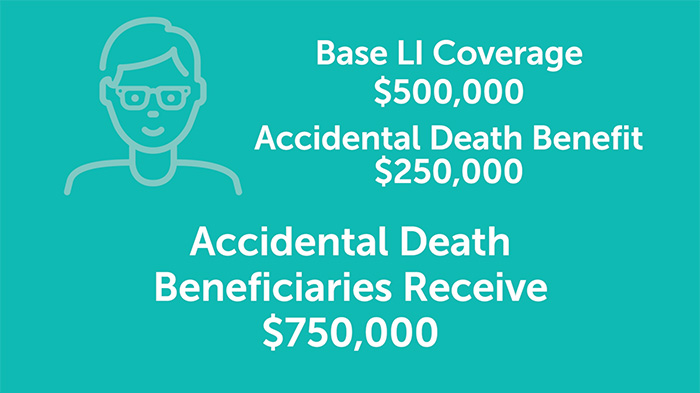

Accidental death life insurance benefits are often attached to life insurance policies and may be collected alongside standard payments. Accidental death benefit is rider that pays sum assured if the insured dies due to accident.

MiCSC Accidental Death and Dismemberment (AD&D)

100% of sum assured if the dies due to an accident during the coverage period.

Life insurance accidental death benefit. The accidental death benefit is an amount paid out from your standalone adb policy, or in addition to your standard life insurance death benefit as a rider. This benefit is an insurance benefits paid to your beneficiary due to an accidental death. “accidental death” shall mean death:

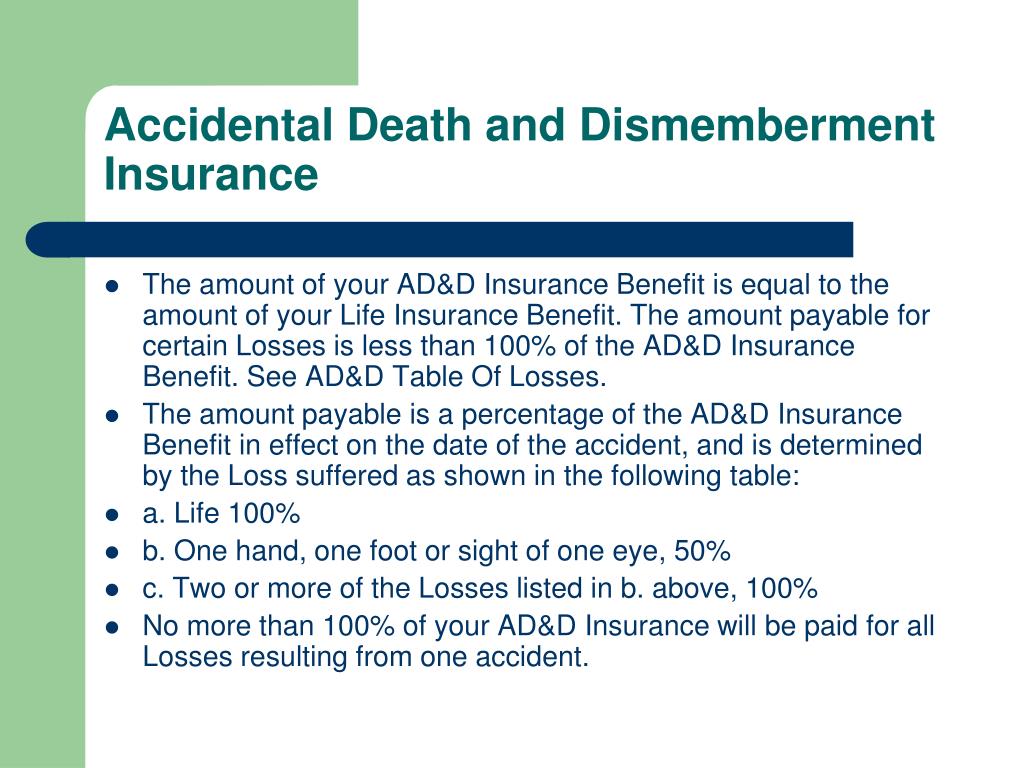

It covers loss of some part of the body, hearing loss, paralysis, burns that affect more than 20% of the body. Accidental injury has become the third leading cause of death in the united states. An accidental death benefit, however, will pay out a death benefit if you die by accident but not by natural causes or illnesses.

Accidental death insurance provides financial benefit covering death exclusively caused due to an unforeseen and unfortunate accident. Tata aia life insurance offers both the accidental death benefit and the accidental disability benefit as one comprehensive rider #. Designed as a supplement to life insurance, accidental death insurance gives individuals a way to financially protect their beneficiaries — like a spouse or children — if they should die accidentally.

Your life insurance policy will pay a death benefit in most cases of death, including accident or illness. Accidental death benefit plans only pay out if you die in a covered accident, while term life covers you if you die from an accident, illness, or natural causes, with few exceptions. An accidental death plan will not have any type of underwriting attached to it and will always be guaranteed issue.

1 to help cover all your bases, an accidental death benefit added to your life insurance policy can help with costs associated with a fatal accident. What are examples of accidental death? Accidental death benefit pays out a cash sum if you die within 90 days of an accident.

Term life insurance policies that. An accidental death benefit rider (also known as a “double indemnity rider”) is an optional feature you can add to your life insurance policy. It then pays half of.

The accidental death benefit rider allows the rider benefit amount to be paid as a single payment or in regular installments, which can provide a regular income for the insured individual's family. Which occurs within 183 days of the occurrence of such accident but before the expiry of the cover. It also may pay for dismemberment or loss of limbs.

Accidental death benefit riders provide an additional sum to a life insurance payout in case an unexpected passing leaves your family members strapped for finances. What if your life insurance isn’t enough? Life insurance plans provide financial benefit covering all causes of death excluding suicide (which may be covered after waiting period).

Life insurance covers your life and provides a death benefit for most causes except suicide whereas an accidental death insurance policy will only pay for a covered accident and not for a death caused by illness. Accidental death benefits refer to financial compensation received by an accidental death insurance policyholder. A heart attack usually won’t count as accidental death.

A “rider” is an added benefit that you can include in a policy you already have. The accidental death and dismemberment rider # covers all bases by being farsighted. Which is caused by bodily injury resulting from an accident and b.

It not only pays a lump sum amount to your family in case of your untimely demise, but it also ensures that your life is financially easier if you suffer from. An accidental death benefit rider provides a higher payout if the insured dies in an accident. Which occurs due to the said bodily injury solely, directly and independently of any other causes and c.

It can also provide benefits to you if you become disabled or paralyzed as the result of an accident. So, it means that an accidental death benefit does not only cover for death. Life insurance and accidental death insurance difference cause of death covered.

It usually needs to be something other than a medical cause. This is an accidental death insurance policy that provides up to $250,000 for a covered accidental death or loss and it costs just $1* to start. It could help your family with the financial burden of medical bills, debt, mortgage payments, and even final expenses.

Accidental death insurance, (also known as accidental life insurance) will only pay out money to your family if your death is caused by accident. An adb policy typically pays out in full until you reach a predetermined age. For most people, term life is the best fit because:

Why consider purchasing an accidental death benefit (adb) if you’re wondering if your life insurance policy can include accidental death, the answer is yes. It is also for the insured who survives an accident. Accidental death life insurance covers your loved ones in case you die of an accident.

In this instance our definition of an accident is where a bodily injury is sustained, caused by accidental, violent, external and visible means, which solely and independently of. Is term life or accidental death benefit insurance right for me? Dismemberment benefits are paid due to loss of eyesight, loss of hearing, loss of speech, or any loss of two limbs caused by an accident.

Insurance companies specify what qualifies as accidental death. It provides more complete coverage. If you were to have an accidental death while owning a life insurance policy depending on your plan you would be protected because this coverage is built into your policy.

In general, ad&d insurance cannot be denied for individuals who meet the age requirements regardless of their health condition. The nominee has the option available to them to choose the payment method that best meets their financial needs and situation.

PPT Standard Life Insurance and Accidental Death and

Accidental Death Insurance How to Handle Claims Life

What Does Accidental Death and Dismemberment Insurance

Life Insurance Accidental Death Benefit / PPT Standard

Accidental Death and Dismemberment Insurance Adam S

Life insurance death benefit insurance

Life Insurance Accidental Death Benefit / PPT Standard

Life Insurance Accidental Death Benefit / PPT Standard

Life Insurance Accidental Death Benefit / PPT Standard

Life Insurance Accidental Death Benefit / PPT Standard

PPT Standard Life Insurance and Accidental Death and

![]()

Life Insurance and Accidental Death Benefits When a Death

Life Insurance, Accidental Death & Dismemberment, Long

Accidental Death Benefit (ADB) & Permanent Total

ICICI Prudential Life Term Insurance Accidental death

PPT Standard Life Insurance and Accidental Death and

Designating an Accidental Death Insurance Beneficiary

Fillable Forms CALIFORNIA STATEWIDE JURISDICTION

Life Insurance Accidental Death Benefit / PPT Standard