Also, as webull is not a bank, it is not a member of the fdic (federal deposit insurance corporation), which insures consumer deposits in u.s. The web user interface will be slightly more confusing on webull, as it’s built for experienced traders.

Is Webull Sipc Insured Digitalflashnyc

Webull financial llc is a member of sipc, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash).

Is webull fdic insured. Their finra license number (or crd number) is. The federal deposit insurance corp (fdic) is a federal entity that covers banking and other financial institutions by: Webull is insured but not fdic because it's not a bank.

This insurance covers up to $500,000 in your portfolio. Our clearing firm, apex clearing corp., has purchased an additional insurance policy. The federal deposit insurance corporation (fdic) is a federal agency that insures consumer deposits in u.s.

The sipc insures the value of your investment portfolio, as well as any cash you have in reserve in your brokerage account. Yeah well fidelity is fdic insured and they're not a bank. Webull offers pretty much all research that is available on the various coins.

An explanatory brochure is available upon request or at www.sipc.org. So, should this worry you? Am i reading it right?

It is an open frontier of finance like the world has never really seen, and no one knows how it will go for sure. Webull's clearing house, apex clearing, has an additional policy in place. Contrast this with webull's disturbing disclaimer:

Banks to give consumers reassurance that their savings would not be lost in the event of a bank failure. The corporation is required to refund the investor’s money and securities as fast as possible. The federal deposit insurance corporation (fdic) is a federal agency that insures consumer deposits in u.s.

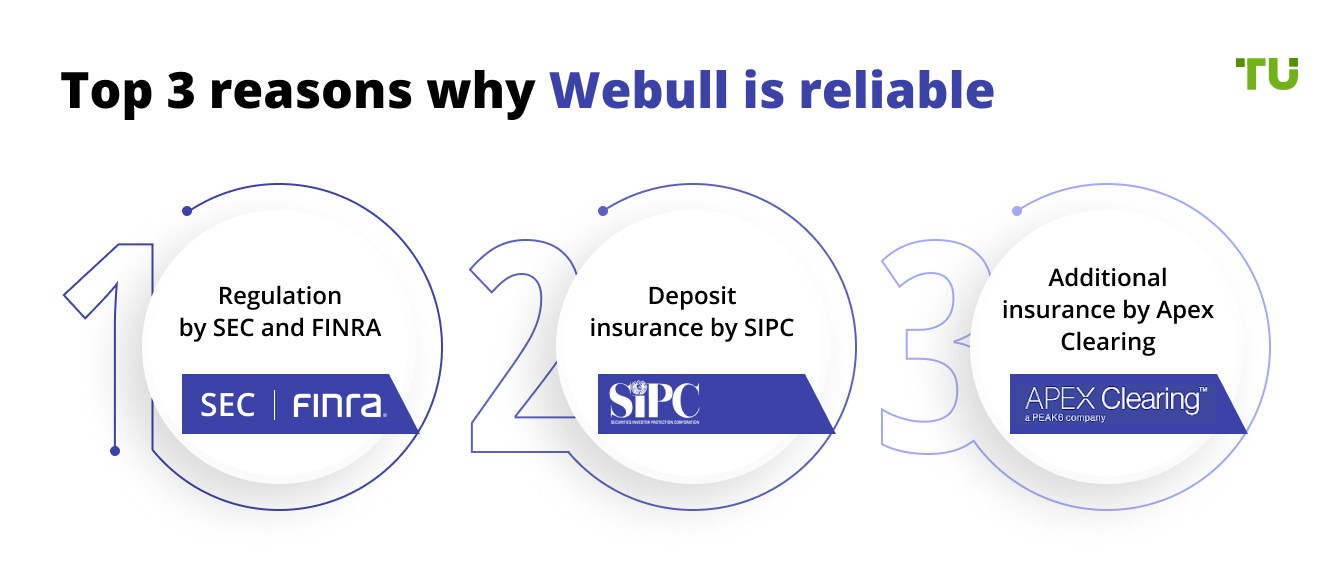

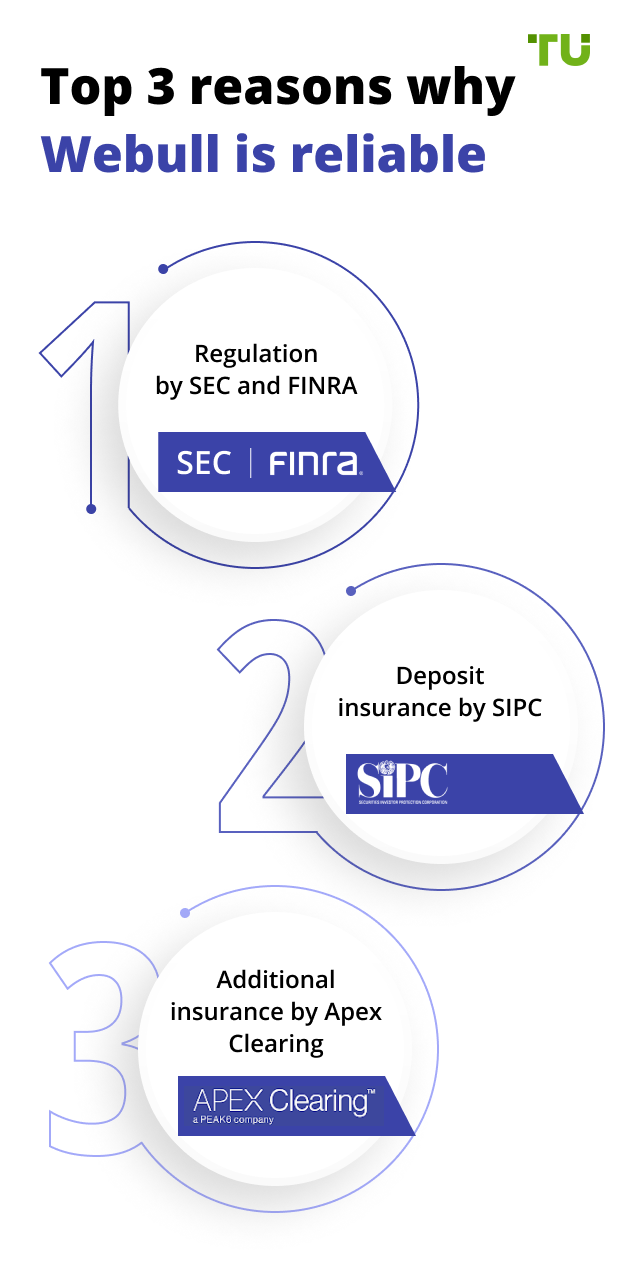

Webull financial is a member of sipc, meaning your securities are sipc insured. Webull financial llc is a member of sipc, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Users enjoy up to $500,000 investor protection ($250,000 cash).

Webull is spic insured, they have more insurance through ally invest, they are registered with the sec, and they’re a member of finra. Robinhood is good for beginners but consider switching to webull once you reach learn how investing works. Examining and supervising financial institutions for safety, financial stability and consumer protection.

Webull financial llc is a member of sipc, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Webull also adds a desktop application that m1 doesn’t have. M1’s desktop web interface is easy to navigate.

Unlike its competitor robinhood, webull also doesn’t offer any kind of bank sweep program that would automatically grant fdic coverage (robinhood offers this for its cash management feature, which also allows clients to. Webull is not a bank, and therefore, it is not a member of the fdic. Founded in 2017, the company is regulated by the us securities and exchange commission (sec) and the financial industry regulatory authority (finra) as well as the hong kong securities and futures commission (sfc).

Existing insurance products are inadequate to cover potential losses if an exchange fails and / or digital wallets are hacked. Webull financial llc is a member of sipc, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Webull is a safe online trading platform because it is regulated by the securities investor protection corporation's (sipc) protection scheme.

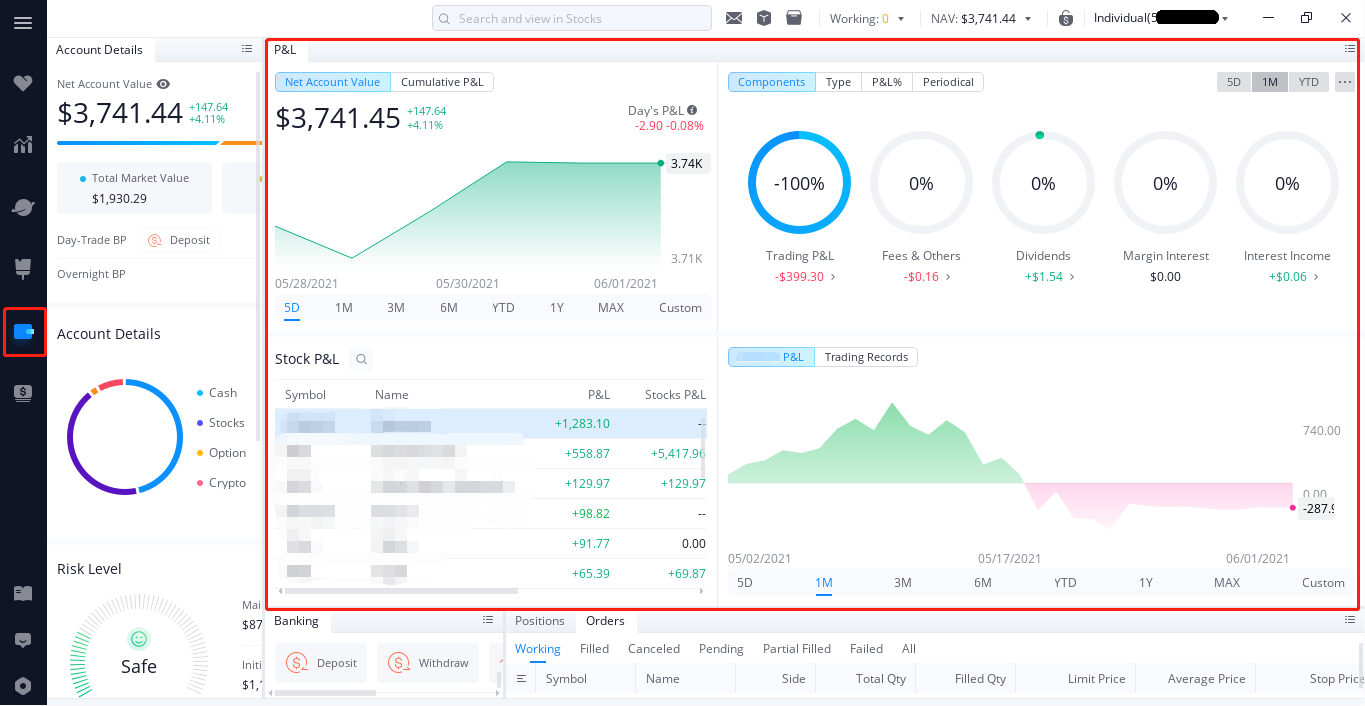

Working to resolve any arising financial issues. If you are still curious to lean more, here's what would happen in the unlikely event that webull goes out of business. Webull is a subsidiary of fumi technology, a chinese company based in hunan.

How much are the trading fees? Also, as webull is not a bank, it is not a member of the fdic (federal deposit insurance corporation), which insures consumer deposits in u.s. I see a disclosure i have to agree to that i understand webull uses apex crypto and that apex is not fdic insured, etc.

Banks to give consumers reassurance that their savings would not be lost in the event of a bank failure. It also insures $250,000 of cash. I prefer webull over robinhood because webull offers better watchlists, free paper trading, and advanced charts for day and swing traders.

Webull is not a bank, and therefore, it is not a member of the fdic. They are open to government regulations, and they are not fdic insured. Is webull better than robinhood?

Accounts holding cryptocurrencies are not protected by [sipc or fdic coverage]. This means that with a standard webull account, users will not need to pay any trading fees.

Get Up to 13 Free Stocks plus 90 in Free Cash with

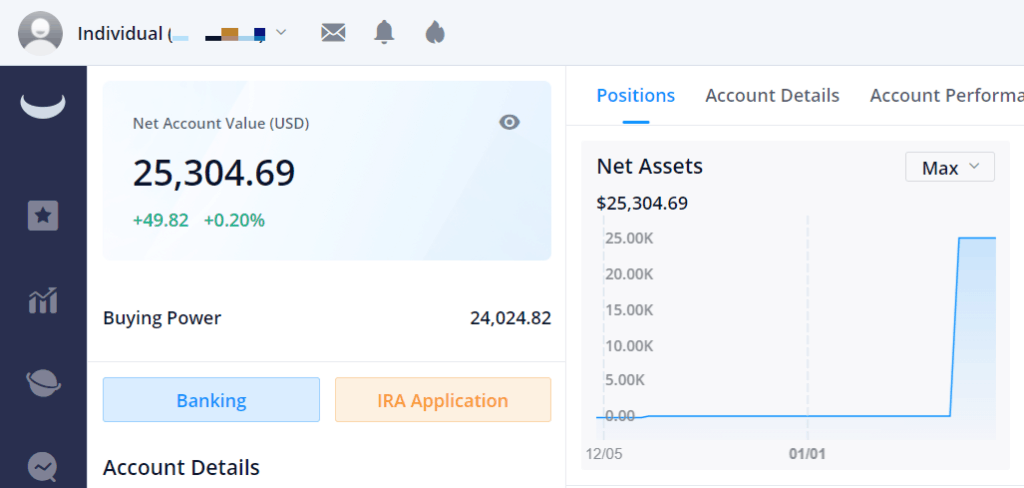

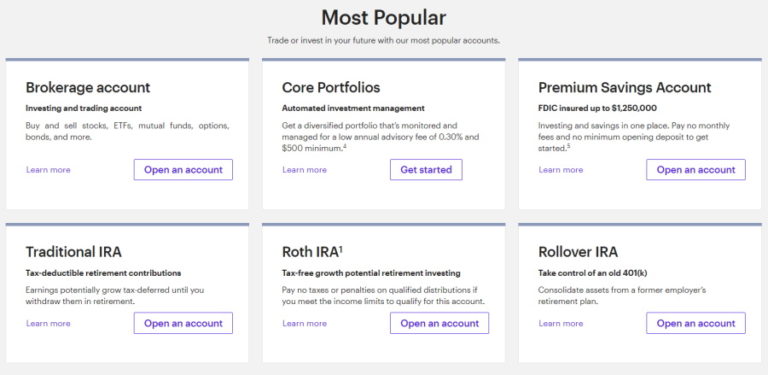

M1 Finance vs. Webull Brokerage Comparison [2021 Review]

Is Webull Sipc Insured Digitalflashnyc

Is Webull Sipc Insured Digitalflashnyc

Crypto Trading Power Webull / Webull Help Center and FAQ

Is Webull Sipc Insured Digitalflashnyc

eTrade vs Webull Cheapest Broker Revealed 2021

Is Webull Sipc Insured Digitalflashnyc

Webull vs Fidelity 2021 Best Free Investing Platform?

What is Webull Is Webull Safe? (Stock Trading App Guide)

M1 Finance vs. Webull Brokerage Comparison [2021 Review]

Get Up to 13 Free Stocks plus 90 in Free Cash with

M1 Finance vs. Webull Brokerage Comparison [2020 Review]

Betterment Review 2021 A RoboAdvisor Worth Checking Out

M1 Finance vs. Webull Brokerage Comparison [2021 Review]

Is Webull Sipc Insured Digitalflashnyc

Is Webull Sipc Insured Digitalflashnyc

Is Webull Sipc Insured Awesome

Is Webull Sipc Insured Digitalflashnyc