A contingent beneficiary is sometimes known as a “secondary beneficiary.” for example, it’s possible that your primary beneficiary may die before receiving the death benefit. They get paid if the primary beneficiary is already deceased, unable to be located, or refuses the money when the policy pays it benefit.

What Does Contingent Mean In Life Insurance? Insurance Noon

Contingent beneficiaries are basically the backup that would receive your life insurance death benefit if all of your primary beneficiaries were deceased.

What does contingent mean in life insurance. A contingent beneficiary is basically your ‘secondary’ beneficiary. Long story short, your contingent life insurance beneficiary is simply a backup in case your primary beneficiaries are unable to receive the death benefit. In life insurance terms, it means that the contingent beneficiary exists just in case the primary beneficiary (or all the primary beneficiaries, if there are more than one) are not alive when the insured person dies.

What does life contingent mean? This person will only inherit the named assets if the primary beneficiary does not. It ensures that your policy will pass on to those you are trying to protect.

Your secondary, or contingent, life insurance beneficiary is simply a backup in case your primary beneficiaries are unable to receive the death benefit. A contingent beneficiary is someone named to insurance policies who receives the death benefit if the primary beneficiary can’t receive the payout for whatever reason. The most important thing to keep in mind is that the contingent beneficiary should understand what this means for them.

Contingent beneficiaries are second in line; This is known as having a contingent beneficiary when you sign up for life insurance. Sometimes relationships change, which is why life insurance companies encourage you to name at least one contingent beneficiary in your policy.

A contingent beneficiary is specified by an insurance contract holder or retirement account owner as the person or entity receiving proceeds if the primary beneficiary is. For example, the 1973 commercial general liability (cgl) policy stated that it provided primary insurance, except when stated to apply in excess of or contingent upon the absence of other insurance.when both this insurance and other insurance apply to. The terms and features of the life contingency option will vary from contract to contract.

Whenever a life insurance policy is purchased by an individual that covers the life of someone else, the person or group that purchased the policy is known as the primary owner. The definition of contingent is dependent for existence on something not yet certain. When purchasing life insurance, you’ll be asked to designate at least one primary beneficiary;

What does contingent mean in life insurance? If you want someone to receive a portion of your death benefit, they need to be a primary beneficiary. Contingent insurance — the term contingent insurance refers to a policy that is contingent on the absence of other insurance.

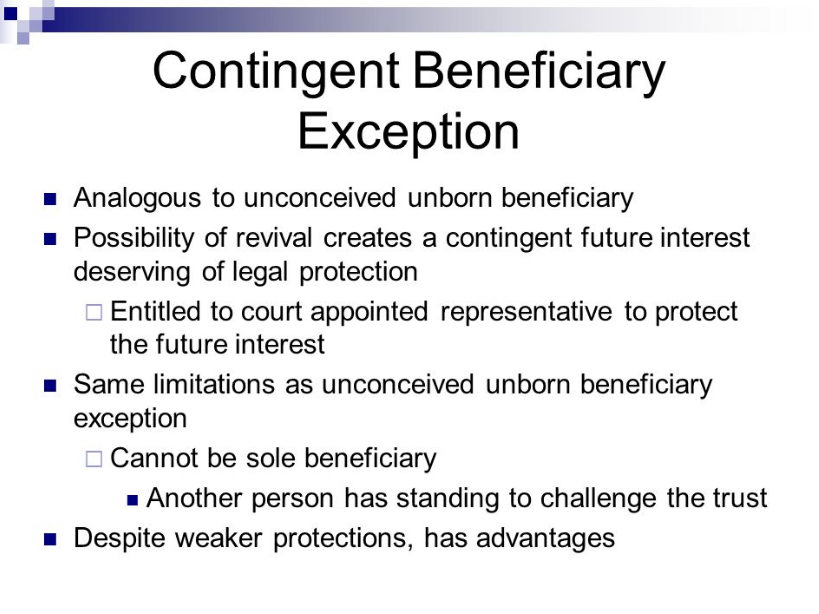

In a life insurance policy or an annuity plan, contingent beneficiary gets proceeds from the policy in the event of a demise of the primary beneficiary at the same time as that of the insured. A contingent beneficiary is a person, organization, or entity that receives your life insurance policy’s death benefit if your primary beneficiary dies. If no contingent beneficiary is named and the primary beneficiary or beneficiaries die, the insured's estate usually becomes the policy's automatic contingent beneficiary.

You should also name at least one contingent beneficiary. When purchasing life insurance, you’ll be asked to designate at least one primary beneficiary; A contingent life insurance beneficiary is someone who will receive benefits if the primary beneficiary passes away.

The release of those benefits depends on the fulfillment of a set of predetermined rules following the death of an insured individual. In life insurance, you can choose a contingent beneficiary or owner for your policy on the condition that the primary beneficiary or owner dies. If your primary beneficiary is unable to claim the payout for whatever reason, your contingent beneficiary will be able to claim the life insurance death benefits.

In a life insurance policy or an annuity plan, contingent beneficiary gets proceeds from the policy in the event of a demise of the primary beneficiary at the same time as that of the insured. The account you designate to be given to a primary beneficiary will be released to your second beneficiary if your first beneficiary can't be found, declines the gift, isn't legally able to accept it,. The word ‘contingent’ is associated with the word ‘beneficiary’ in the life insurance dynamic.

Contingent beneficiaries do not receive anything if the primary beneficiary is. For instance, the owner of the policy chooses his/her spouse as the primary beneficiary.however, the spouse dies at. Learn about the differences between primary and contingent beneficiaries, as well as how to make sure your death benefit gets to the right family members.

But what does it mean in life insurance? Typically, primary life insurance beneficiaries are your spouse and adult children. In the area of life insurance, you might hear the term contingent owner at some point.here are the basics of what a contingent owner is and what rights they have.

You should also name at least one contingent beneficiary. Can there be two primary beneficiaries? Contingent beneficiary is the person you select to collect the death benefits when you are not present.

A term life insurance policy. A life insurance policy that does not pay out any dividends to the policyholder. A contingent beneficiary is second in line behind the primary beneficiary of an inheritance.

Siblings and favorite charities are great contingent life insurance beneficiary options. A policy with the effective date of february 1, 2021, means that if the insured passes away on or after that date, the policy will pay out the death benefit to any listed beneficiaries. In the case your primary beneficiary passes away or becomes impaired, the contingent beneficiary acts as a backup.

Save 10% on your will with the ramsey10 promo code.contingent online accounting beneficiaries can be spelled out in your will for items you want to give to people. Without a contingent beneficiary in place,. Save 10% on your will with the ramsey10 promo code.contingent online accounting beneficiaries can be spelled out in your will for items you want to give to people.

Definition of life contingency a life contingency option is an annuity payout option that provides a death benefit in case the annuitant dies during the accumulation stage. It is a very commonly used term in life insurance.

Contingent Meaning For Insurance MEANOIN

What Does Contingent Annuity MEANINH

What Does It Mean To Be A Contingent Beneficiary? Budgetable

Joint And Contingent Annuity Detailed Login Instructions

What Does Contingent Mean In Life insurance? Life

Contingent Cargo Insurance Meaning CladAsia

Contingent Life Insurance Beneficiary Thismuchistrue Karen

Life Insurance Legal Definition Life Insurance

What Does Contingent Mean In Life Insurance? Insurance Noon

/17121703798_09a79a32cf_k-981bb57af6904f0b85d31bc6843f550b.jpg)

Contingent Life Insurance Beneficiary Thismuchistrue Karen

What Does Contingent Beneficiary Mean?

Non Contingent Offer Real Estate Greatest Sources Around

What Does Contingent Mean In Life insurance? Life

Simple Memorial What Is A Contingent Beneficiary On A

What Does Contingent Beneficiary Mean in Life Insurance?

Who is Contingent Beneficiary in life insurance contract?

What Is A Contingent Beneficiary? Business Promotion

Simple Memorial What Is A Contingent Beneficiary On A

Which Of The Following Best Describes A Contingent