Do i need to declare points for temporary car insurance? This means that you’re legally obliged to tell a prospective (or current) insurer of any penalty points you receive.

Driver License Audit Number Texas

Do i have to tell my insurer how many demerit points i have?

Do i need to tell insurance about points. Things you need to tell your insurer immediately. Learn how points work and how they can affect your car insurance rates. Insurers do not require you to report changes in your driving record during any particular policy term.

All you have to do is plug into the system, put the work in to find prospects, then help them with their insurance needs. In general, insurance companies will calculate your premium based partly on the nature and number of your offences. 1 answerif you get 3 points on your license, your car insurance premiums will likely increase and you.

Penalty points will remain on your driving record for 3 years and must be reported to your insurance company when applying for insurance. You'll need to reply within 28 days, sending back the name and details of the person driving at the time. Under the road traffic act 1998, it is an offence to withhold relevant information when applying for car insurance.

Attending a speeding awareness course is not classed as a conviction, which requires the ticking of the box on insurance quotation forms to disclose such an offence in the last 5 years. If they’re serious or many, you’ll be paying more. Do i need to declare motoring convictions?

Any period where your licence is out of date does not count as part of the 3 years. When applying for car insurance you will usually need to tell your insurer about any motoring convictions, such as speeding, received in. The premium you and your insurance company agreed to, whether for six or 12 months, is set in stone for that time.

There should be something in the policy t&c saying they have to be immediately notified of any changes. But it might be a good idea to err on the side of caution, and fess up. Do i need to tell my car insurance if i get points?

If you get a speeding ticket or penalty points, are disqualified or have an accident (even if you weren’t at fault and aren’t planning to submit a claim) tell your insurer. Technically, you might not need to declare a driving conviction when you get it, if your insurance is already running. But research by rac insurance found that nearly a fifth of motorists would not inform their insurer if they picked up penalty points while driving.

Having current penalty points can affect your insurance premium. Should you inform your insurer when your points expire? Also, you must let your insurer know if you're diagnosed with an illness that has to be.

Although insurers are allowed to ask about spent points, it is illegal for these to influence how a company prices your cover. You do need to inform them as soon as the points are on the license. If you need to, you can check your driving record and penalty history via gov.uk.

Insurers determine risk differently, so speak with yours directly about how demerit points affect your car insurance. If you're unsure about whether you need to tell your insurer something, you should give them a ring. Motorists frequently ask whether they need to disclose to their car insurance companies that they have received driver education as a result of speeding.

Your insurer will likely ask how many demerit points you've accrued or if you've ever lost your licence, and you will need to answer truthfully and accurately. After your ban is over, you can apply for car insurance just like anyone else, but you need to tell your insurer about any driving convictions and. If you don’t, your insurance policy will be invalidated, meaning any future claims could be turned down.

In fact, the speeding ticket you just received will not have an effect on your policy whatsoever…until your policy renews. If you have points on your licence, you are legally obliged to tell your existing insurer and you must declare it when shopping around for a new policy. This means that you’re legally obliged to tell a prospective (or current) insurer of any penalty points you receive.

Yes, you must declare points for temporary insurance, just as you would when buying annual car insurance. But what if your points have only just, or are due to, expire? Some insurers’ policies say that you must inform them if you get a conviction during the year.

Yes, it’s important to tell your insurance provider if you receive points for a motoring conviction or a fixed penalty notice. If you happen to get penalty points, it’s important to notify your car insurance provider. If you or any named drivers receive a fixed penalty, motoring conviction or are disqualified during your policy term you must tell your insurer at renewal.

1 answertwo points will increase a driver’s insurance costs by roughly 20% to 100%, depending on the state, insurance company and type of violation. Penalty points and your driving licence most types of penalty points, things like sp30s (speeding on a public road) and cu80s (using.

What To Consider About Commercial Auto Coverage Trainee

Illinois Driver License Lookup

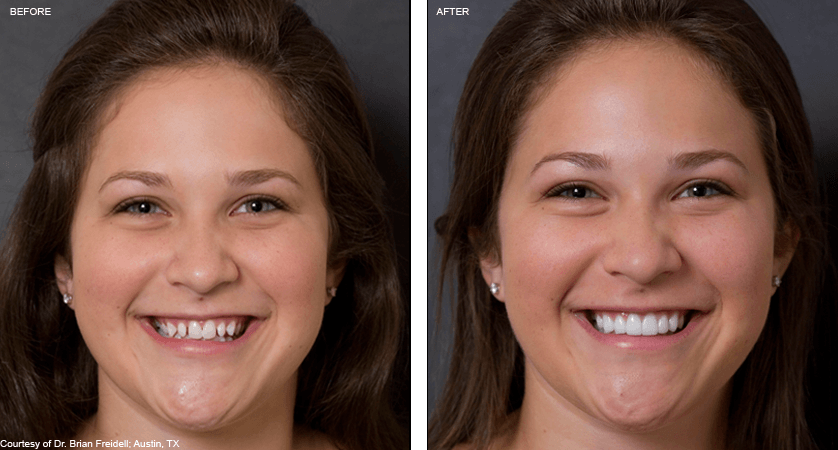

Does My Insurance Cover Veneers Awesome

How Much Does 3 Points Increase Car Insurance? Go Girl

How Long Do Insurance Adjusters Have To Respond inspire

Does My Insurance Cover Veneers Awesome

Worst government agencies to work for

What Kind of Life Insurance Do I Require? Soutas

National Insurance number registration of DWP benefit

Does Delta Dental Insurance Cover Night Guards inspire

How Long Does A Dui Stay On Your Insurance In Pa Awesome

Does My Insurance Cover Veneers Awesome

Does Banking Related To Finance Marketing

Does Banking Related To Finance Marketing

What Do Points On Mortgage Mean

How Long Does It Take To Get Contacts From 1800contacts

What Kind of Life Insurance Do I Require? Soutas

How Long Does It Take To Get Contacts From 1800contacts

Stunt Driving Can I get my license back early?