You still pay a monthly premium (although it’s typically much less than your health insurance premium), and supplemental plans still provide payments via claims. Long term care insurance pays for your final years in an assisted living facility.

Different Types Of Life Insurance Explanation & The

These types of policies help to cover expenses that are not covered by major medical insurance and reduce the money paid out by the insured.

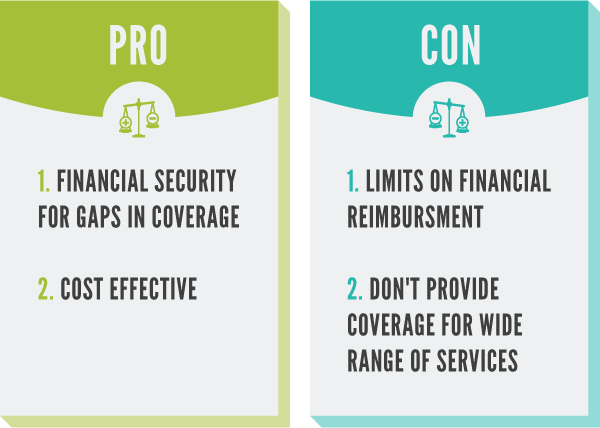

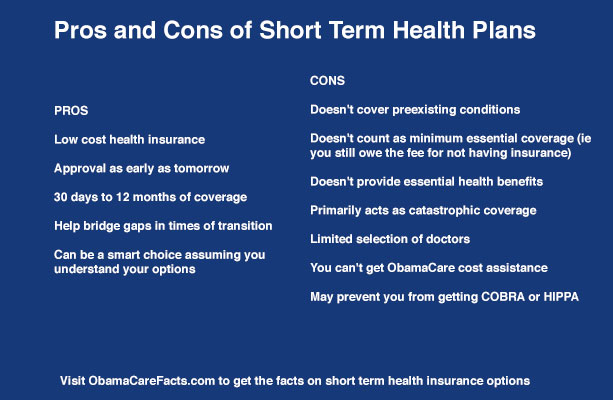

Pros and cons of supplemental insurance. Supplemental disability insurance is less expensive than a standalone disability policy, though the exact amount you pay will depend on your plan and current health. Be sure to carefully weigh the pros and cons of both supplemental coverage and a separate term life insurance policy when choosing your coverage. Supplemental unemployment insurance is an insurance policy that provides income to workers that become unemployed.

Pros and cons of supplemental insurance one of the biggest benefits to having several health plans is extended coverage. The medigap pros and cons list was compiled by our licensed insurance agents. In this article, i will discuss 5 pros and cons of selling insurance.

Benefits of social insurance 6 Supplemental insurance can help you remain financially stable in the event of a severe illness, injury or other catastrophe, but it can also be an unnecessary financial burden. There are several key benefits of supplemental plans.

Many supplemental life insurance policies increase the death benefit of your group life policy. This type of supplemental insurance can be expensive. Not only can it change, but your plan can go away completely or your physicians can be out of network from one year to the next.

Supplemental insurance works a little differently than a regular health plan, and that’s a good thing. Monthly premiums can be pricey. Types of supplemental life insurance.

The price of individual health insurance varies widely and can have a. The younger you are when you. Large volume of customer satisfaction.

May not be able to enroll after initial enrollment period. Should you get supplemental life insurance or a term life insurance policy? The pros & cons of supplemental security income.

Whether you’re interested in selling life insurance like final expense, or health insurance like medicare advantage, you’ve come to the right place! Guaranteed 6 month enrollment period when 1st eligible. A+ ratings by both the bbb and am best.

You may have the option to pay more to get more coverage, up to a certain limit set by your company. Plans cover all or part of medicare additional fees. Not every carrier offers this type of coverage.

The variety of plans available lets you pick and choose the benefits you want, such as your doctors and hospitals. The pros and cons of supplemental unemployment benefit plans. That’s where medicare supplement insurance plans — also known as medigap plans — come in.

Payments from this type of insurance are made in addition to state unemployment. There are both pros and cons associated with ssi eligibility criteria. While cancer insurance is available it may be very hard to find.

By jacquelyn grinder | jan 30, 2020 | fringe benefits, resources. Pros and cons of medicare supplement insurance. Additionally, by purchasing only the amount you need to supplement the coverage you already have,.

Supplemental insurance products such as cancer and accidental injury insurance are not a replacement for major medical insurance. Difficult to switch once enrolled. Learn about the pros and cons of buying a medicare supplement insurance plan.

Some of the most common features of best. Medigap insurance can be a good option for certain senior retirees than relying completely on original medicare or supplemental insurance plans purchased through private insurance companies. Medicare supplement insurance, also called medigap, is designed to bridge the payment gap left by original medicare, a traditional indemnity plan that in most cases pays only a portion of.

This is helpful if you’re determining whether a supplemental plan is right for your health insurance coverage. Plans are easy to compare. Coverage while traveling (both in the u.s.

Before we explore the pros and cons, though, it’s helpful to first know what supplemental life insurance can do. If you leave your job, you could lose your group and supplemental insurance. Boost your disability benefit and receive closer to 80% to 100% of your predisability income with supplemental disability insurance.

Freedom to choose healthcare providers without referrals; Better coverage on deductibles and coinsurance; This means when a portion of your medical claim isn’t covered by your primary insurer, then you can go to your secondary insurer who.

An advantage is that support is available to any individual who has limited income and is disabled, blind or at least 65 years old. Purchasing supplemental insurance through your employer can bypass the health exam requirement that many private insurers require. If you are investigating a possible career in insurance sales, or are assessing different insurance agencies to potentially join, this article is for you.

Buying life insurance is an important decision.

Medicare Supplement Advantage Plans Pros And Cons Of

Aetna Medicare Supplement Review Everyday Health

What Are the Advantages and Disadvantages of Medicare

Is Medigap the Best Medicare Supplemental Insurance?

Pros/Cons of Medicare Advantage Plan AARP Online Community

Pros And Cons Of Medicare Advantage Vs Original Medicare

Mutual of Omaha Medicare Supplement Plans Review

What are the pros and cons of Supplements? The Health

medical insurance meaning Do You Know How Many People

Pros And Cons Of Medicare Advantage Vs Original Medicare

Medicaid And Medicare Supplement Insurance

Aetna Medicare Supplement Review Everyday Health

Pros and cons of life insurance insurance

Blue Cross Blue Shield Medicare Supplement Review

Medicare Supplement Plans Pros & Cons Turning 65 Solutions

Colonial Life Cancer Policy Claim Form inspire ideas 2022

The Pros and Cons of Medicare Supplement Insurance

Colonial Life and Accident Supplemental Insurance ASi