With benefits designedspecifically for the. The federal long term care insurance program is available to federal employees, their relatives, and domestic partners.

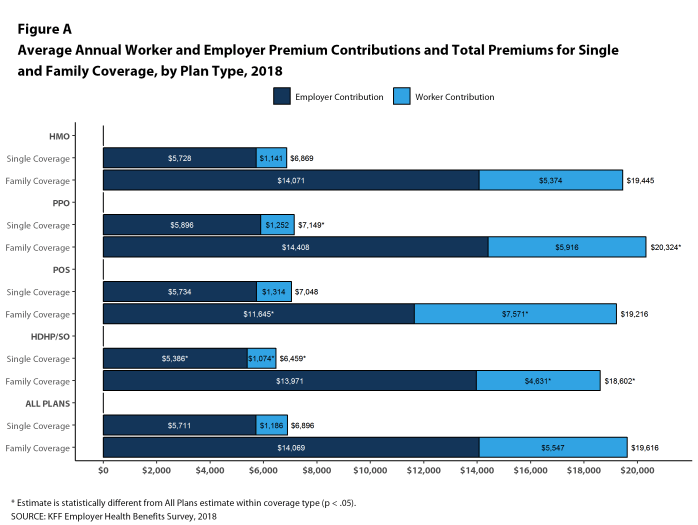

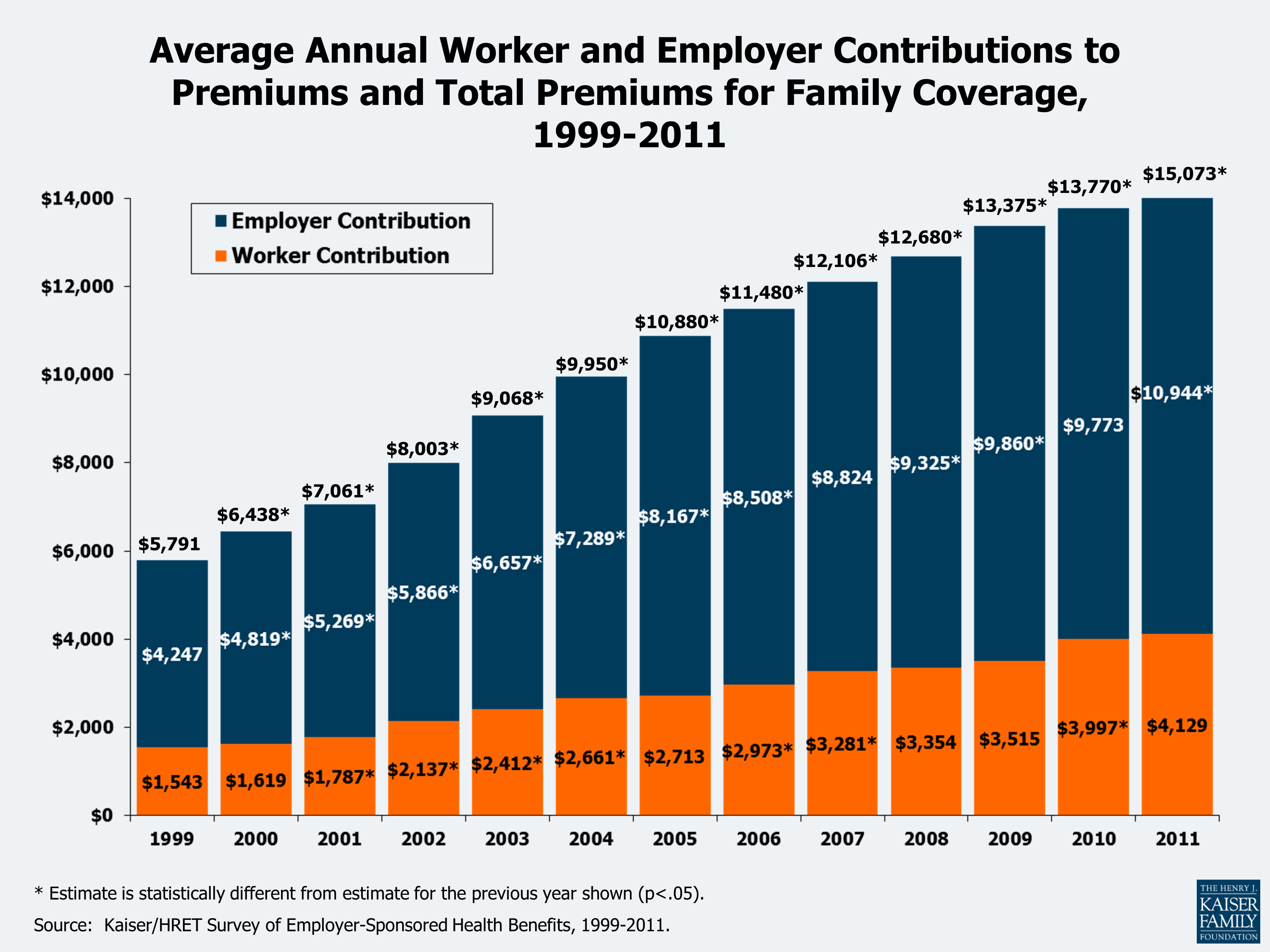

Average Annual Worker and Employer Premium Contributions

They pay the full cost of that insurance, and on nov.

Federal employee long term care insurance cost. This plan provides a simple long term care plan for federal employees and their spouses. According to long term care partners, which administers the fltcip, the bottom line on the rate increase is that current premiums are. No matter where you are in your career, consider theprospect of needing long term care, and how applying for longterm care insurance coverage under the federal long term careinsurance program (fltcip) may help.

A primary reason for the drop in individual ltc insurance sales is increasing premium costs. The daily withholding rate is $1.53 ($21.46 x 26 ÷ 364) and the daily contribution rate is $4.39 ($61.51 x 26 ÷ 364). Fers and csrs federal employee retirement benefits are generous, however they will cost you retirement dollars, especially for health and life insurance coverage.

Daily cost comparison for national average (mobile view) types of care startyear projectedyear; Cost without long term care insurance. Where would someone receive care?

For example, the national average cost for a semiprivate room in a nursing home is $92,710 1 per year. Office of personnel management subject: Federal employees and retirees who participate in the federal long term care insurance program (fltcip) are in for some serious sticker shock.

The policies are underwritten by john hancock life & health insurance company. The federal long term care insurance program is available to federal employees, their relatives, and domestic partners. If you cannot perform everyday tasks such as eating, dressing, and bathing because of a chronic illness, injury, disability, or aging, fltcip can help you pay for the assistance you need.

Federal long term care insurance premiums. Uncle sam will continue federal employee's health benefits, as long as you were enrolled in the program for the last five years of your service, however you must pay the same monthly. The federal long term care insurance program (fltcip) provides long term care insurance to help pay for the costs of care you need if you can no longer perform everyday tasks (activities of daily living) by yourself due to a chronic illness, injury, disability or the aging process.fltcip includes the supervision you might need due to a severe cognitive impairment (such as.

The biweekly employee share of his health benefits plan premium is $21.46 and the biweekly government share is $61.51. Advertisement there are three drivers of rising medical care expenditures that are contributing to the challenge of paying for health care in retirement. Federal employees have access to a long term care program called the fltcp 2.0.

Furthermore, long term care insurance premiums, like all medical expenses, are only deductible as an itemized deduction, subject to the 7.5% (10% some years) of agi threshold. Long term care costs the cost of long term care can be expensive and vary greatly depending on the type of care you receive, the place it's provided, and where you live. The federal long term careinsurance program.

Most federal employees (check with your human resources office if you are unsure of your eligibility), annuitants regardless of fehb eligibility, and their qualifying relatives, including: These plans offer comparable coverage to what is available from a host of private insurers. To get ballpark figures of how much long term care insurance costs, check out our online calculator.

Many individuals can no longer purchase individual ltc insurance because they can no longer afford to pay the premiums.

Compare LongTerm Care Insurance Policies

State Spending on Medicaid The Pew Charitable Trusts

PPT New Employee Benefits Orientation PowerPoint

Federal Long Term Care Insurance Application CladAsia

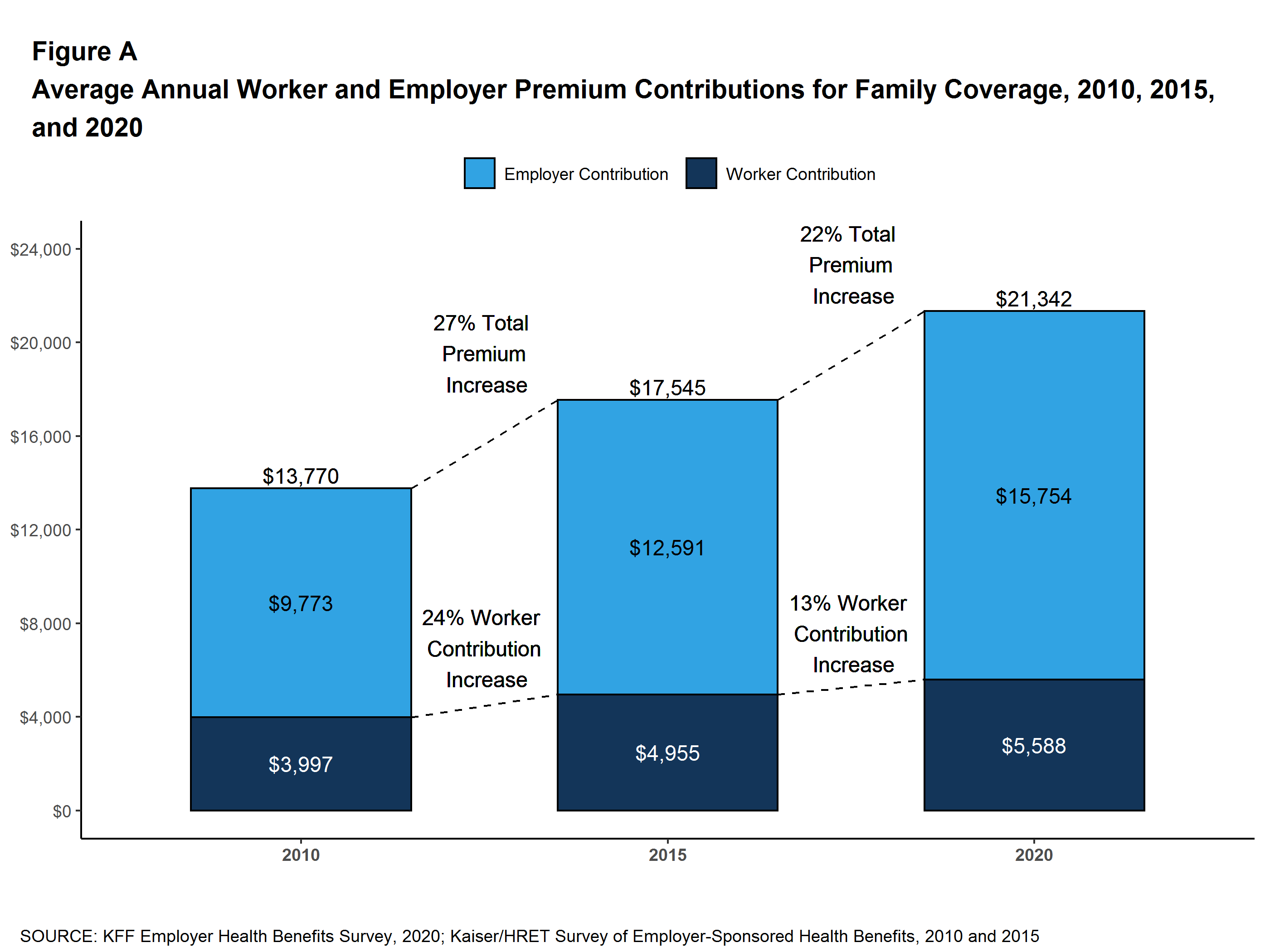

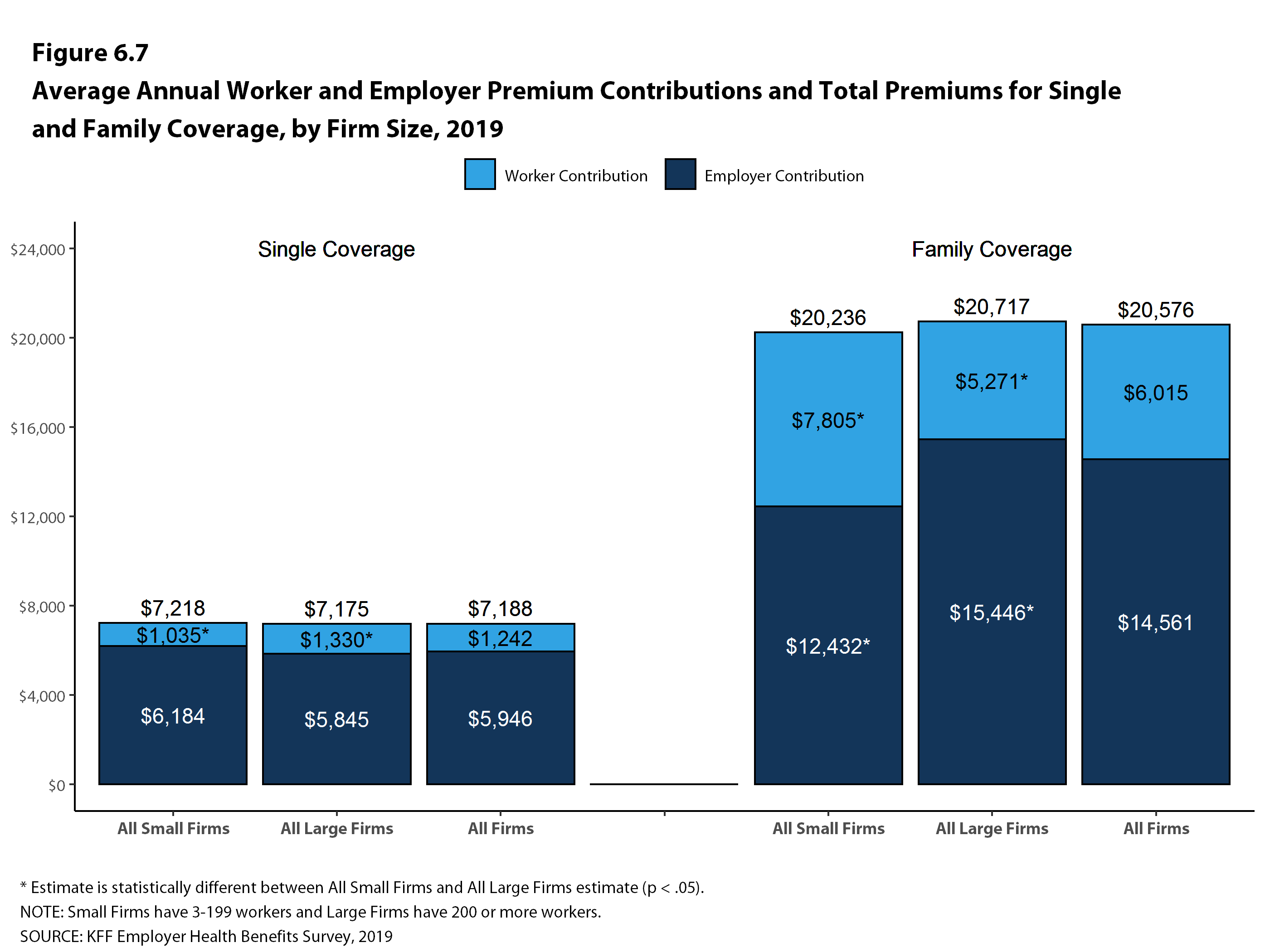

Average Annual Worker and Employer Premium Contributions

LongTerm Care Neckerman Insurance Services

Federal Long Term Care Insurance Application CladAsia

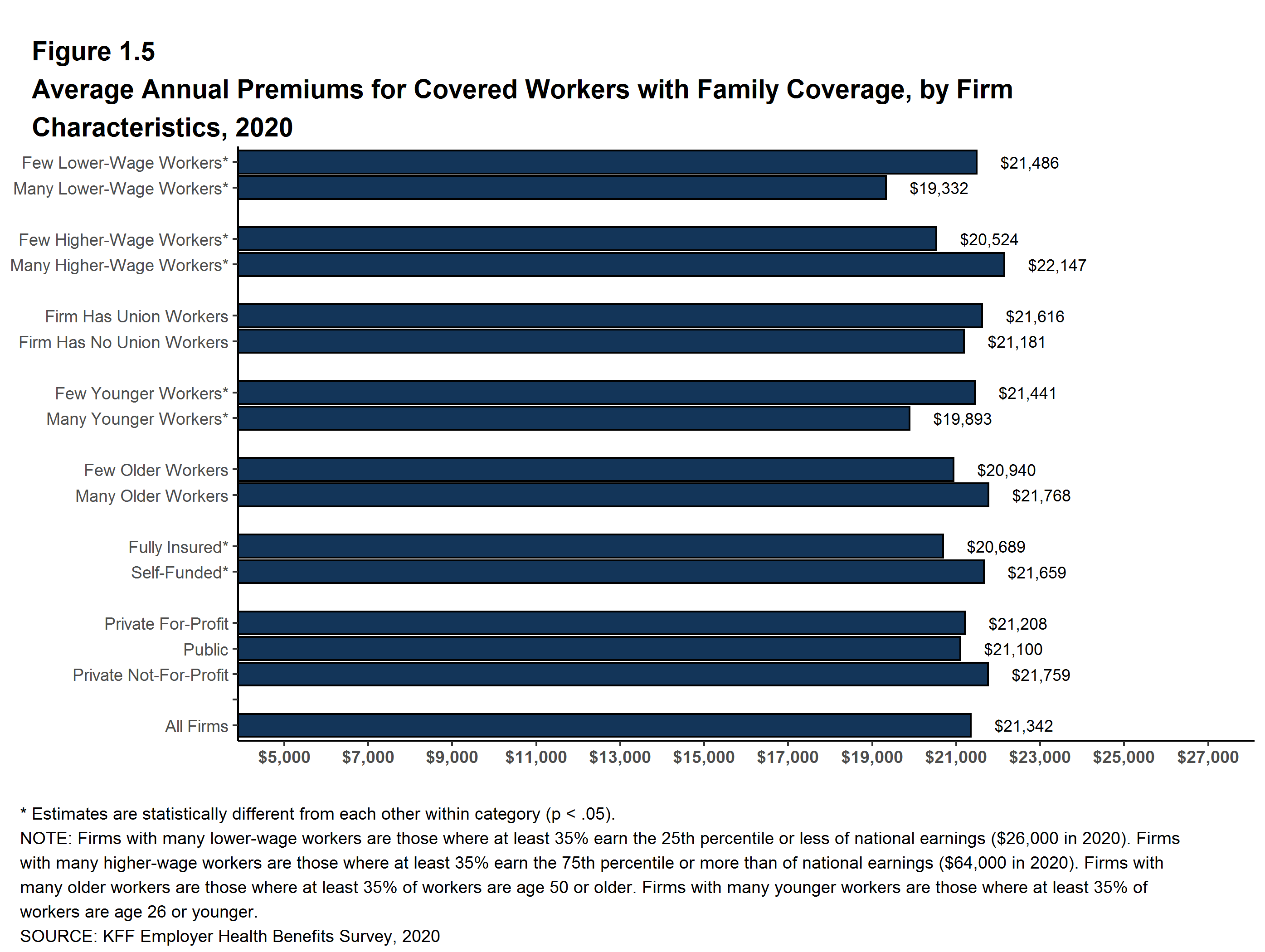

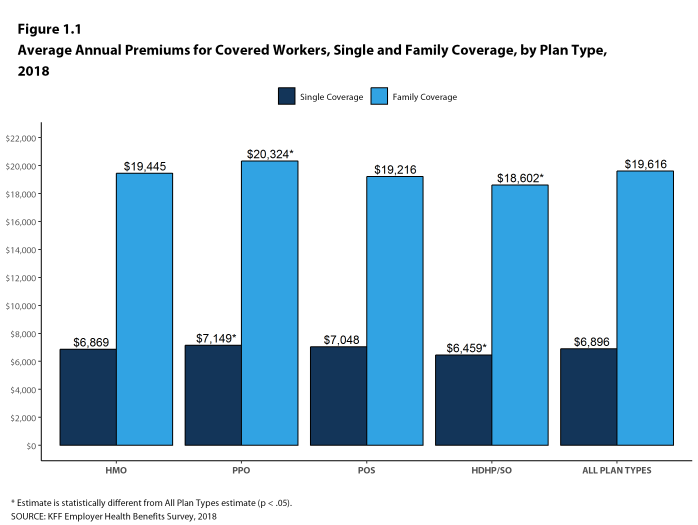

Average Annual Premiums for Covered Workers With Family

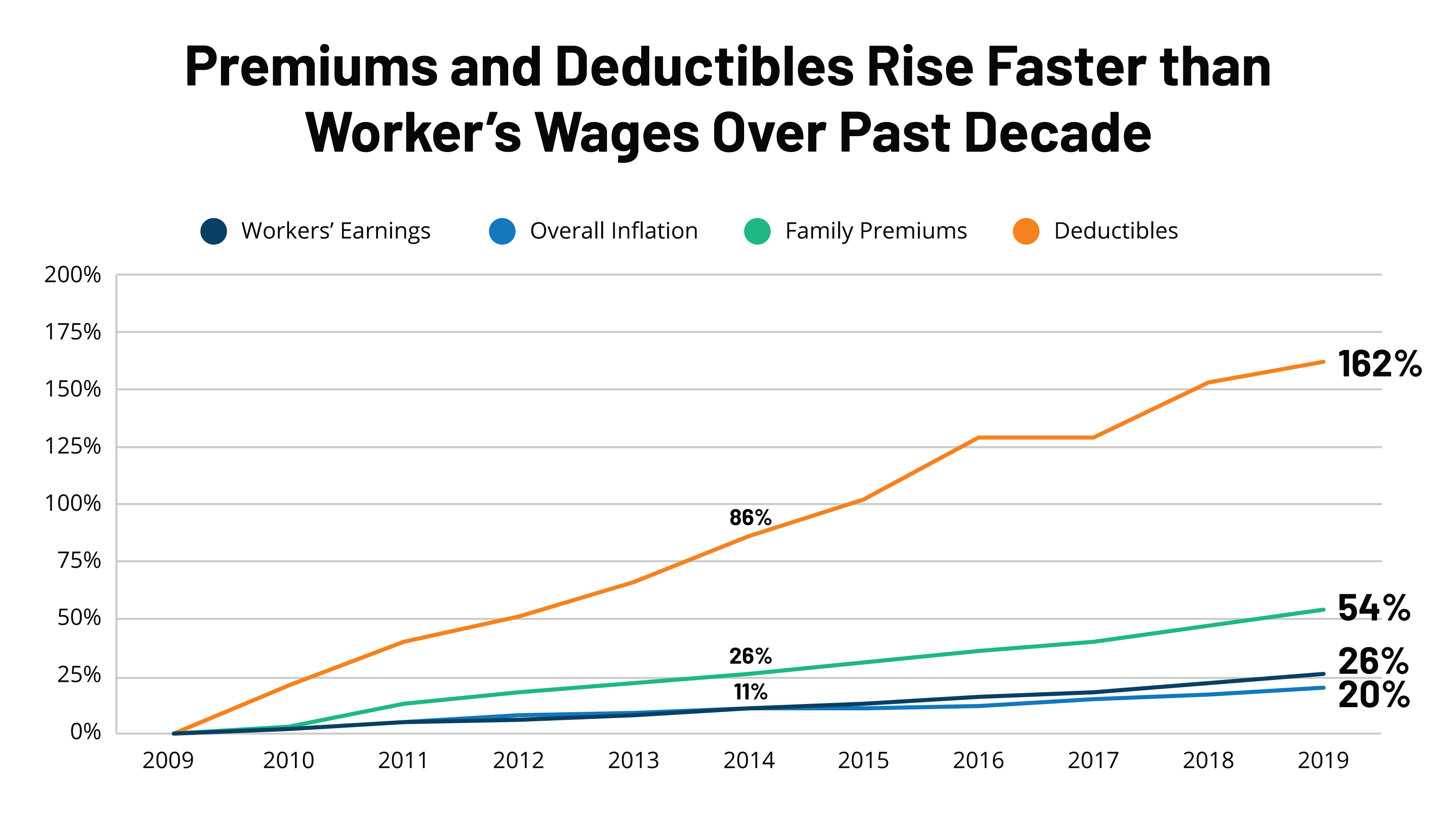

Growing Burden of EmployerProvider Health Care Has

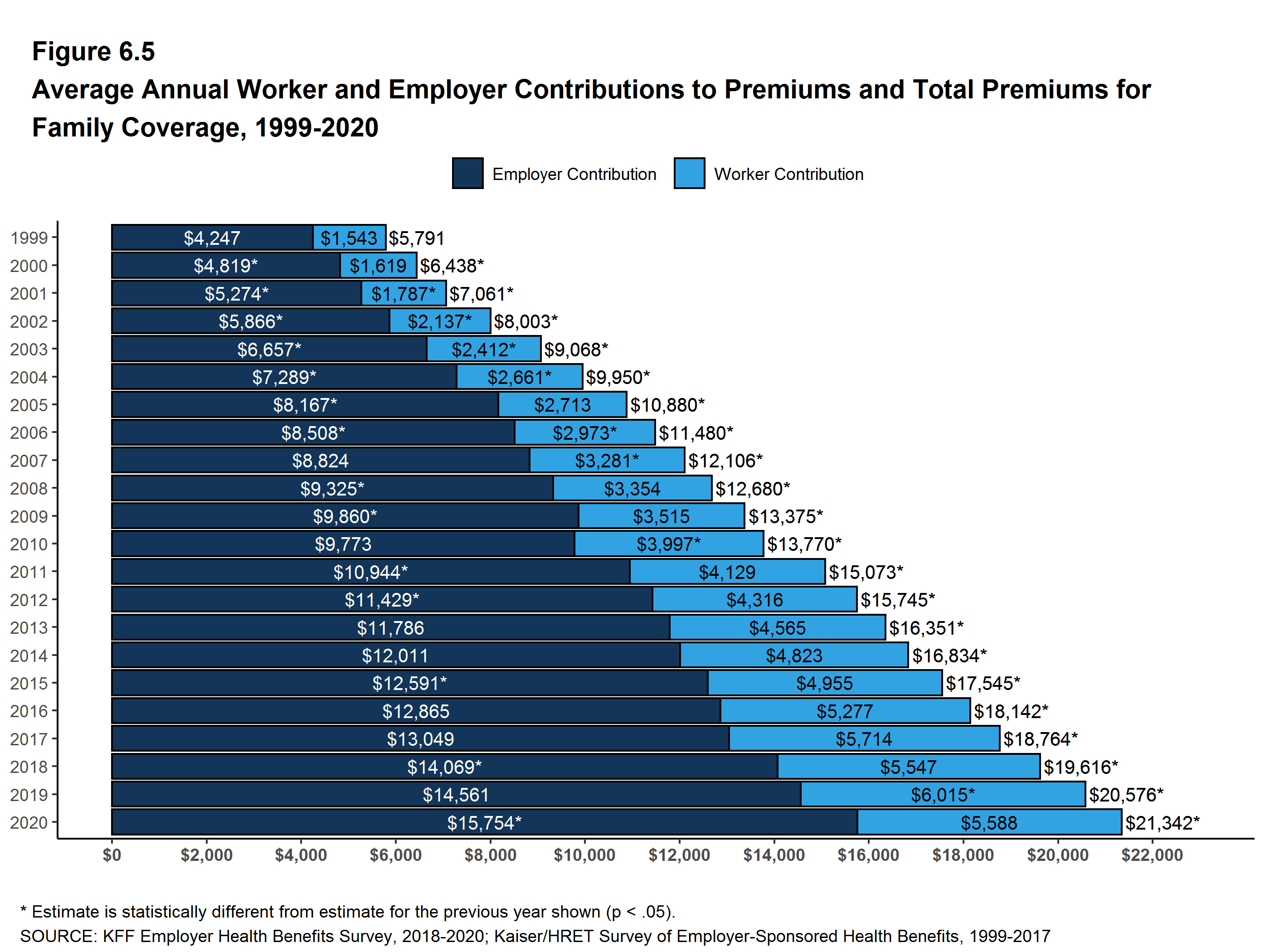

Average Annual Worker and Employer Contributions to

The Medicaid shift Shortterm cost savings, longterm

Lincoln Financial Group Annual “What Care Costs” Study

How Much Will Your Healthcare Cost in Retirement? Health

Federal Long Term Care Insurance Premiums Awesome

Average Annual Premiums for Covered Workers, Single and

Section 1 Cost of Health Insurance 9335 KFF

Average Annual Worker and Employer Premium Contributions

Health Care Costs A Primer 2012 Report KFF

Building Your Best Future Federal Long Term Care