As the graph below shows, we have closed over usd $4 billion of collateralised reinsurance, generating. That is over ten years of ‘hands on’ ils experience.

Insurance Linked Securities Market Securing tomorrow

Today, csils’s investment team and broader market access platform 1 contains more than 20 specialized.

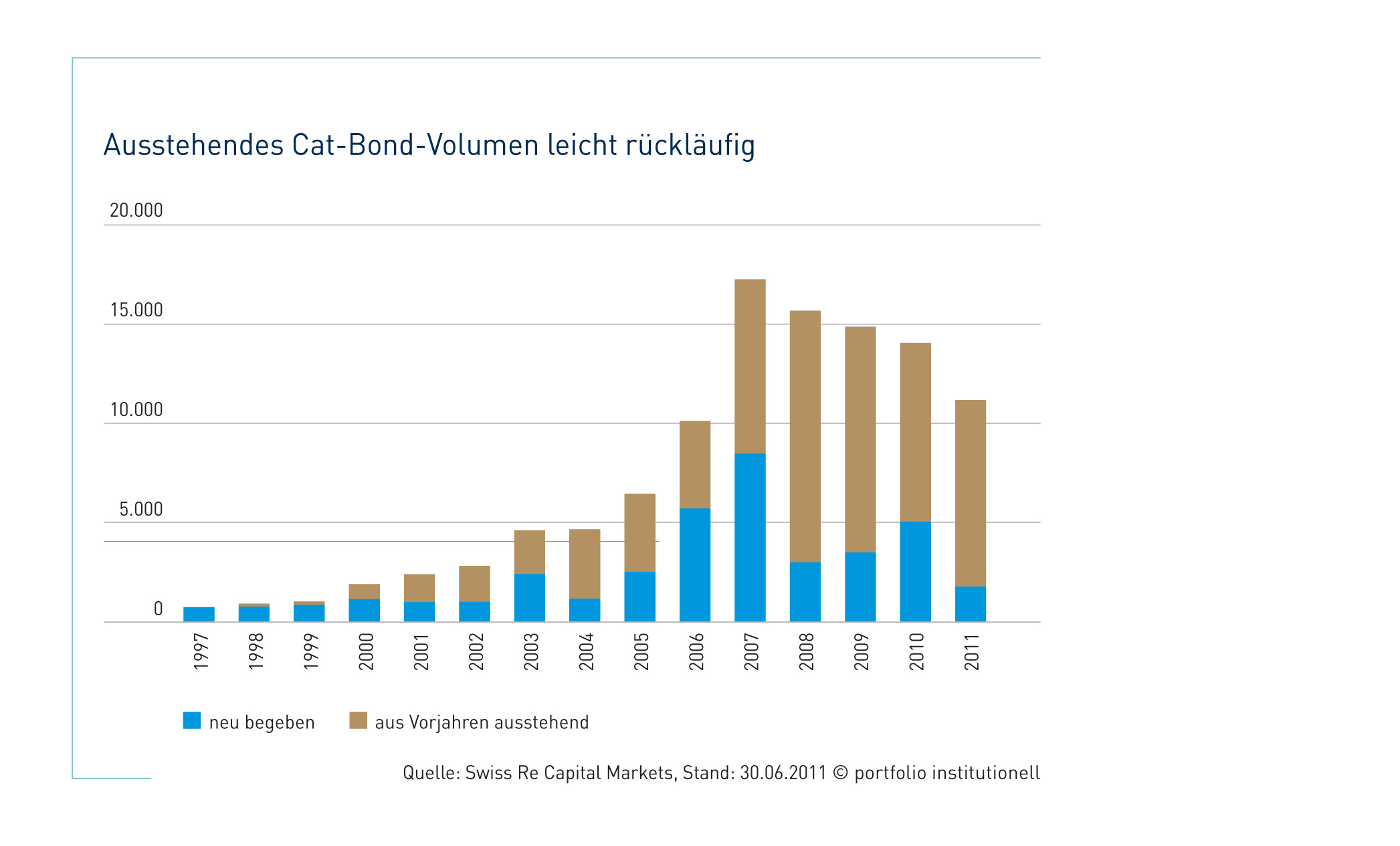

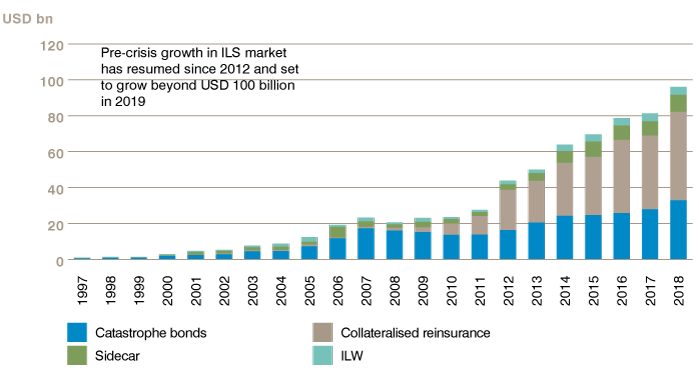

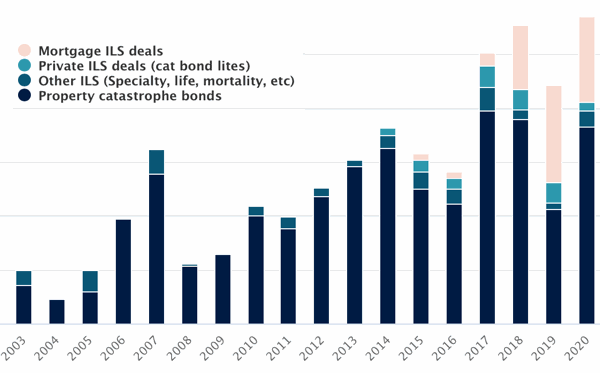

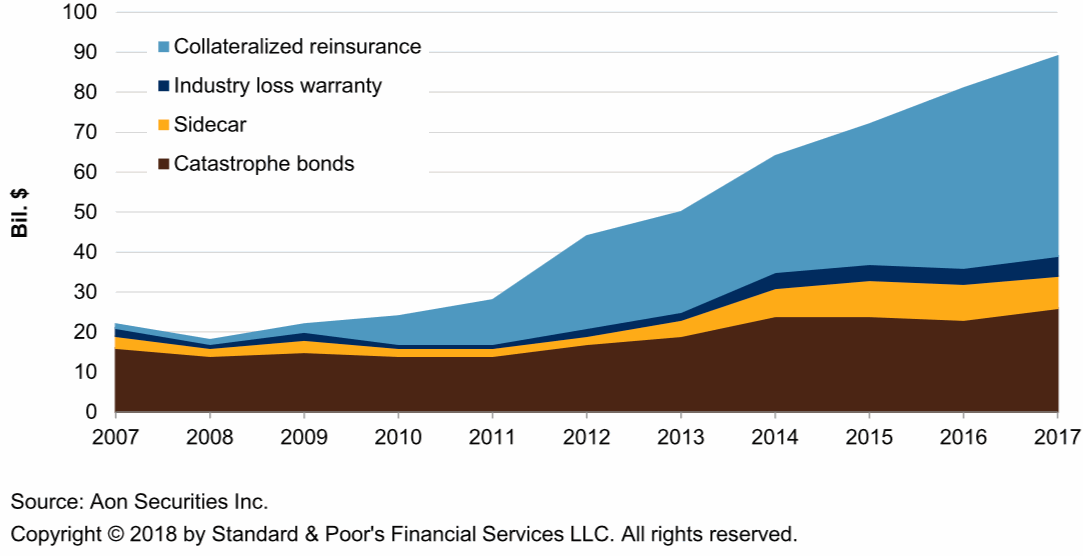

Ils insurance market. Steadfast re have been structuring and executing collateralised reinsurance on a full indemnity basis since 2004. However, of the overall ils market, which is estimated at around $103 billion, only around one third is comprised by cat bonds. A few large risks have bypassed the traditional insurance market entirely and used alternative capital providers for risk protection.

The securitization model has been employed by insurers eager to transfer risk and use new sources of capital market funding. Ils, both from the life and property/casualty (p/c). Insurance linked securities and collateralised reinsurance.

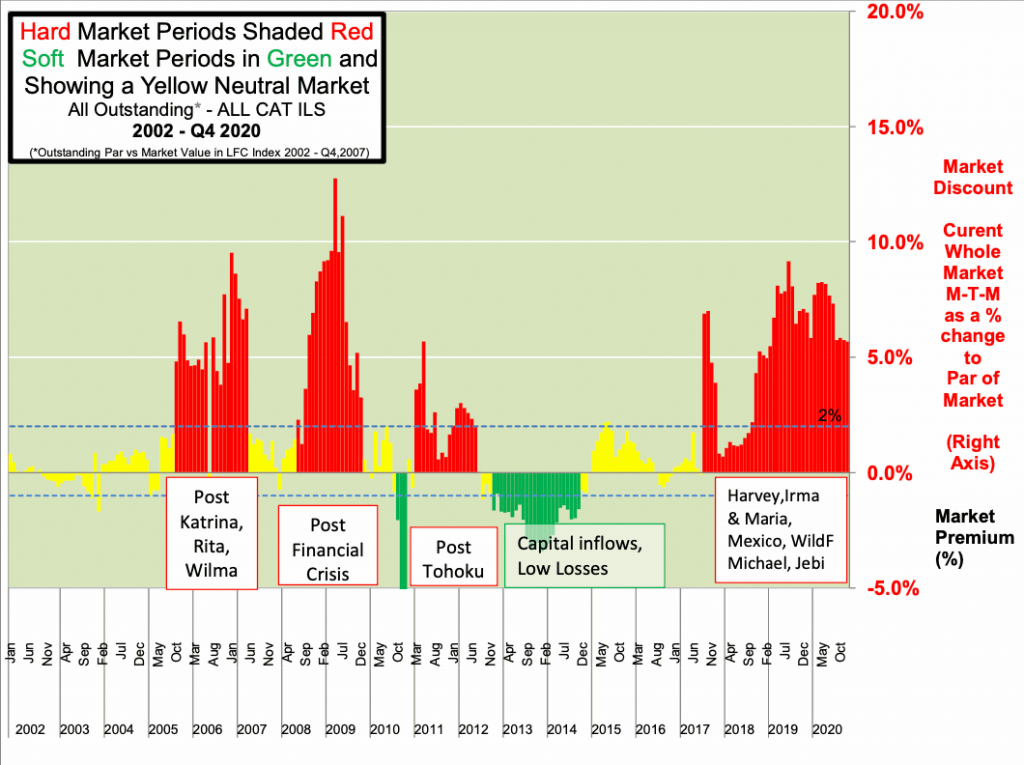

The winning transaction will be able to show significant participation from ils markets and demonstrate a benefit to the cedant in meeting their need for protection. The delay is emblematic of challenges facing the ils market, which has been on the backfoot since the $100bn+ of cat losses the insurance industry absorbed in 2017. Credit suisse’s insurance linked strategies team (“csils”) has one of the longest track records in insurance linked strategies (“ils”).

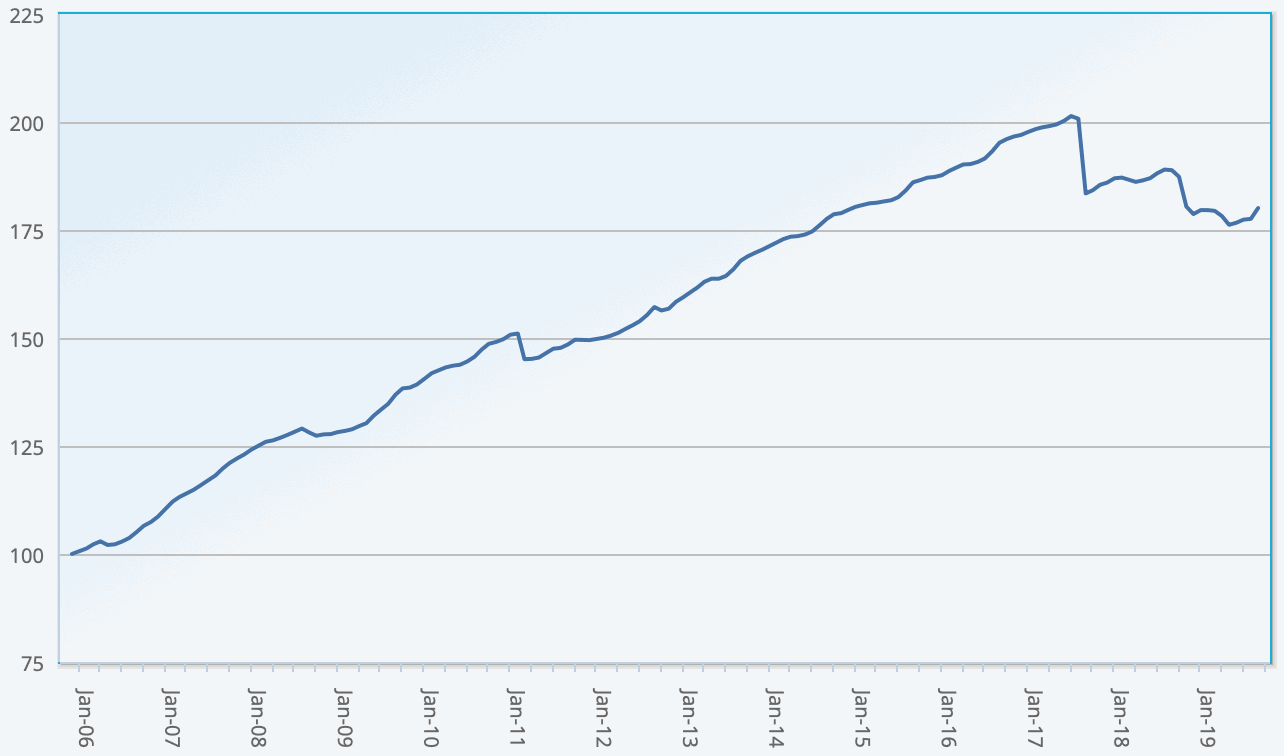

This award will recognise a reinsurance or ils transaction that insures risk that was previously uninsured or not highly insured. Market a source of fresh capital to take advantage of distressed asset valuations. Since its inception in 2003, the team has firmly established itself as one of the leading ils managers globally.

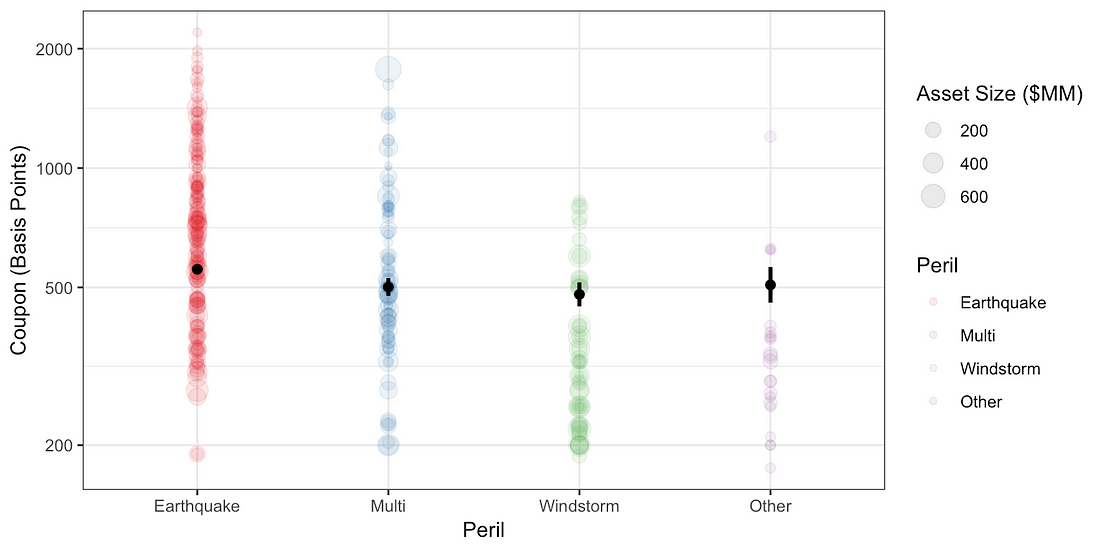

This has been especially promising, in comparison to the traditional Ils value is influenced by an insured loss event underlying the security. •investors may be required to consolidate the issuer for accounting purposes under certain circumstances.

The island’s depth of talent has solidified the jurisdiction as a global center of risk innovation. 4 this paper focuses on reinsurance companies, but insurers can and do use alternative capital. The life insurance industry in india recorded a total premium of inr 5.73 tn ($81.3 bn) in fy20 witnessing a growth of 12.75% over the previous year and the private insurers accounted for 33.7% of total premium underwritten by the industry.

January and february were marked by tightening spreads as the sector was flush with capital. These products are generally not offered directly to individual retail investors. Rapid economic growth, rising wealth, low insurance penetration and significant exposure to natural catastrophe risks all point to a tremendous opportunity.

Long respected as the ‘world’s risk capital’ and market leader in ils and alternative capital, bermuda is the ideal location for the convergence of capital markets and (re)insurance. •an investment in the insurance linked securities may have adverse tax consequences for investors. The ils market must increase its focus on risk assessment and price adequacy ::

Riding the momentum from its resilient performance through 2020, the ils market saw growth opportunities in the first half of this year. Ils transactions may include a reinsurance “sidecar.” a sidecar is a transaction whereby a reinsurer enters into an insurance contract with an spv (similar to the transaction between the sponsor and spv in diagram 1 above). Brothers), with current ils, there is less reliance on trs counterparties and greater reliance on collateral liquidity.

7 national association of insurance commissioners, “capital markets special report: This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital. •if the issuer of the insurance linked securities becomes insolvent, investors may lose some or all of their investment.

The ils market reacted positively, with capital meeting selling pressure, driving only modest price movements, even at the very worst of the market.

Insurance Linked Securities Market Securing tomorrow

![]()

ILS market issuances decline 56 in firsthalf 2019 Swiss

Cat bond & ILS hard market may be coming to an end Lane

Increases moderate further to 15 on Marsh Global

Modeling ILS Market Dynamics. The market for insurance

Insurance Linked Securities (ILS) Fermat Capital Management

Insurance Linked Securities Market Securing tomorrow

Investor confidence in catastrophe models underpins ILS

Reinsurer managed alternative capital shrank faster than

Willis Towers Watson ILS Market Update Q2 2018 Growth

Catastrophe bond & insurancelinked security (ILS

2020 ends with an ILS whimper, as rates go sideways Lane

Covid19 to speed up cyber insurance market growth S&P

What are insurancelinked securities and how do they work

ILS Asia 2021 Insurance linked securities conference

Insurance Linked Securities Market Securing tomorrow

Collateralized reinsurance market shows no signs of

ILS market growth continues in first quarter of 2017

Cat bond recovery drives 1.42 average ILS fund return in