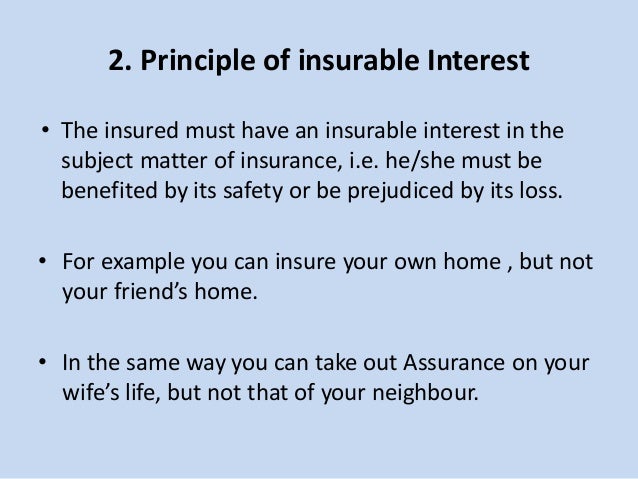

The insured must have an insurable interest in the subject matter of the insurance. I n t er es t.

When Must Insurable Interest Exist For A Life Insurance

The person getting insure d must have.

Principle of insurance interest. The legal right to insure arising out of a financial relationship recognized under the law, between the insured and the subject matter of insurance. The following 5 principles ofthe insurance in the insurance: (iii) principle of insurable interest:

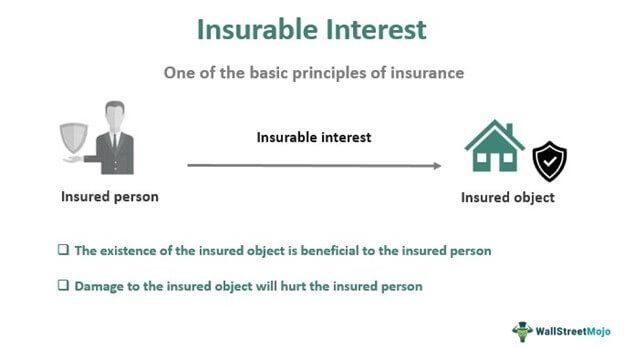

The financial stake that you have in insuring something you own—for instance, your car—is termed ‘insurable interest'. In simple words, the insured person must suffer some financial loss. Insurable interest just means that the subject matter of the contract must provide some financial gain by existing for the insured (or policyholder) and would lead to a financial loss if damaged, destroyed, stolen, or lost.

A legitimate rationale or relationship explaining the relevance of the subject matter of insurance in their life must exist for a person to avail of insurance. Insurable interest is a fundamental principle of insurance. Insurable interest is the principle that defines who can take out an insurance policy.

It is not possible to affect an insurance policy on a subject matter by someone who has got no insurable interest on that subject matter. In insurance law, you can only buy insurance for something or someone in which you have an insurable interest. The principle of insurable interest or insurable interest is one of the fundamental principles of insurance.

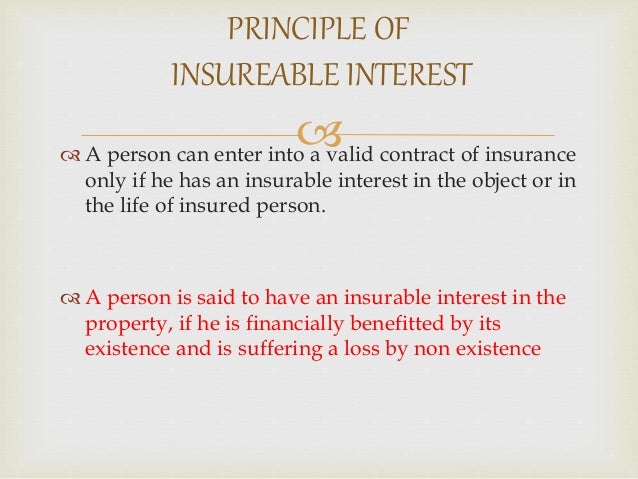

Principle of insurable interest insurable interest means a cover mentioned in insurance agreement should provide a financial gain by its existence. Under law terms, insurable interest means; Insurable interest is where you have a valid & legal right to insure and stand to suffer a direct financial loss if the event insured against occurs.

In the absence of insurable interest, the contract of insurance is a mere gamble and not enforceable in a court of law. A pe rson has an insurable interest w hen. The principle of insurable interest.

Without the principle of insurable interest, the types of insurance as we know them would not exist. Insurable interest means that the subject matter for which the individual enters the insurance contract must provide some financial gain to the insured and also lead to a financial loss if there is any damage, destruction or loss. The principle of insurable interest is the foundation of a contract of insurance.

Insurable interest is a core principle in insurance. Absence of insurance makes the contract null and void. Principle of insurable interest denotes that only the person who has insurable interest on a subject matter of insurance can insure that particular subject matter.it is not possible to affect an insurance policy on a subject.

Insurable interest simply means “right to. Insurable interest may be defined as follows: Principle of insurable interest this principle states that insurance policy holder must have insurable interest in the subject matter of insurance.

Under this principle of insurance, the insured must have interest in the subject matter of the insurance. Insurable interest in the ob ject of insurance. Principle of insurable interest this principle says that the individual (insured) must have an insurable interest in the subject matter.

It is an important and fundamental principle of insurance. An insurable interest must exist at the time of the purchase of the insurance. Insurance companies are applying the principles of insurance.

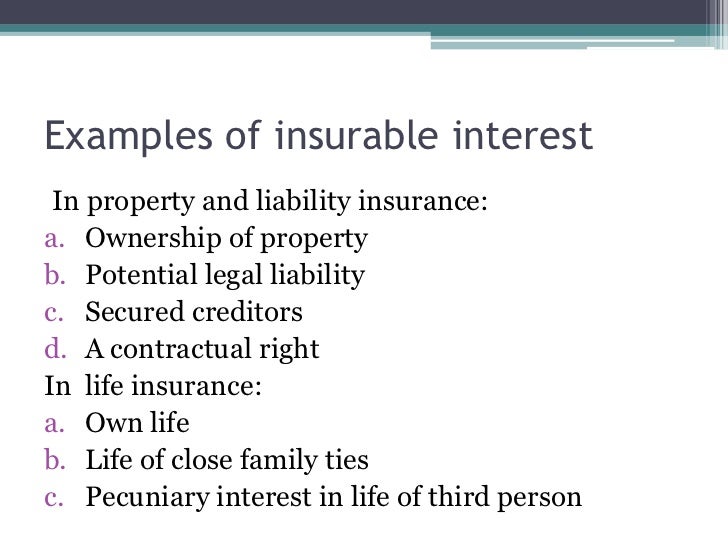

A person offers an insurable interest in something once damage or lost might result in suffering financial loss. The insurable interest principle applies in different ways to property insurance and life insurance. It is defined as the concern of an individual towards obtaining an insurance policy for an item or an individual against any type of unforeseen events such as losses or death.

If there is no insurable interest, an insurance company will not issue a policy. It means that the person wishing to take out insurance must be legally entitled to insure the article, or the event, or the life. Mostly ownership, direct relationship or possession is recognize under insurable interest.

In case of property insurance, the insurable interest must exit at the time of loss. The principle of insurable interest in case of life insurance states that a person or organization can draw an insurance policy on the life of another person if the person or the organization values the life of that person more than the amount of the policy. If the insurance company can prove a policyholder provided falsified information and did not act in good faith, the insurance company can revoke its liability in the insurance claim.

There are six principles in insurance: The happening of the event insured against or death of the. The principle of insurable interest says that a party which wants to get the insurance policy must have some interest in the property or life that insured.

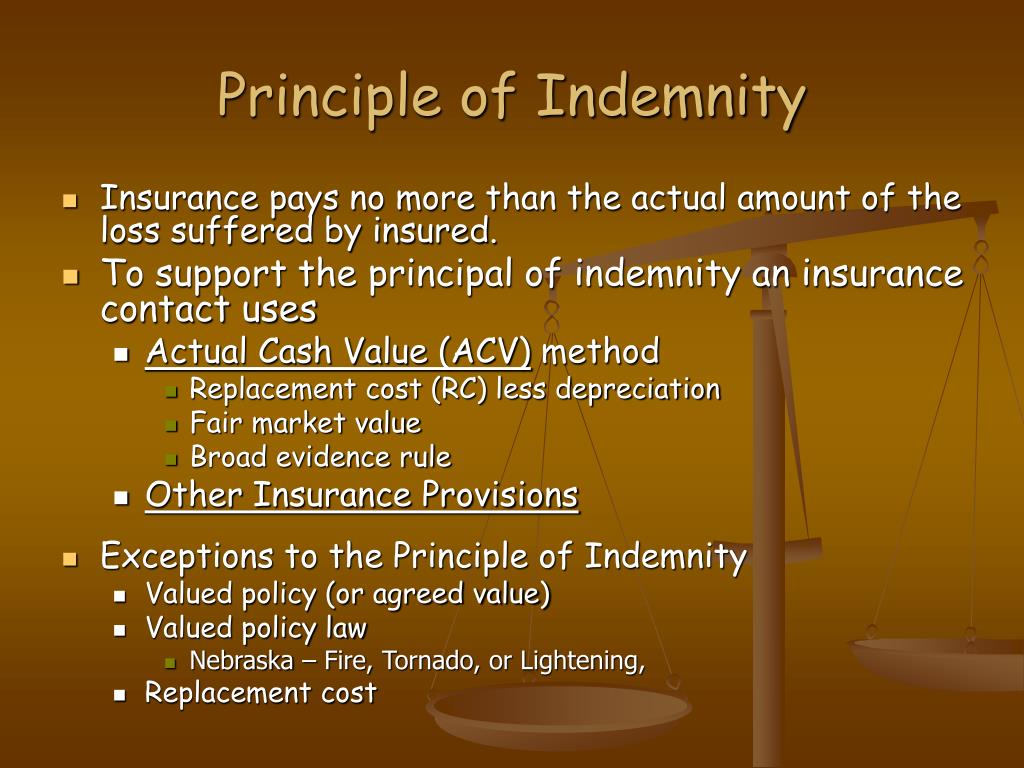

The indemnification principle holds that insurance policies should compensate a policyholder for a covered loss, but losses should not reward or. Utmost good faith (‘uberrima fides’) opposite of ‘caveat emptor’ (let the buyer beware) is fundamental to the buying and selling of insurance. The insurable interest principle states that getting insurance should be prompted by reasonable interest, ownership right, or a close relationship to the insured object.

Insurable interest is said to exist when an insured person is. Examples of insurable interest before discussing the examples of insurable interest, i want to explain the basics regarding this doctrine. The principle of insurable interest states that the person getting insured must have insurable interest in the object of insurance.

The existence of insurable interest is an essential ingredient of any insurance contract. The principle of insurable interest states t h a t. The principle of indemnity and insurable interest.

PPT 6. Legal Principles in Insurance Contracts

PPT Principles Of Insurance PowerPoint Presentation

Articles Junction Principles of Insurance Basic

Insurable Interest Definition And Example inspire ideas 2022

FUNDAMENTAL PRINCIPLES of INSURANCE authorSTREAM

When Must Insurable Interest Exist For A Life Insurance

Insurable Interest Definition And Example inspire ideas 2022

Principles of Insurance with example Insuregrams

Principles of Insurance 7 Basic General Insurance Principles

Principles of Insurance 7 Basic General Insurance Principles

When Must Insurable Interest Exist For A Life Insurance

PPT 6. Legal Principles in Insurance Contracts

When Must Insurable Interest Exist For A Life Insurance

Principle Of Insurance Interest Chapter 5 Legal

Articles Junction Principles of Insurance Basic

Principles of Insurance 7 Basic General Insurance Principles