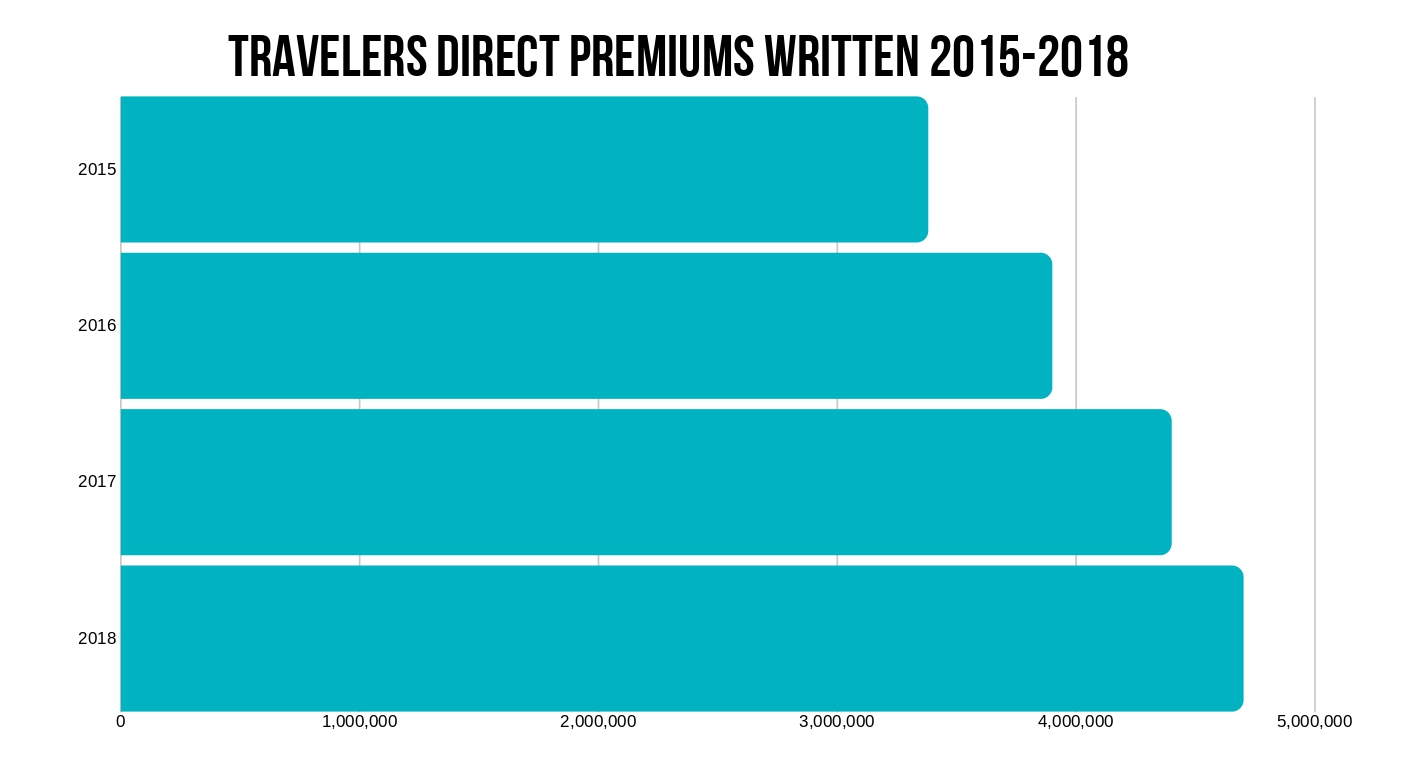

Travelers Auto Insurance Review (2021)

Income earned during the year.

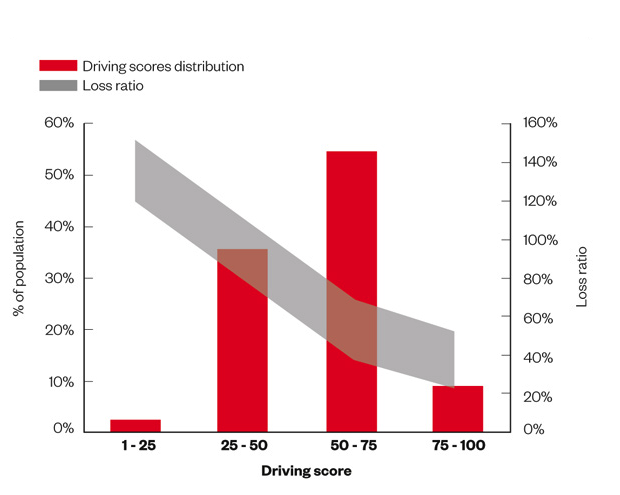

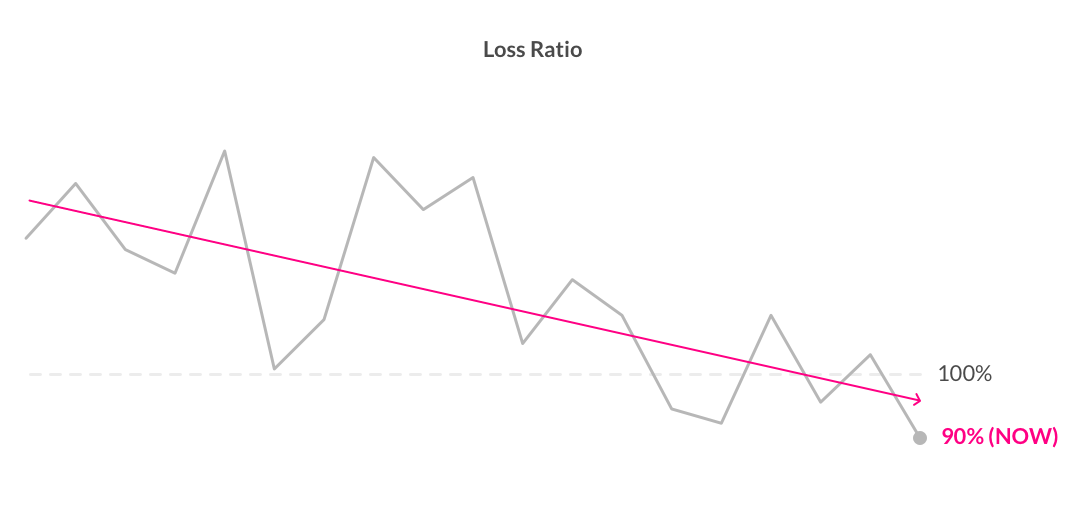

What is a good loss ratio for insurance companies. Loss ratios among health insurance companies, for instance, can be between 60 percent and 110 percent. Loss ratios for property and casualty insurance (e.g. Ratios above 100 percnet denote a failure to earn sufficient premiums to cover expected claims.

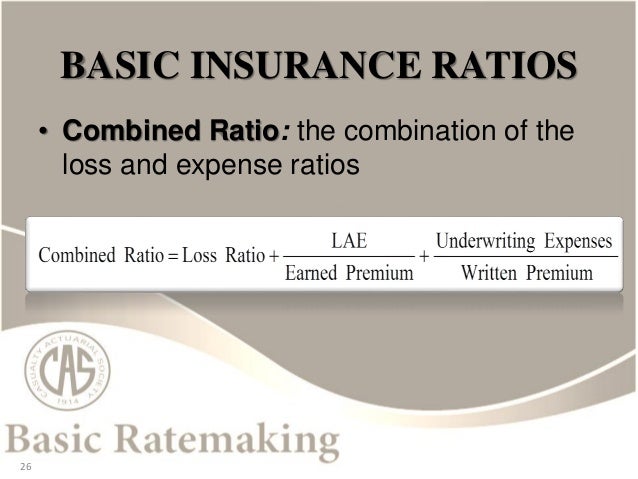

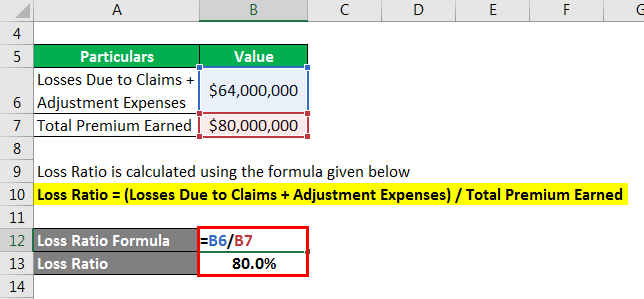

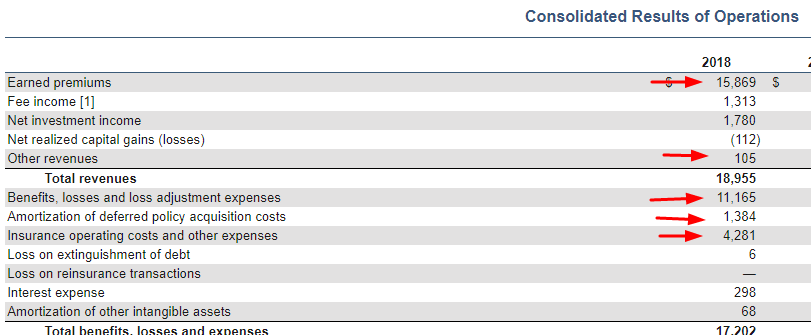

The loss ratio formula is insurance claims paid plus adjustment expenses divided by total earned premiums. Why loss ratio is useful? Loss ratio for insurance companies.

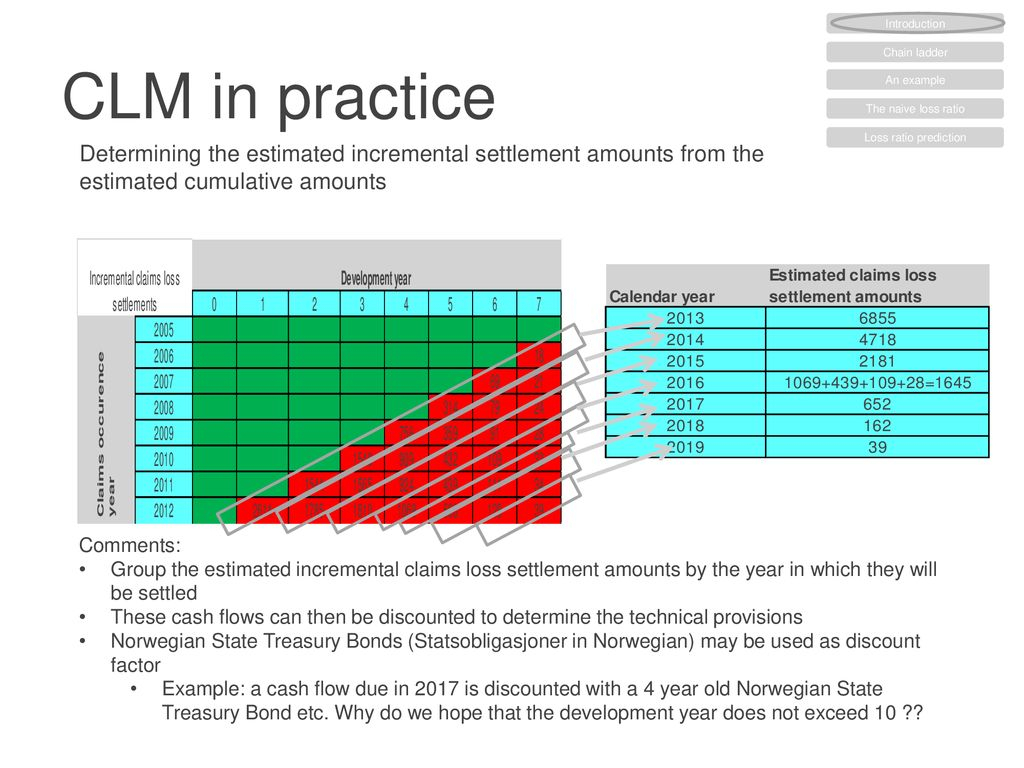

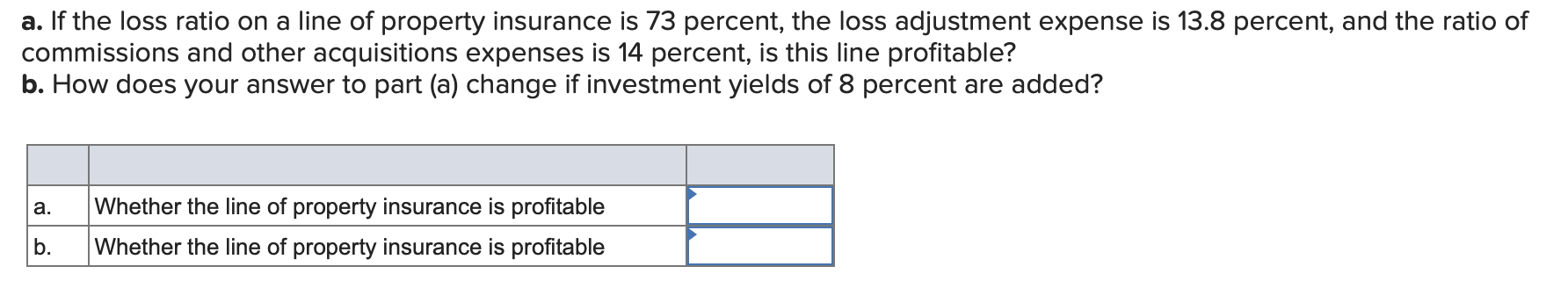

A loss ratio or “claims ratio,” is simply the ratio of incurred losses from claims plus the cost of settling claims to earned premiums: High ratios can usually occur either because of underpricing and/or because of unexpected high claims. On the flipside, a combined ratio of more than 100% represents an 'underwriting loss', which means an insurer is reliant on investment income to square the ledger.

How to improve auto insurance loss ratio. Loss expenses incurred (0.9%) 64,605 65,221 61,829 60,932 58,706 56,951 56,552 55,730 54,312 54,268 underwriting expenses 10.8% 167,982 151,652 148,692 145,753 139,846 136,586 130,809 124,768 122,662 120,673 A healthy combined ratio in the field of insurance sectors is generally considered to be in the range of 75% to 90%.

Loss ratio = (incurred losses + loss adjustment expenses)/earned premiums). Insurance companies always keep a reserve on hand to pay claims that their actuaries know statistically are coming soon. Why is this metric important?

This ratio provides insight into the quality of the policies an insurance company writes and the rates it charges. The operating ratio measures a. As an insurance agent, your auto insurance loss ratio is the ratio of premiums to the amount of claims paid by the company for your specific book of business.

This percentage represents how well the company is performing. The expense ratio can be used to compare a company’s performance over a period of time. A ratio below 100 percent represents a measure of profitability and the efficiency of an insurance firms underwriting efficiency.

The loss ratio is the percentage of the total claims paid by an insurance company in relation to the total premiums received during the course of a year. This is an indicator of how well an insurance company is doing. With all that in mind, many companies consider a.

According to the national association of insurance commissioners, the average losses incurred across all lines of insurance is 55.2%. Combined ratio = ( loss ratio + expense ratio ) Farmers insurance posted a loss ratio of 155% while allstate corp posted a ratio of 257%.

The ideal balance point, which is also called the permissible, target or expected loss ratio, for an insurance company will depend on a number of variables and is largely dependent on the insurance company's industry. Maintaining a good loss ratio is important because the company gives you liberty to write more policies if your ratio of payouts is low. Signifying the efficiency of an insurance company and measuring its profitability, the expense ratio gives a clearer picture of the financial aspects of the company.

Alternatively, when we take into consideration the financial basis combined ratio, the insurance company is paying out the equivalent amount as the premiums it receives. It is in the insurance. Motor car insurance) typically range from 40% to 60%.

It reflects whether the company is collecting enough premiums to meet its obligations and operational commitments or under. [ citation needed ] such companies are. The expense ratio serves as the ideal measure providing clarity on the logistics.

If the loss ratio is above 1, or 100%, the insurance company is unprofitable and maybe in poor financial health because it is paying out more in. It is a good idea to review what the loss ratio is for the type of insurance you want to purchase. For example, if a company pays $80 in claims for every $160 in collected premiums, the.

A high loss ratio suggests that an insurance company has too many clients filing claims. Out of that small share, they still need to set aside money for their cash reserves. If the insurer's acceptable loss ratio is 65 percent, this prospect must understand that, in order for it to be considered for coverage (at a reasonable premium), it must find a way to shed at least 30 percent from its loss ratio.

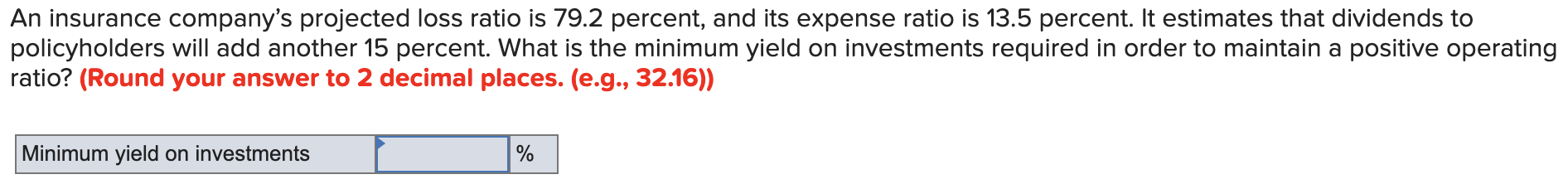

Solved An Insurance Company's Projected Loss Ratio Is 77

Insurance Ratemaking and premium data analysis

Solved An Insurance Company's Projected Loss Ratio Is 79

Insurance Ratemaking and premium data analysis

What Is A Good Expense Ratio For An Insurance Company

What Is A Good Expense Ratio For An Insurance Company

Are Market Cycles Finally Ending?

Sunday, a Strong Contender in the General Insurance

Nationwide Auto Insurance Review [The Complete Guide, 2020]

2016 Insurance Market Forecast

What Is A Good Expense Ratio For An Insurance Company

Lemonade's H1 Insurance Underwriting Report Lemonade Blog

Calendar Year Loss Ratio Calculation Calendar Printables

Solved A. If The Loss Ratio On A Line Of Property Insuran

How the Combined Ratio Reveals Profitable Insurance

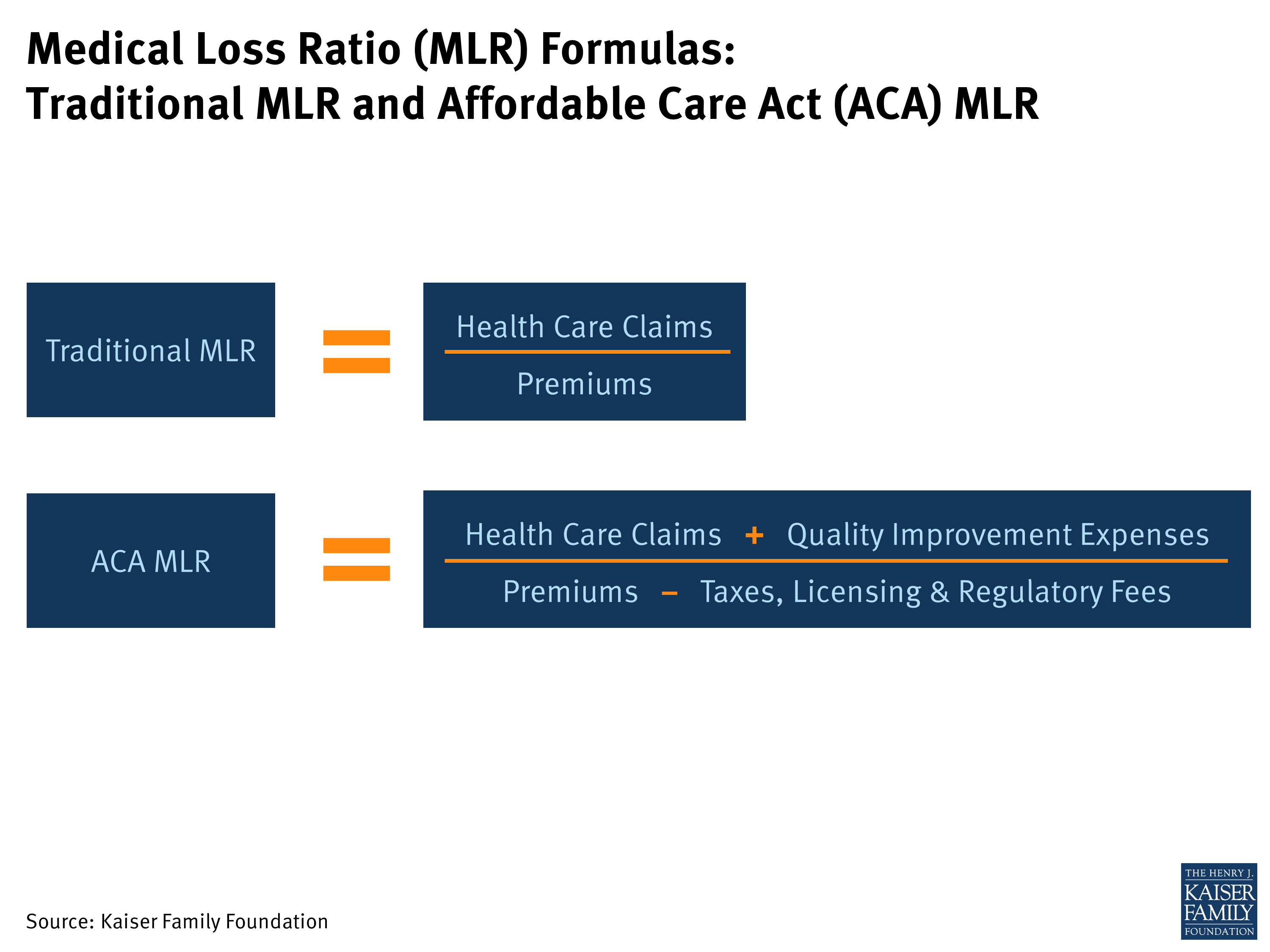

Explaining Health Care Reform Medical Loss Ratio (MLR) KFF

Calendar Year Loss Ratio Month Calendar Printable