Nevada has over two thousand traditional carriers licensed to conduct business in our state that are domiciled in other states. 264 are domiciled in nevada, and 202 companies are captives.

Nevada Insurance Premium Tax How to Enroll Nevada

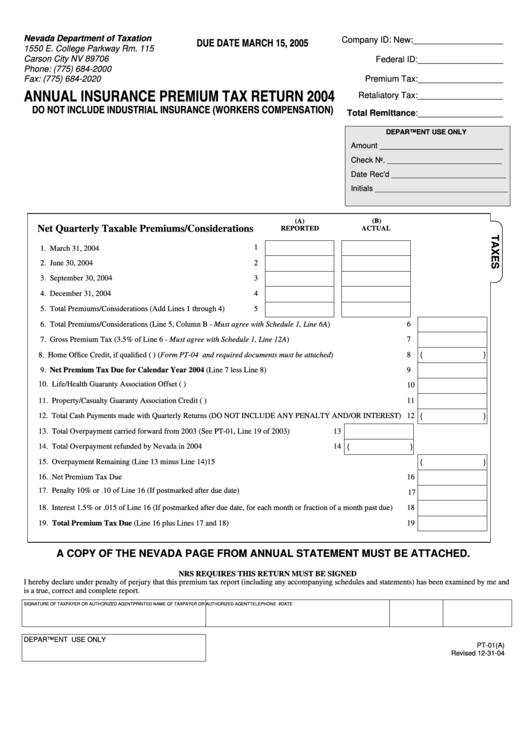

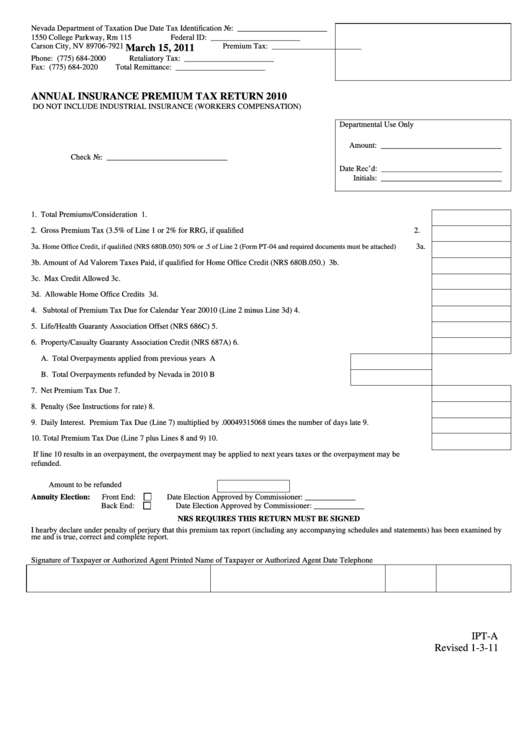

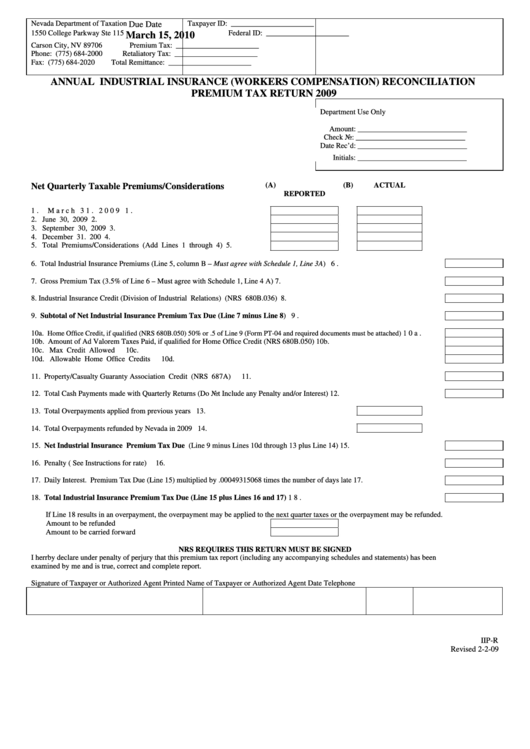

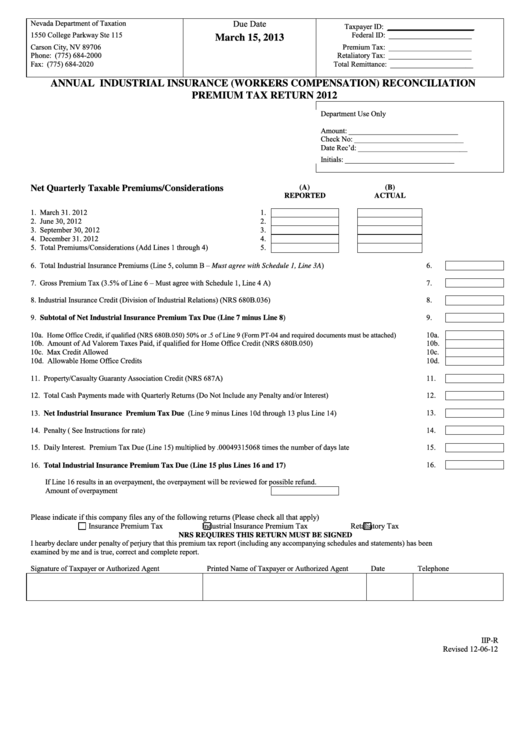

This form is to be used for all annual filings.

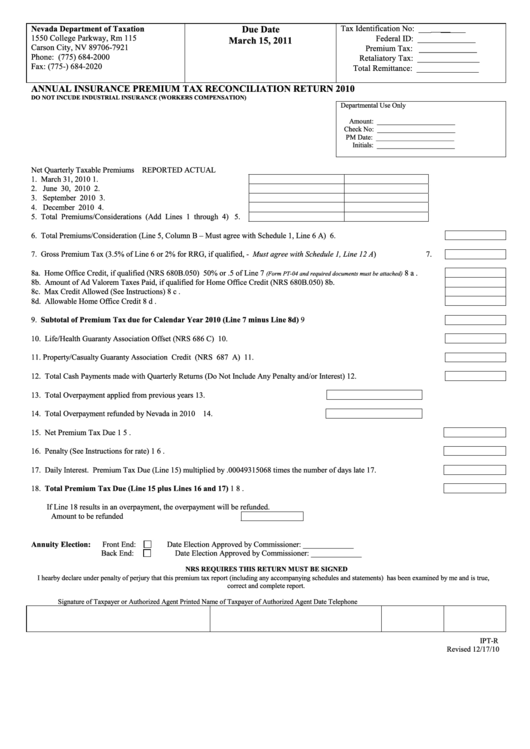

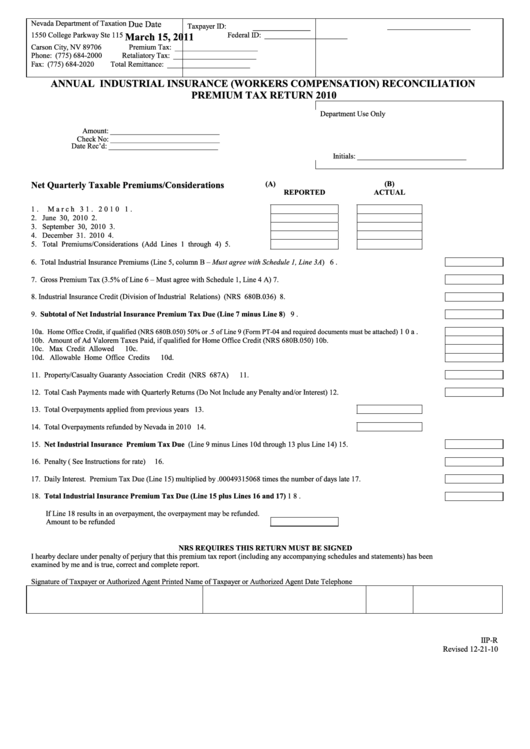

Nevada insurance premium tax. Pure captives required to affix signatures on line 15 and 16 all captives minimum annual tax due $5,000 pursuant to nrs 694c.450 mark if original return If you reported under $2000 in tax last year you do not need to file this form. This annual return is a reconciliation of the calendar year.

2% (annually) (except life insurance) mississippi. This annual return is a reconciliation of the calendar year. American rescue plan act of 2021 (american rescue plan)

The annual premium tax forms are available on the state of nevada division of insurance’s captive insurers page under forms. Instead, it will be deducted from the initial value of the annuity contract. * a captive insurer is entitled to receive a nonrefundable credit of $5,000 applied against the aggregate taxes owned for the first year in which the captive insurer incurs any liability for the payment of taxes.

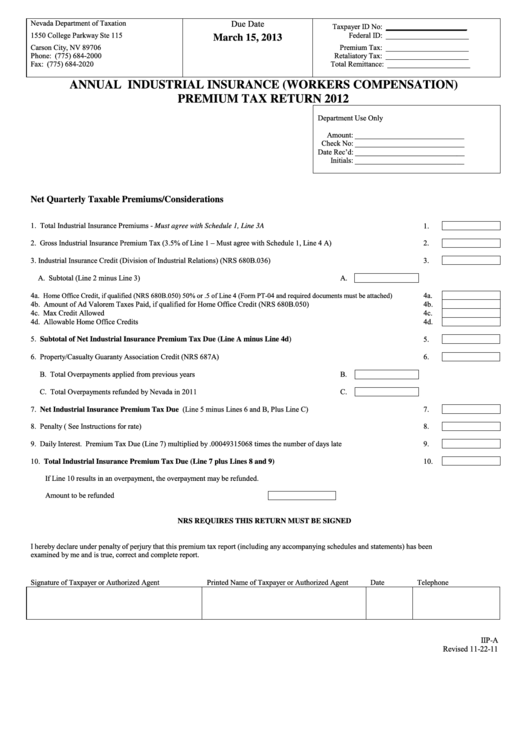

Insurers who have industrial insurance premiums to report will have to use industrial insurance premiums tax return. Nevada annual captive insurance premium tax return 2014 due on or before march 1, 2015 remit filing and payment to: Your tax credit is based on the income estimate and household information you put on your marketplace application.

A premium tax credit, sometimes called subsidies or discounts, can be used to lower your monthly insurance payment (called your “premium”) when you enroll in a health insurance plan through nevada health link. The nevada premium tax rate is 3.5% or 2% for risk retention Premium taxes are due for the year that the captive is licensed.

The nevada premium tax rate is 3.5%. The result is the amount of penalty that should be entered. The nevada department of taxation requires written premium

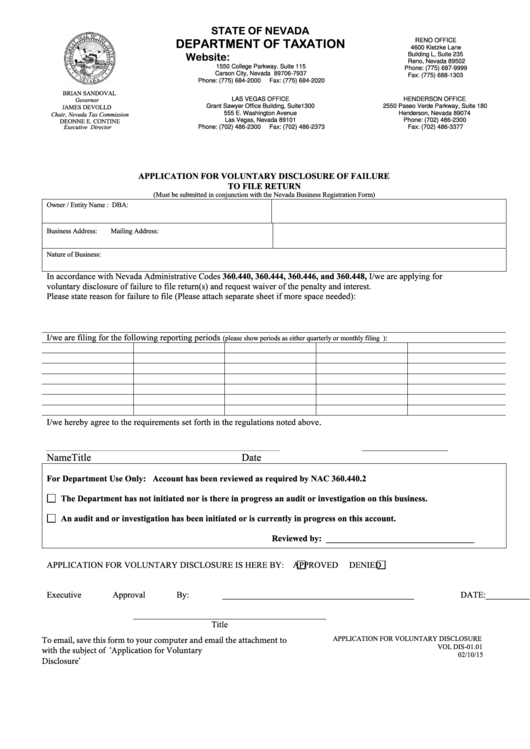

The tax is assessed on each insurer transacting insurance business in this state on net direct premiums and considerations at a rate of 3.5 percent. 115 carson city, nv 89706. Nevada department of taxation 1550 college parkway, rm.

§384.051 (6) 5% (annually) montana. Pursuant to nrs 680b.025, premium tax is a tax levied by the state of nevada on insurance companies doing business in this state. Nrs 680b.036 general tax on premiums:

3% for policies issued against fire, lightning or tornado) missouri. Nrs 680b.027 requires insurers to pay a 3.5% tax on net direct premiums and net direct considerations written in nevada. Determine the number of days late the payment is, and multiply the net tax owed (line 8) by the appropriate rate based on the table above.

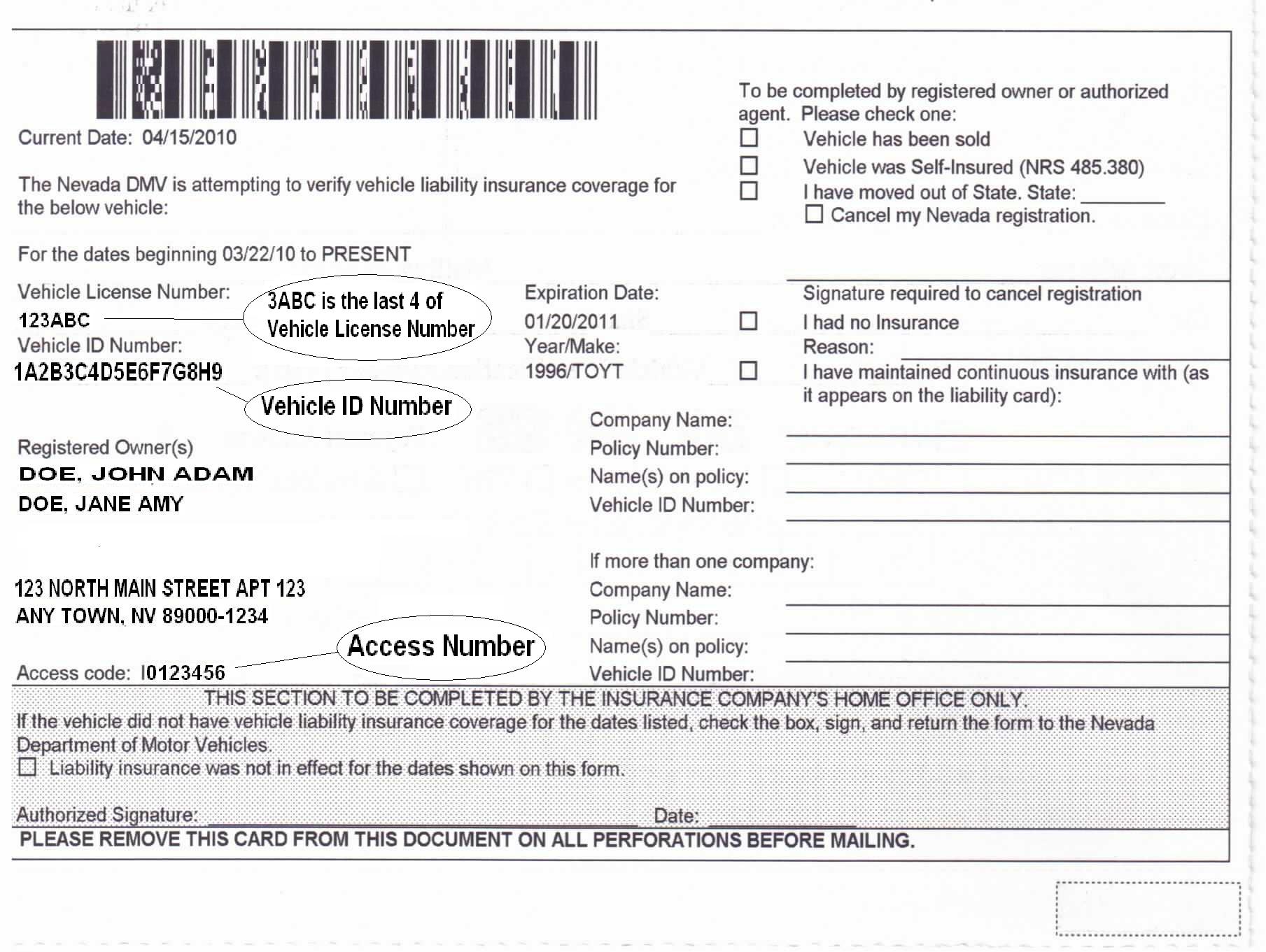

Where nevada is not the home state of the insured, no premium tax filing in nevada will be required. Division of insurance, captive premium tax captive section phone: On september 14, 2012, the commissioner of insurance adopted by regulation a standard consent form to document the permission of the vehicle owner or the owner’s authorized representative to an insurer’s towing of a motor vehicle in certain circumstances.

The nevada premium tax rate is 3.5%. This annual return is a reconciliation of the calendar year. State workers enrolled in public employee healthcare plans in nevada will be charged up to $55 per month if they aren't vaccinated

When someone buys a deferred annuity, the premium tax is collected during the annuitization, or payout, phase. State of nevada bgordon@doi.nv.gov attn: College parkway, suite 103, carson city, nv 89706 captive section fax:

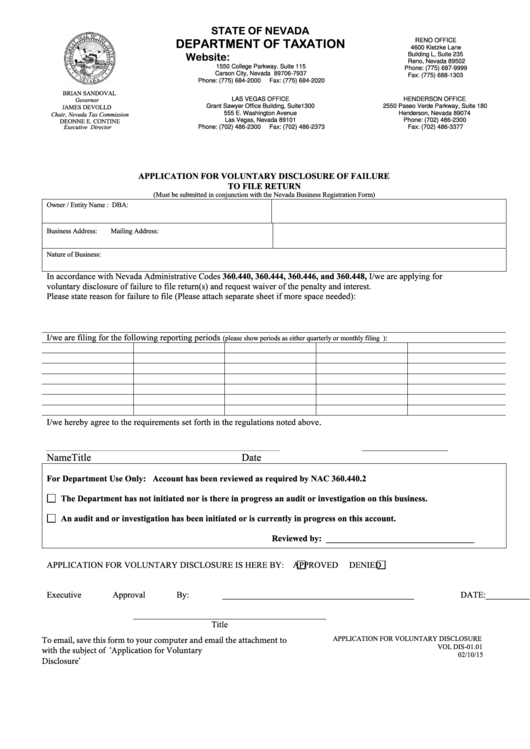

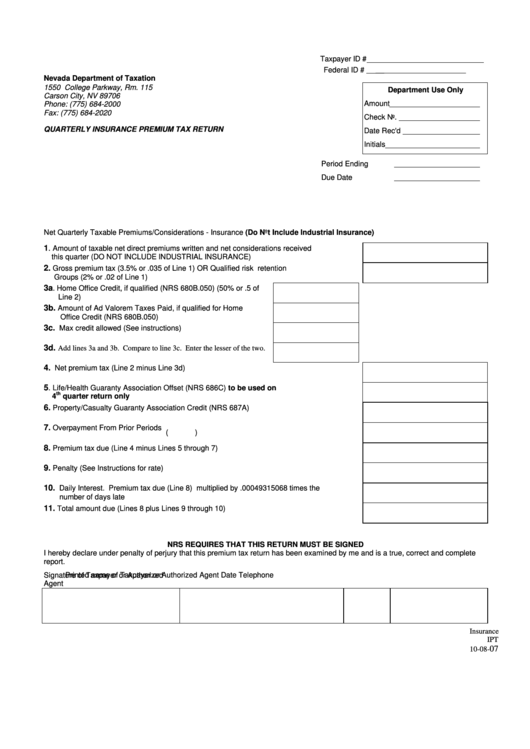

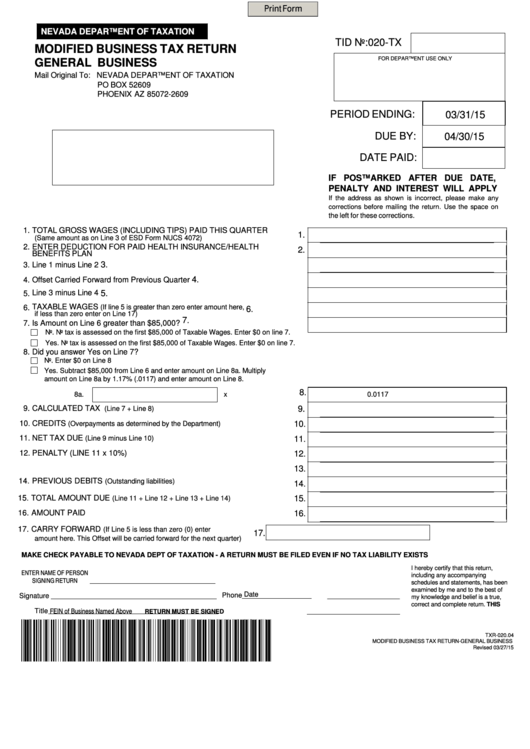

The insurance premium tax was enacted in 1933 and is authorized by nevada revised statutes section 680b. This form is for the reporting of insurance premium tax on a quarterly basis. Insurers are required to obtain and document the consent of the vehicle owner or owner’s authorized.

For example, the taxes were due january 31,. Premium taxes range from $5,000 minimum to 175,000 maximum Nrs 680b.0355 insurer to provide statement to insureds if portion of premium is attributable to general premium tax, fees or assessments under certain circumstances.

The premium tax will be deducted from the first payment. Nevada's insurance premium tax provided over $358 million of revenue to the state's general fund for fiscal year 2017. This form is to be used for all annual filers.

The nevada premium tax rate is 3.5% of premiums written on policies and Credit for policies of industrial insurance. A premium tax credit, sometimes called subsidies or discounts, can be used to lower your monthly insurance payment (called your “premium”) when you enroll in a health insurance plan through nevada health link.

The statute does not prevent the insurer from passing this cost on to their customers. Your tax credit is based on the income estimate and household information you put on your marketplace application. If you buy an immediate annuity, you will pay the premium tax up front.

One component of the insurance premium tax involves annuities which are Quarterly insurance premium tax return.

Nevada Insurance Premium Tax How to Enroll Nevada

Fillable Form IipA Annual Industrial Insurance (Workers

Form Pt01 Annual Insurance Premium Tax Return 2004

Nevada General Insurance Claims Phone Number CladAsia

Form IptR Annual Insurance Premium Tax Reconciliation

Nevada Insurance Premium Tax How to Enroll Nevada

Nevada Insurance Premium Tax How to Enroll Nevada

Nevada Insurance Premium Tax How to Enroll Nevada

Form IptA Annual Insurance Premium Tax Return 2010

Nevada Insurance Premium Tax How to Enroll Nevada

Blank Nv Sales And Use Tax Form Form IIPR Fillable

Nevada Insurance Premium Tax How to Enroll Nevada

Form IipR Annual Industrial Insurance (Workers

Motor Insurance Motor Insurance Database Register

Nevada Insurance Premium Tax How to Enroll Nevada

Fillable Form IipR Annual Industrial Insurance (Workers

Form Ipt Quarterly Insurance Premium Tax Return

Health Plan Of Nevada Tax Form Individual Health

Nevada Insurance Premium Tax How to Enroll Nevada