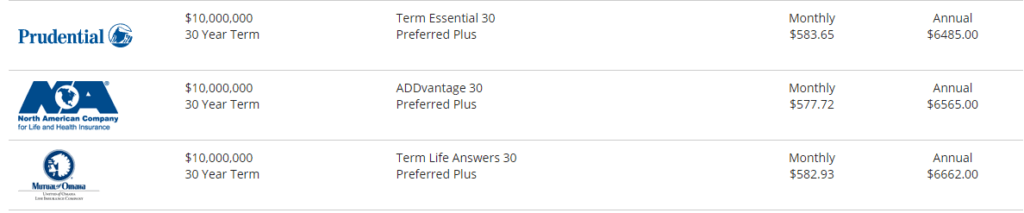

Sample $5 million term life insurance rates were run for 10 years, 20 years, and 30 years. $400,000 mortgage balance = $400,000 mortgage life insurance.

Million Dollar Life Insurance Do You Need it? Trusted

The insured pays a premium payment, and in return, the life insurance company will pay a lump sum payment of a million dollars to the insured named beneficiary should the insured pass away while the contract is active.

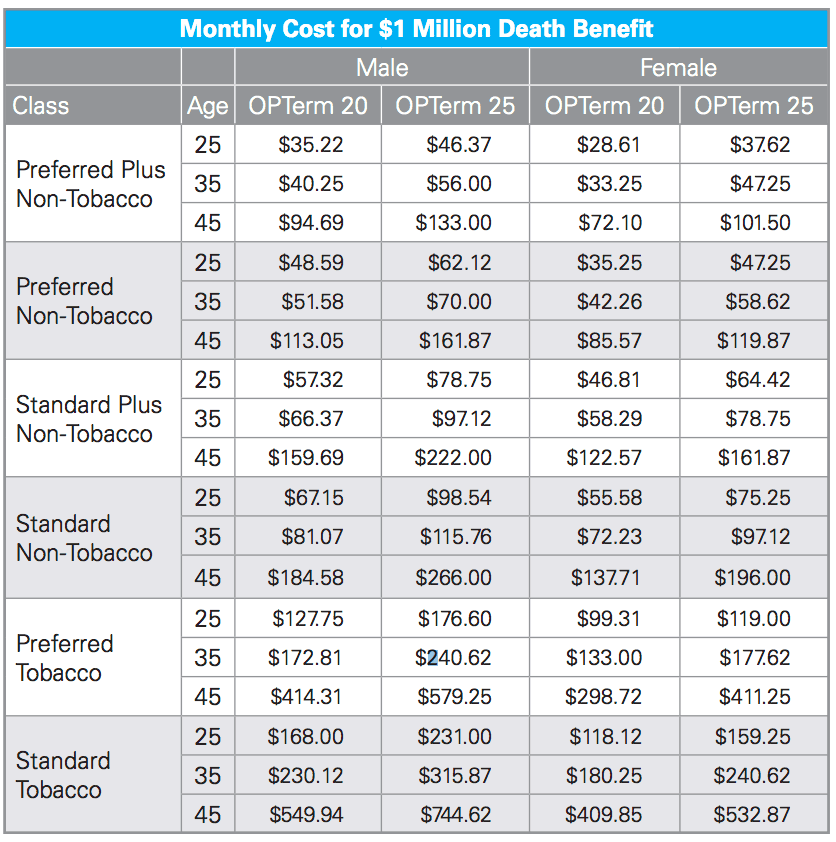

Million dollar term life insurance premium. For universal life insurance quotes, term life insurance rates, or return of premium quotes, use the instant quote form on the right (or below). Cost for 1 million life insurance policy vs 500k. The best companies include banner life, protective, and lincoln financial.

Average million dollar life insurance rates. It gets even more complicated because every company has their own underwriting requirements and their own rates. What are the features of million dollar life insurance?

The good news is term life insurance isn’t nearly as costly as most people think. If you are in the market for a one million dollar term life insurance policy you probably are protecting income or a mortgage. Here are the needs a $10 million life policy can meet:

Now, your will need to get an estimate for mortgage life insurance rates, along with an additional death benefit to cover your income. A one million dollar life insurance policy may seem like a lot at first blush but when you think about how far a dollar can go nowadays, $1,000,000 of life insurance coverage might just be what you need. Term life insurance is cheap.

When it comes to large face amount cases the first step is to find a plan based on your overall health, lifestyle, hobbies, family history and background information. Quotacy explains why and how much it costs. The cost of a 1 million term life insurance policy is very affordable under the age of 50.

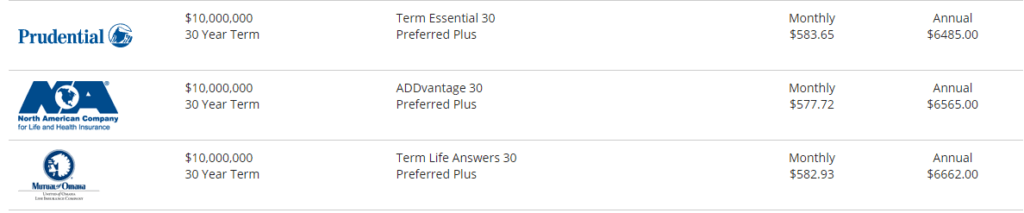

What makes term even better is that larger policies cost less on a per thousand basis than smaller policies do. We've found that the average cost of life insurance is about $147 per month for a term life insurance policy lasting 20 years and providing a death benefit of $500,000. $200,000 income (x 3 years) = $600,000 life insurance.

1 million life insurance premium 👪 sep 2021. For most families, term is the better. To be honest, purchasing $1 million in term life insurance coverage didn't bother me because it's so incredibly affordable.

Or $23,040 a year if paying premiums for 30 years. A million dollar life insurance policy covers both needs: The features of a million dollar policy depend on the type of the policy you purchase.

So the same healthy 25 year old might pay $300.00 per year with company a, and $480.00 per year with company b for the same million dollar term policy. $1,000,000 of life insurance guaranteed for 5 year term = $1,315.00. You’ll have an idea of what premiums look.

We specialize in helping people purchase affordable term life insurance especially those who are between the ages of 60 to 69. Another factor to consider is cost. You should think of this number strictly as a baseline — your own rates for life insurance will change depending on your age, the insurer you choose and the amount of coverage you purchase.

$1,000,000 of life insurance guaranteed for 20 year term =$2,105.00. 2 million dollars of life insurance this, of course, comes with the benefit of knowing your family is secure in the event something unfortunate happens. Premium for 1 million life insurance.

*rates based on 50 year male in good health. $1,000,000 of life insurance guaranteed for 10 year term =$1,165.00. $26,322 in annual premium (pay 30 years) for variable universal life insurance.

How much $2 million in term life costs how much $2 million in term life costs will depend on what you need to protect. When determining how much a million dollar life insurance policy costs it is important to know that You may find the premium on a $1 million policy is only a little bit higher than it is for $500,000.

Life auto home health business renter disability commercial auto long term care annuity. The short answer is that it depends on the type of life insurance policy. Larger plans worth more will cover greater expenses, but at the same time end up with a higher monthly cost , though do not get too discouraged, million dollar life insurance might be cheaper than you think !

You should only choose a vul policy if you have good. The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors. A million dollar life insurance policy is a contract between a life insurance company and an insured.

$1,000,000 of life insurance guaranteed for 30. Permanent insurance costs were also calculated for are for a whole & universal life insurance policy.

how much does a one million dollar life insurance policy

What Is A Million Dollar Life Insurance Policy And Do You

Compare Million Dollar Life Insurance Policy Rates [Top 5

Life Insurance Quotes for 250,000 1,000,000 of

Million Dollar Life Insurance Premium Digitalflashnyc

How Much is a Million Dollar Term Life Insurance Policy

How Much Does 1 Million In Life Insurance Cost ABINSURA

Million Dollar Life Insurance Cost 3 Million Dollar Life

10 Million Dollar Life Insurance Policy What you need to

Million Dollar Term Life Insurance Policy Quote

Best Quotes 1 Million to 2 Million of Term Life Insurance

Million Dollar Life Insurance From 15 a Month

1000000 Life Insurance / One Million Dollar Life Insurance

Million Dollar Term Life Insurance Policy Quote

How Much Does a Million Dollar Term Life Insurance Policy

Million Dollar Life Insurance / Do I Need a One Million

Best Quotes for a One Million Term Life Insurnace Policy

1000000 Life Insurance / One Million Dollar Life Insurance

Million Dollar Term Life Insurance Policy Quote