The cash value will accumulate with interest and it can be cashed out if needed. Surrendering a life insurance policy means that you have agreed to take a cash payout in return for forgoing the death benefit.

What is surrender value and paidup value of a life

How to surrender your life insurance?

Surrender life insurance. Alternatively, you can visit your insurance company agent in person for this step. I want to surrender the policy due to _____ (reason for surrender) i request you to kindly complete the formalities of the claim of policy and transfer the surrender policy amount of this policy to my account no. (note that outstanding loans are also counted as part of the gain.)

Insurers pay the sum from the earnings on your premium portions allocated towards savings. The insurance company assigns a value to your policy and that is the amount that you will receive upon surrender. The cash surrender value calculation is a way to figure out how much money you will receive if you choose to surrender your life insurance at a.

Surrender value is the money you receive on voluntary exit from your life insurance plan before the maturity date. When you surrender your life insurance policy, you essentially cancel it. Surrender behaviour under “normal circumstances” 5 2.1.

Can i surrender my life insurance policy? They will provide you with a. When you cancel whole life insurance, you gain the full amount of your investment, minus fees.

If you surrender a cash value life insurance policy, any gain on the policy over and above your cost basis (premiums paid) will be subject to federal (and possibly state) income tax. Many life insurance companies offer policies that have surrender periods that last for 10 to 15 years. For the first three years, this factor is zero and keeps increasing from third year onwards.

Once you surrender your life insurance policy, your dependents will no longer get a death benefit if you pass away. If you want to surrender your life insurance policy, make sure to only do so if you have another policy in place. By surrendering, you agree to take the cash surrender value (which is assigned by your insurance provider) while also forgoing the death benefit.

All life insurance policies can be surrendered, but only certain ones will come with a cash value. Surrender value factor is a percentage of paid up value plus bonus. More life insurance guide to policies and companies

Stop making the premium payments. If you’re looking to truly maximize this source of income, you may be better off selling all or a portion of your policy via a life settlement. The special surrender value = (30/100) * (6,00,000* (4/20) + 60,000) = rs.

For simple cash generation purposes there are many options which are better and simpler than surrendering a life policy 6 2.3. This means that you're asking the insurance company to cancel your coverage in exchange for the policy's surrender value. A life insurance policy surrender is the act of cancelling your life insurance policy, “surrendering” it for the cash surrender value your insurance company has assigned you.

If you're in need of quick cash, you can surrender your permanent life insurance policy for cash. Although steps may vary slightly by provider, these are the typical steps you’ll take to surrender your life insurance policy: _____ (account number), which is already updated in records and terminate the aforesaid policy.

The cost basis of a life insurance policy is the sum of all your insurance premium payments. Cash surrender value is the sum of money an insurance company will pay you, the policyholder, in the event you voluntarily cancel your life insurance policy before its maturity or an insured event. This amount is payable to you after deducting the applicable surrender charges.

While surrendering your life insurance policy may seem like a quick and painless way, it rarely will result in you getting the highest possible amount. Upon surrendering, the insurance company will take anywhere from 10% to 30% in fees. Call your insurance company and tell them you would like to surrender your life insurance policy for cash value.

Due to some financial issues at my personal end, i am compelled to surrender this policy because i will not be able to manage this policy and moreover, i will have handsome amount of money. Surrendering is common for whole life insurance policies, which accrue cash value over time. People should consider surrendering their life insurance if they no longer need it, or can no longer afford it.

To initiate the policy surrender process, call your insurance agent and request a surrender form. To cancel or surrender your life insurance policy, use these steps: Cash surrender value life insurance refers to a policy where you pay the insurance premium plus fees and a cash value.

More the number of premiums paid, more is the surrender value. Cash surrender value is the sum of money an insurance company pays to a policyholder or an annuity contract owner if their policy is voluntarily terminated before its maturity or an insured event. On february 5 th, 2005, i had opened a life insurance policy with your branch.my lic policy number is 123456 and till present date, all the premium stands clear for this policy.

You may be tempted to give up your coverage so that you can get the cash surrender value, but keep in mind that if you do that, your loved ones will be left with zero financial security that your death benefit would have otherwise provided if you pass away. Just telling them you want to cancel isn’t enough. The surrender value in life insurance plans refers to the amount of money an insurance company owes you if you cancel or withdraw your policy before the maturity date.

Surrender charges can be substantial during the first few years of the policy. Complete the surrender form the insurance company sends you. It varies from company to company and.

Contact your insurance agent and notify them that you would like to surrender your policy. The insurance company can only hold your cash surrender value for a set period that is determined by law before they have to give it to you. A surrender charge is a fee levied on a life insurance policyholder upon cancellation of their life insurance policy.

The surrender value and charges can differ for each policy as per the details of the plan.

Bajaj Allianz Surrender Form Life Insurance Signature

SurrenderFormFormno50743510.pdf Economy Related

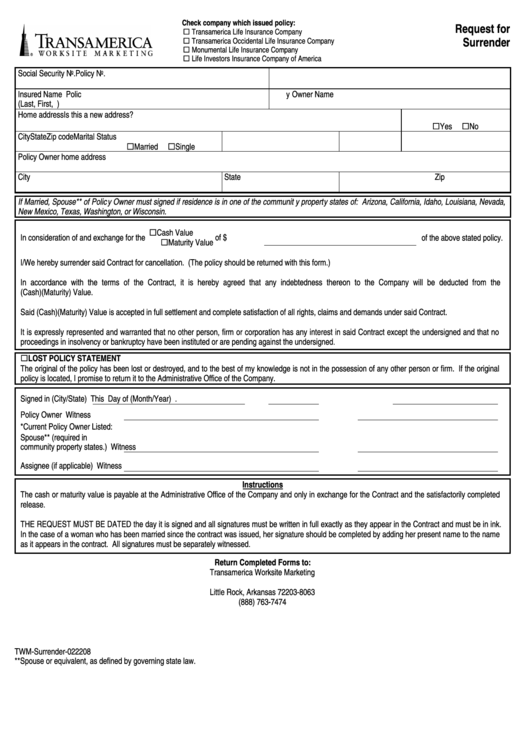

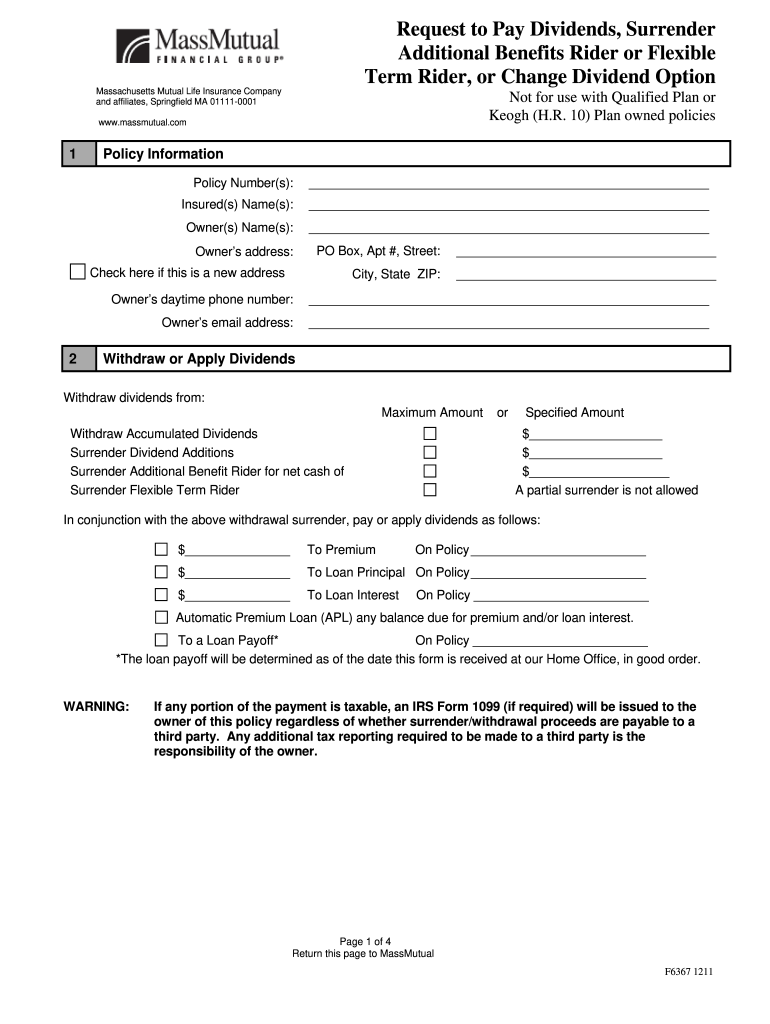

Request For Surrender Transamerica printable pdf download

Surrender Form Life Insurance Insurance

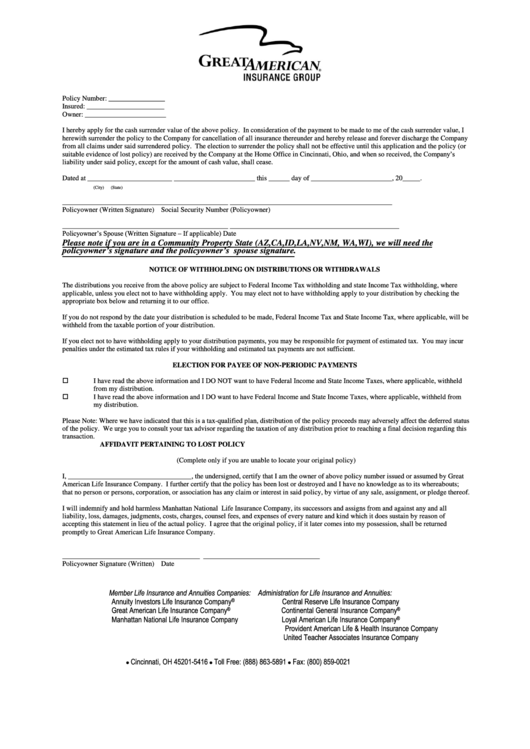

Life Surrender Form Great American Insurance Group

Things Not To Miss While Surrendering a Life Insurance

New Surrender Form Life Insurance Insurance

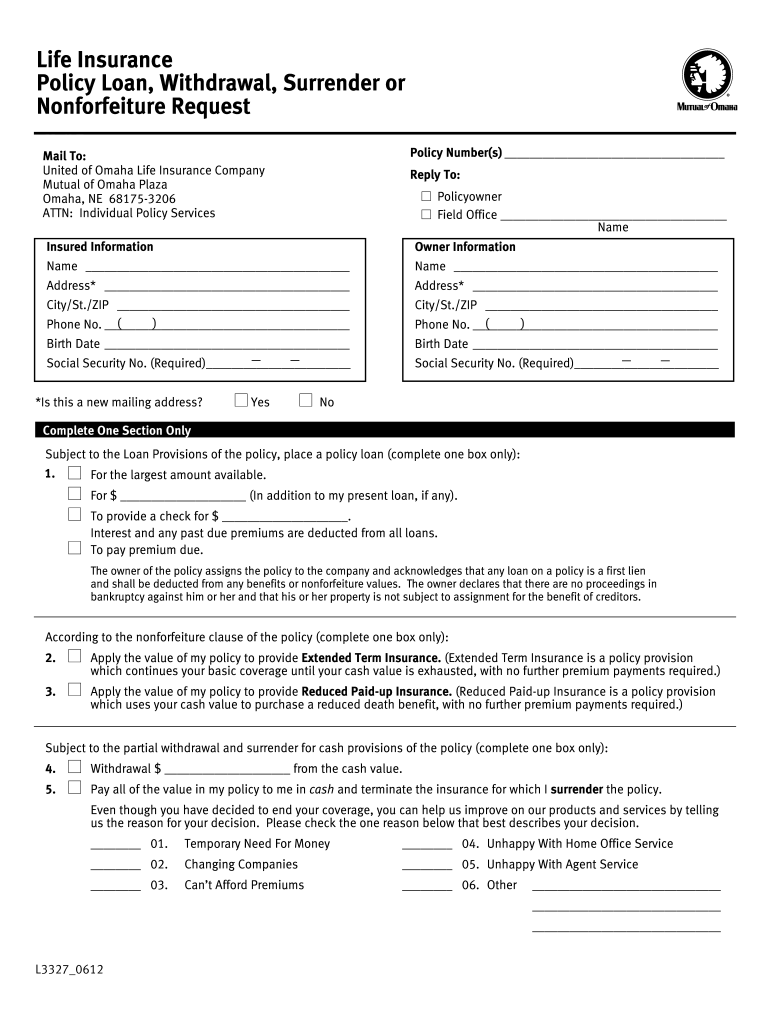

United Of Omaha Life Insurance Cash Surrender Form Fill

Reliance Surrender Form Cheque Life Insurance

3 Ways to Surrender Life Insurance Policy The Investment

Foresters Life Insurance Surrender Form Fill and Sign

Surrender Value In Insurance / Maturity Claim in Life

Life insurance policy surrender Want to surrender your

Surrender Life Insurance Policy Tax Consequences

Surrender Application Form(1) Insurance Policy

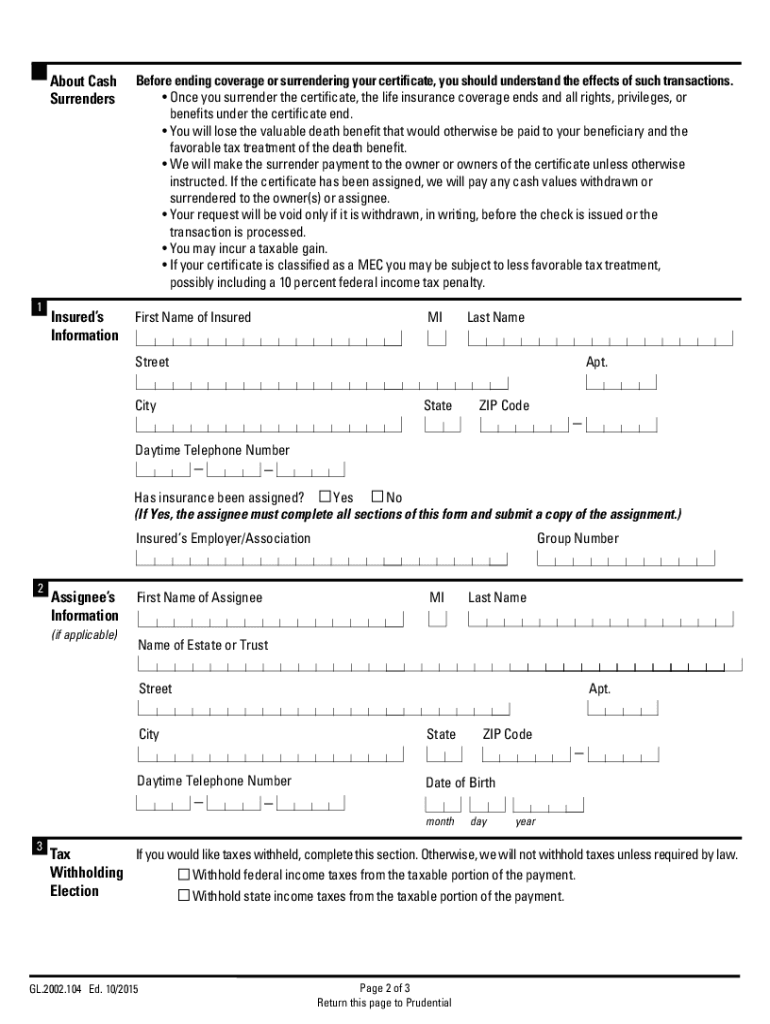

Prudential Life Insurance Surrender Form Fill Online

Surrender Discharge Voucher of LIC Form No. 5074

Surrender Life Insurance Policy For Cash Value Taxable

Surrender Form Fill Out and Sign Printable PDF Template