Get affordable life insurance quotes online with a simple search. They can get joint life insurance with their domestic partners or buy a separate policy for them.

Life Insurance for Women A Guide on What You Need to Know

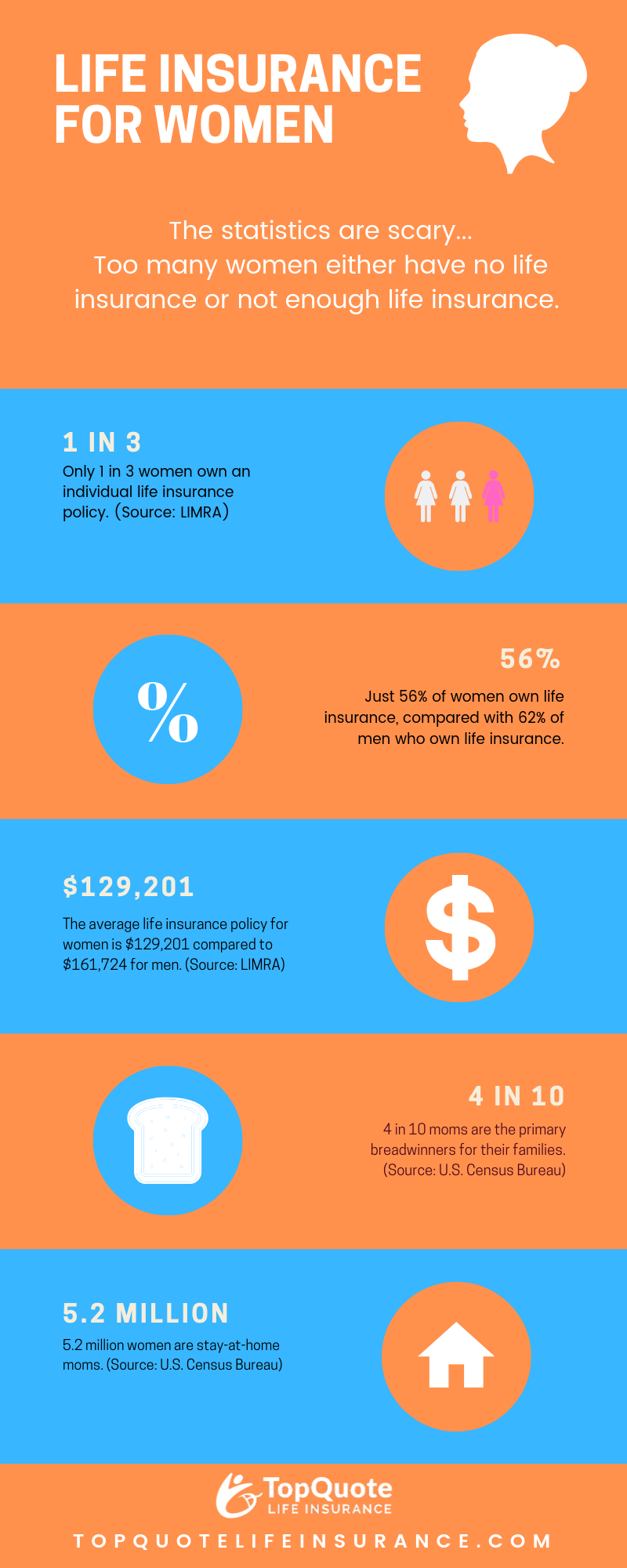

Yet women purchased only 36% of the life insurance policies issued in the country, in 2019.

Life insurance for women. A convenient tool for tax rebates. * on average, women pay 25% less than men for life insurance at any given age: If something were to happen, the kids may.

A tragic event will not only result in an emotional loss but a substantial impact on. Life ant has life insurance policies for women and can help women save money on life insurance by comparing quotes from different providers. Before retiring, women must first get their financial affairs in order.

Women, regardless of marital or employment status, can use life insurance to better protect loved ones, safeguard finances, and plan for the future. For women, life insurance can provide financial support for loved ones, cover small business debts, and even provide for a child’s education or a down payment on a home later in life. Even though a woman may not be considered a breadwinner in the conventional manner, she also needs to protect against life’s risks, and thus needs life insurance.

It is affordable and provides sophisticated coverage. Affordable life insurance coverage options for women can help close this gap. In today's world, a woman's.

Life insurance companies especially reward women with cheaper premiums because female life expectancy is even higher than that of men. And because the mortality risk for women is lower overall, their premiums are also lower. While men might not give it due attention, risks also exist in a woman’s life, sometime even more than a man’s life.

Life insurance companies base their premium amounts on the mortality risk of an individual. Having a health condition may rule you out from certain life insurance policies, but other insurers will still offer cover. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Life insurance for women is a crucial part of financial planning for the whole family. In its simplest form, life insurance means protection against risks in life. Each spouse can get their own plan based on their needs, health, and lifestyle choices.

Affordable, flexible term life insurance at your pace. Married couples do not need to get the same type of life insurance coverage; If you need life insurance, please enter your zip code in our quote box above to get started.

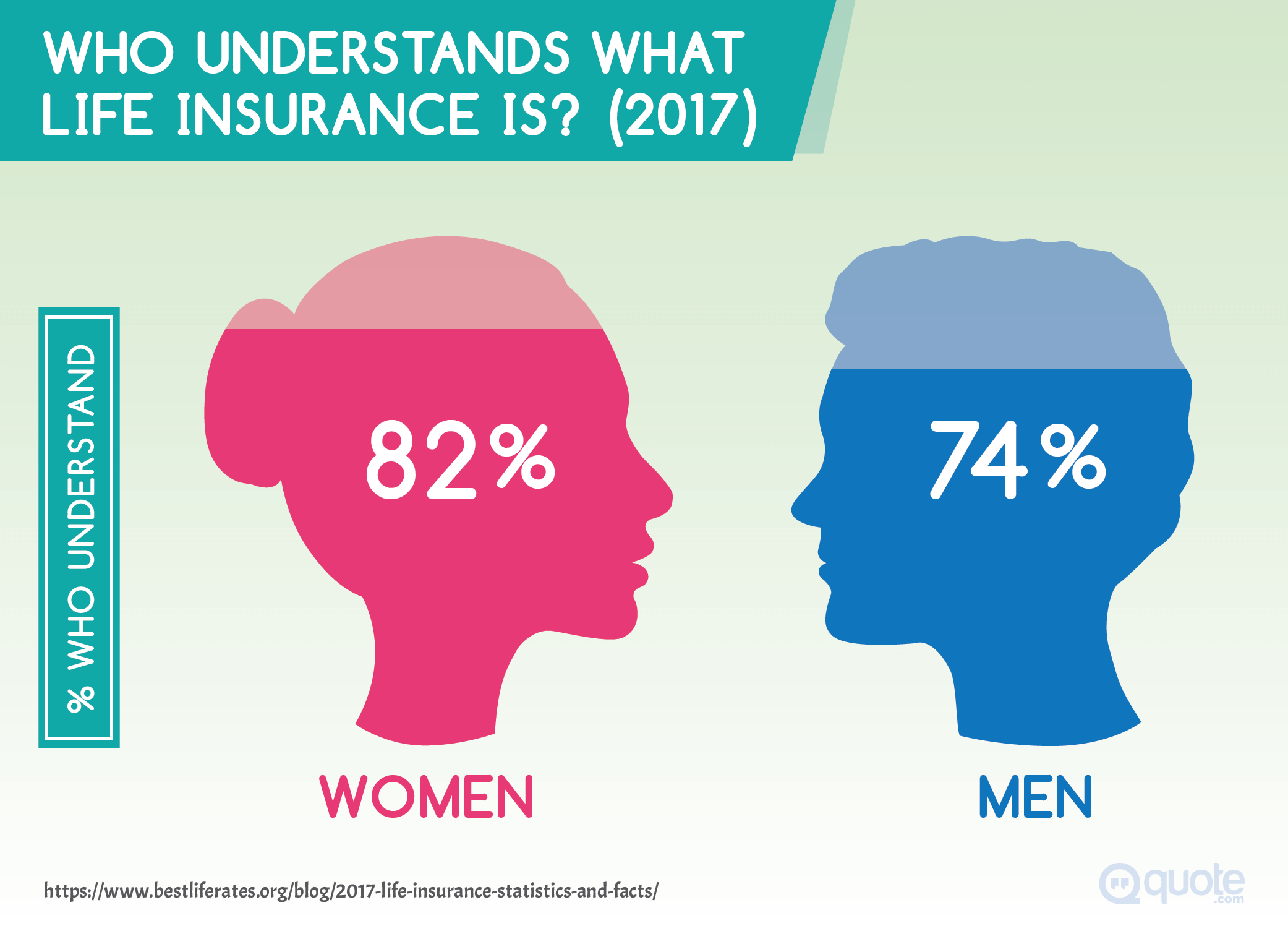

Based on the statistics provided by haven life and quotacy, women sell themselves short when it comes to coverage. However, when it comes to life insurance coverage, women continue to lag behind men. Thankfully, life insurance premiums tend to be cheaper for women compared to men.

Women pay less for life insurance than men because women statistically outlive men. Women own an average life insurance amount of $231,342. Therefore, it is essential to understand the importance of.

If you have anyone who would be financially impacted by your passing, life insurance is a smart and affordable tool to ensure you leave behind a legacy rather than any debt or expenses. Women experience an average of 19 years of ill health compared to 16 years for men and distinct conditions that affect women include breast and cervical cancer. On average, men have $206,357 worth of individual life insurance while women only have $160,782.

Buy life insurance for women. Can health conditions affect women’s life insurance? A life insurance policy is a perfect product for women who have evolving jobs, from homemakers to income providers, as it satisfies the twin goals of money related freedom and budgetary security, for themselves and family.

There’s still a gender gap in many areas of modern life, and it can be seen when looking at life insurance for women. Imagine the matriarch of your family becoming ill or passing away. There are many reasons to take out life insurance as a woman.

For the exact same life insurance policy, women pay a significant. Stay at home moms also need life insurance. Life insurance coverage through work may not be enough to protect your spouse and children.

One study by haven life found that only 67% of women with children under the age of 18 had life insurance, compared to 79% of men. Life insurance for women can help deal with the costs of outstanding debts, but can also cover childcare expenses and the myriad of daily life expenses when it. Of those with life insurance, men’s average coverage amount was almost twice as high as women’s.

Buying a life insurance policy with a maturity benefit is a wonderful method to achieve this. The insurance will accumulate capital throughout time and pay a lump amount when it matures. It basically means that your dependents will be financially protected if you die “of course no one wants that”.

While there is still a disparity in numbers between the male and female life insurance policyholders, with an increase in the exposure and awareness of life insurance among women, there is a slow yet significant change in this sphere. If you work, your family can depend on your income, and if that income disappears, they could be in trouble.

Prudential Financial 4 Factors Women Should Consider When

Life Insurance for Women Canada Protection Plan

Why women need life insurance more than men and how to

Why Is Life Insurance Cheaper for Women? Plus Extra Info!

Women need life insurance too! Here is why YOU may need it

Woman's Life Insurance Society Serving The Fort Wayne Area

Life Insurance For Women Is It Important? McDoglaz Note

5 Reasons For Why and When Should Women Need Life Insurance

Life Insurance for Women 8 Things You Need to Know Now

Why Women Need Life Insurance Coastal Wealth Management

Lifeline Direct Insurance Services Releases Women and Life

5 important reasons why women need life insurance

Women and Life Insurance Why twothirds of UK households

life insurance for women What is Insurance How Many

10 Best Life Insurance Plans For Women In India

7 Tips For Single Women To Purchase Term Life Insurance

Prudential Financial 4 Factors Women Should Consider When

Why All Women Need Life Insurance Femme Frugality