The insurance linked securities (ils) sector is seen as strong and viable according to fitch ratings, despite alternative reinsurance capital remaining flat. The catastrophe bond (cat bond) market surpassed 2018 by usd 375m in new issuance in the same

Insurance Linked Securities Market Digitalflashnyc

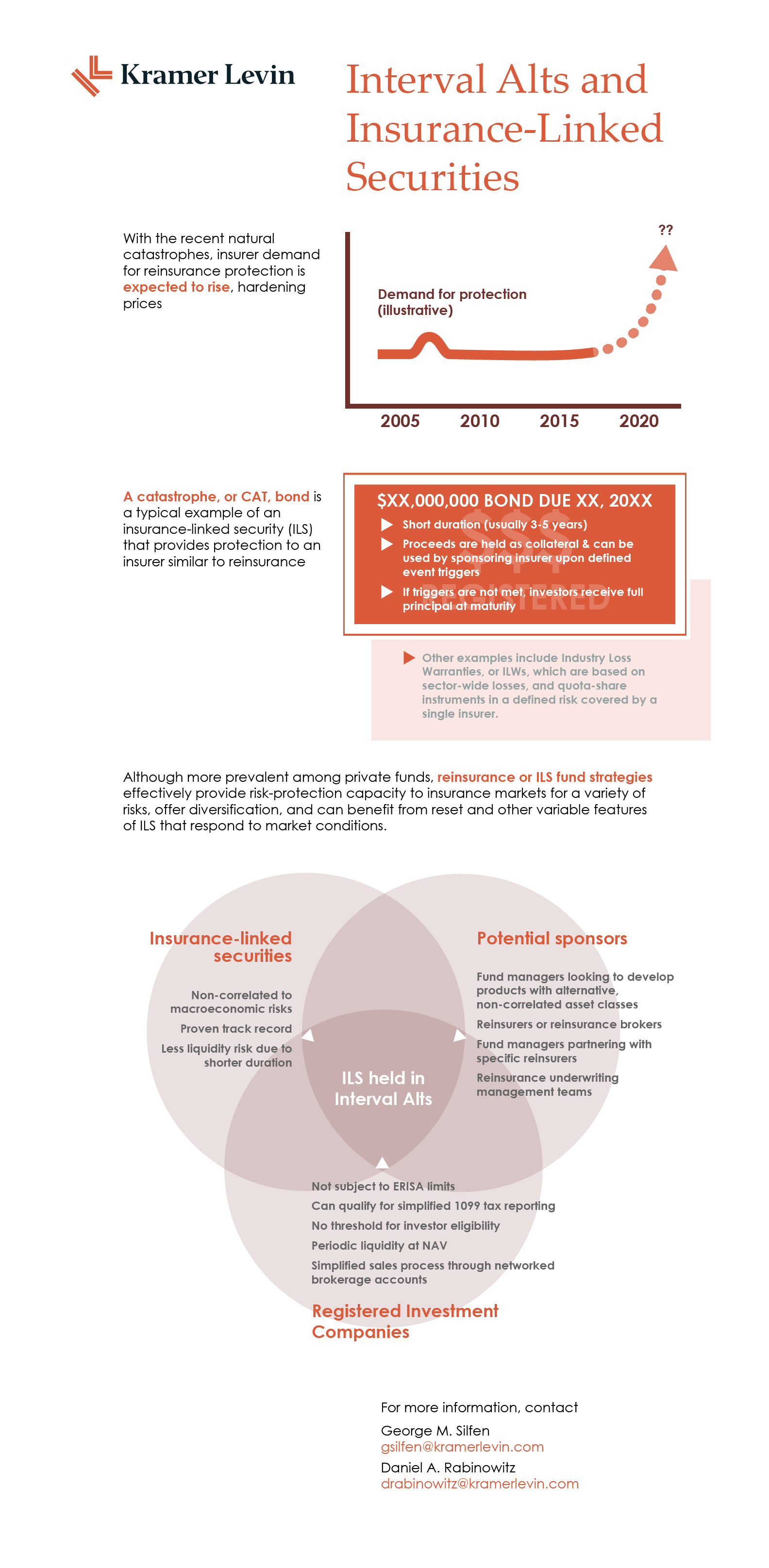

The securitization model has been employed by insurers eager to transfer risk and use new sources of capital market funding.

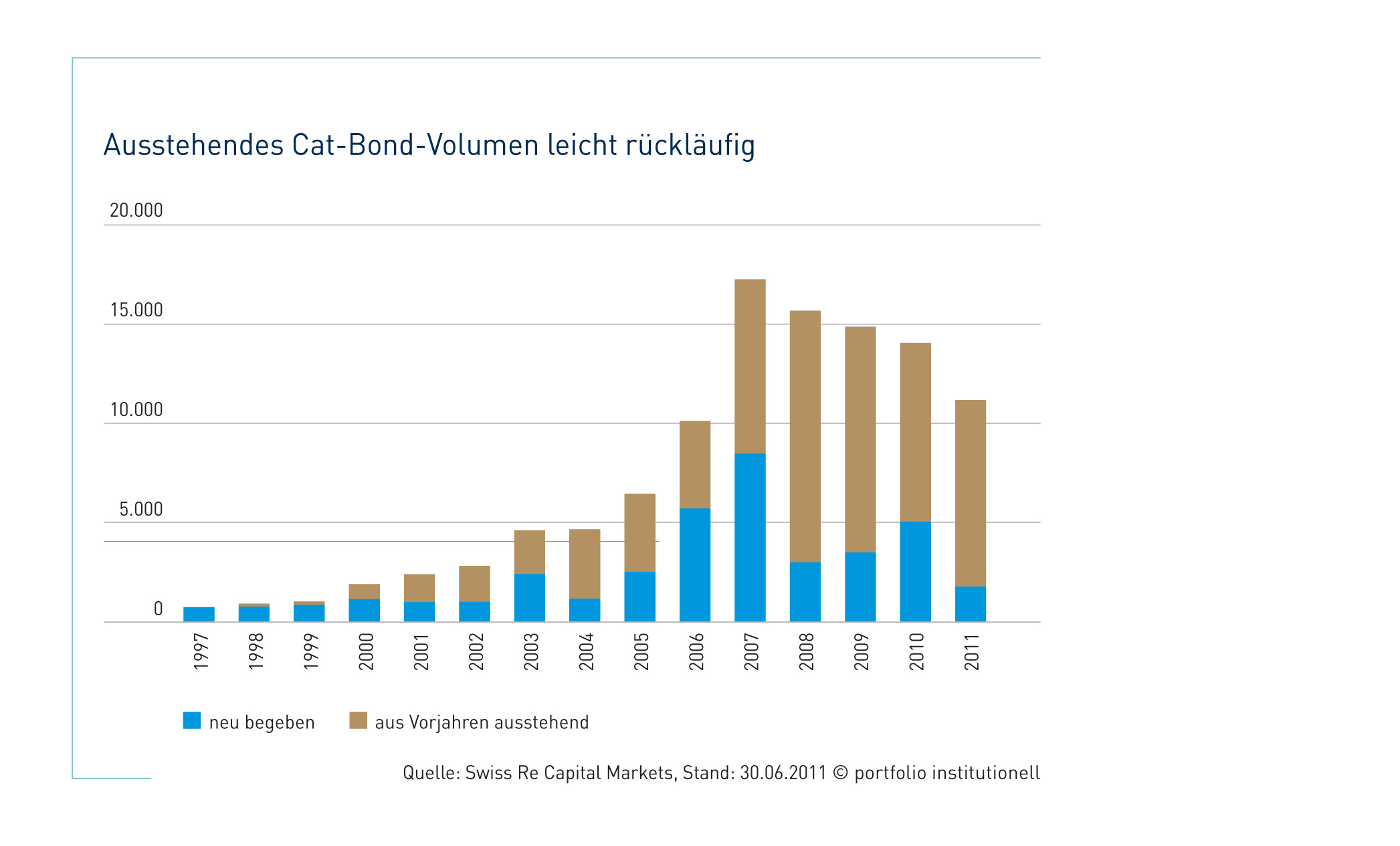

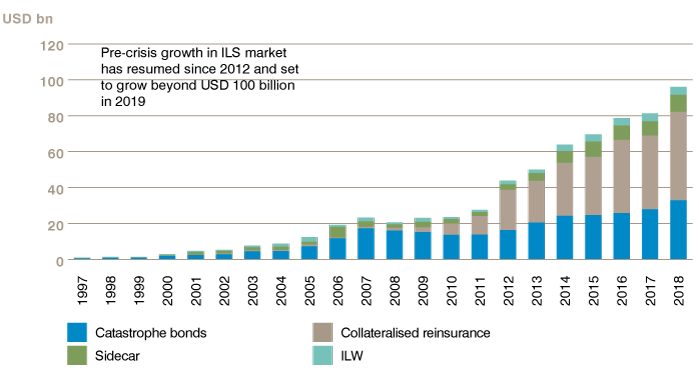

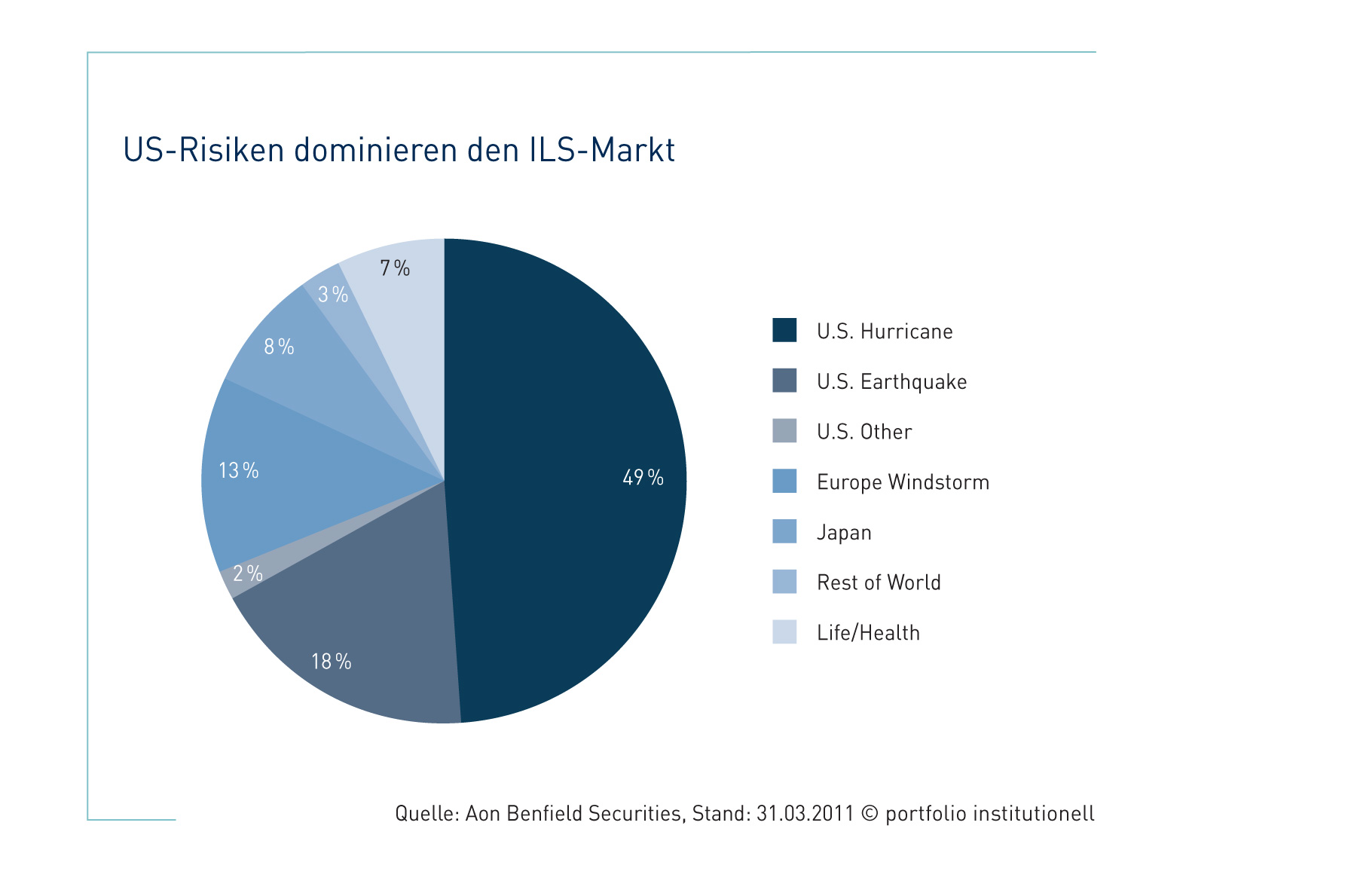

Insurance linked securities market. Growth of the insurance linked securities (ils) market reached $93 billion in 2018, up from $88 billion during the prior year, according to the new ils market. This means performance is not correlated with traditional asset classes, whose returns are more closely linked to factors such as economic strength or weakness, a company’s good or bad performance, or geopolitical concerns. This report details the investor appetite for ils and how the asset class can support the growth of esg investing.

The ratings agency said that investors remain committed to the ils market,. Ils value is influenced by an insured loss event underlying the security. As one of the most experienced investment banking firms in this market, aon securities offers expert underwriting and

This is where the reinsurance and capital markets converge, offering capital providers a place to invest with a reasonable return that barely correlates to most capital market risks, while offering the reinsurance market capital Ils, both from the life and property/casualty (p/c). They allow investors such as pension funds and hedge funds to take the place of reinsurers on certain classes of business, primarily property catastrophe.

As one of only a small number of alternative asset managers currently offering ils investment solutions, we have been able to provide access to this rapidly developing asset class. Tony dowding september 20, 2021. This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital.

Insurance linked securities market looks set for another record year, says fitch. You should consult this information when considering any investment activity. In this q&a, portfolio manager rick pagnani, head of.

The securitization model has been employed by insurers eager to transfer risk and tap new sources of capital market funding. Pimco has built an ils investing platform to tap into this growing opportunity. Those such instruments that are linked to property losses due to natural catastrophes represent a unique asset class, the return from which is uncorrelated with that of the general financial market.

That should be good news for (re)insurers in the developed markets o.

Insurance Linked Securities Market Securing tomorrow

Insurance Linked Securities Market Securing tomorrow

Insurance Linked Securities Market Securing tomorrow

Insurance Linked Securities Market Securing tomorrow

Insurance Linked Securities Market Securing tomorrow

Insurance Linked Securities Market Securing tomorrow

2nd Insurance Linked Securities Summit Europe

Insurance Linked Securities Market Digitalflashnyc

Insurance Linked Securities Market Securing tomorrow

Insurance Linked Securities Market Securing tomorrow

Insurance Linked Securities Market Digitalflashnyc

Securing tomorrow Insurancelinked securities in the

Insurance Linked Securities Market Securing tomorrow

Insurance Linked Securities Market kenyachambermines

Insurance Linked Securities Market Securing tomorrow

Insurance Linked Securities Market Securing tomorrow

![]()

Insurance Linked Securities Market Securing tomorrow

Insurance Linked Securities Market kenyachambermines