Bodily injury/death of two or more persons $100,000; The cost of fr44 insurance is determined by your state’s minimum liability requirements.

Fr 44 Insurance / FR44 Florida Insurance Cheap FR44

Sr22fr44insurancevirginia.com is a proud member of the the insurance exchange of america and can obtain your sr22 fr44 insurance today.

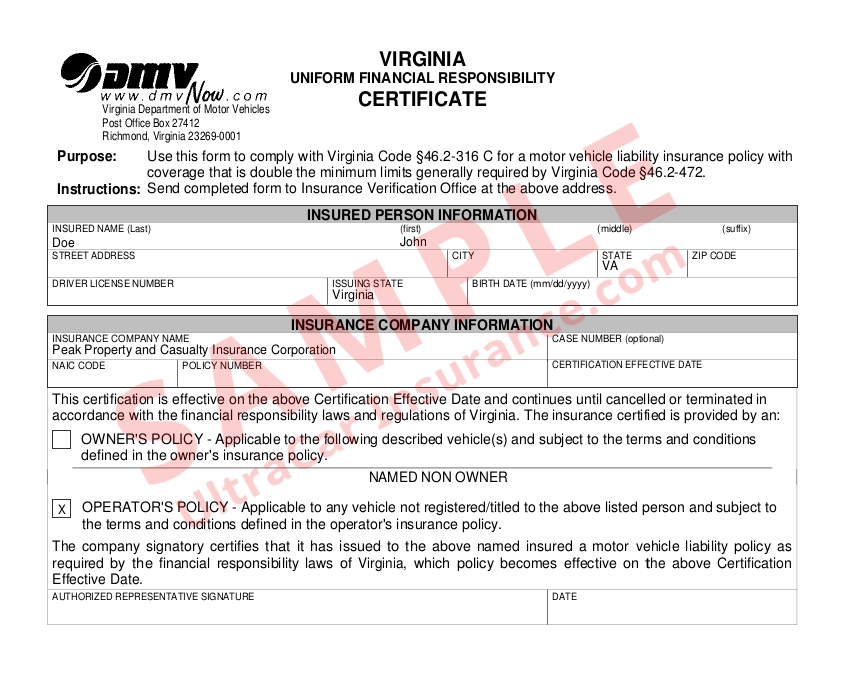

Fr44 insurance virginia. Florida and virginia are only two states that use the fr44 form after a driver has been convicted of driving without insurance or convicted of a serious traffic violation. Fr44 insurance requirements in virginia. Virginia drivers who are not on fr44 insurance have to maintain auto insurance at minimum limits of $25,000 per person / $50,000 per accident in bodily injury coverage and $20,000 in property damage limits.

We offer sr22, non owner, fr44 & sr50 filing. Standard state minimum liability limits are only $25k per person for bodily injury and $50k per accident plus $20k for property damage. Bodily injury/death of one person $50,000;

$100,000 bodily injury per accident. $50,000 of bodily injury per person liability. A sr22 or fr44 filing is an extra form that an insurance company provides to virginia dmv on your behalf.

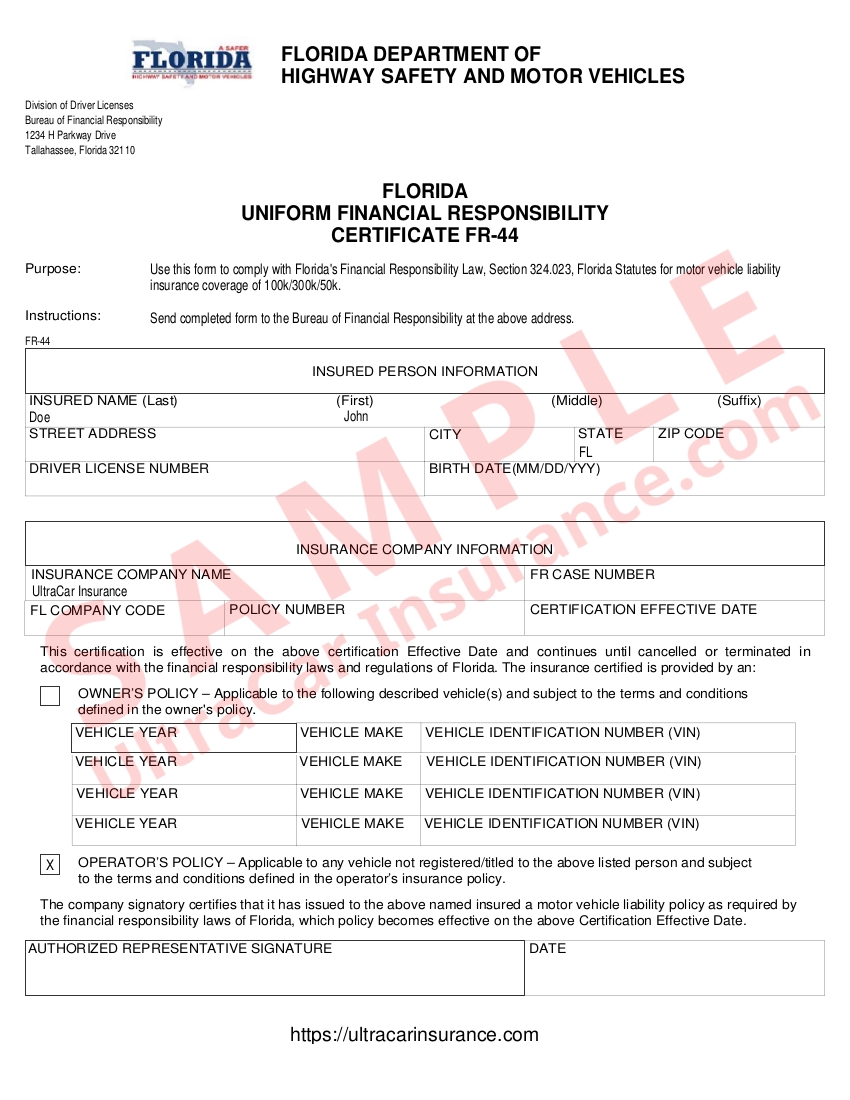

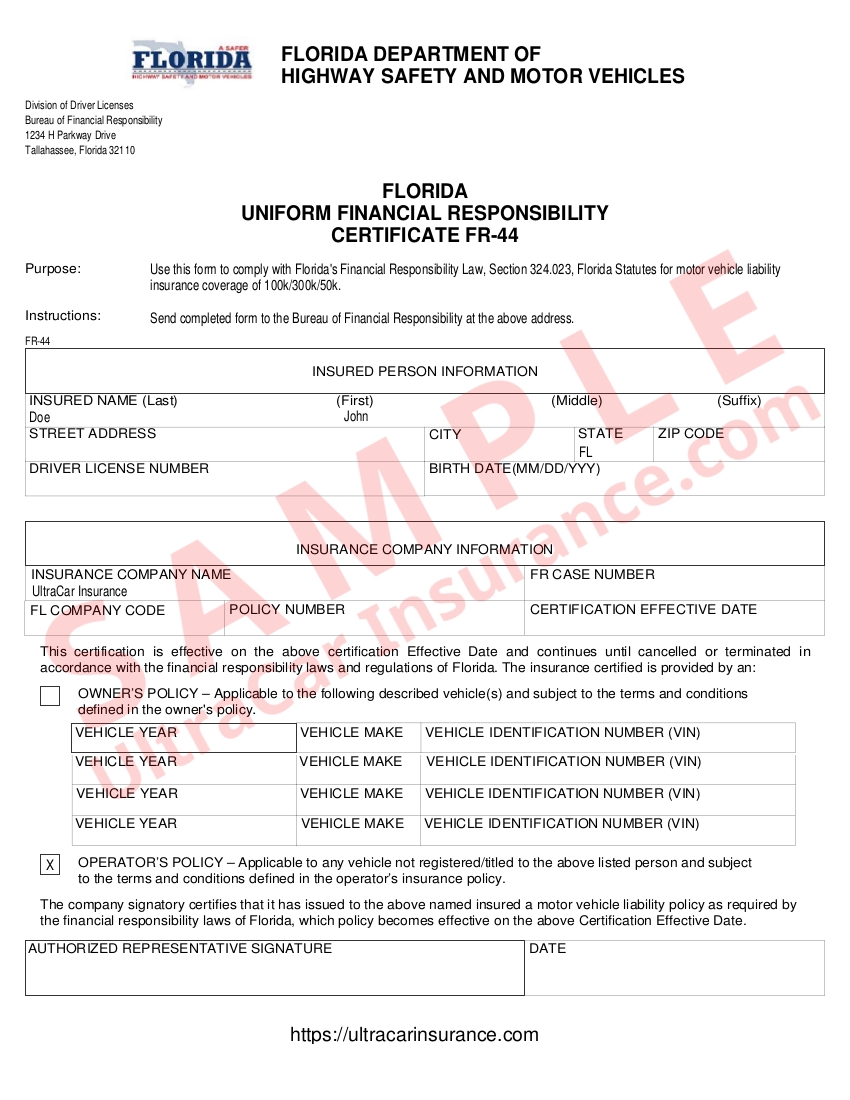

Stratum insurance agency can help with fr44 filings and insurance in florida and virginia (even if you live in another state). An fr44 filing is similar in theory to an sr 22, except that it may indicate that you maintain more than just the minimum amount of coverage required by the. How does virginia fr44 insurance work?

The liability insurance requirements for fr44 coverage are 50/100/40: You must have auto insurance coverage to obtain an fr44. The fr44 insurance minimum in virginia is $25,000 for injury to one person, $50,000 for injury to two or more people, and $20,000 for property damage.

In the state of florida, filing of auto insurance fr44 certification is required for drivers with dui or dwi conviction. The normal limits are $25,000/$50,000 in bodily injury and only $20,000 in property damage. Enter the customer number in the customer no field.

An fr44 is not an insurance policy, but a form that ensures you have the proper car insurance when you are out there on the road. Sending this form is crucial if you want to operate a vehicle legally in virginia. Sr22 fr44 insurance virginia looking for sr22 fr44 insurance?

What is fr44 insurance in virginia? These limits are $50,000 for bodily injury per person and $100,000 per incident, plus $40,000 for property damage. Fr44 & insurance in florida and virginia.

$40,000 of property damage liability. Due to the higher coverage the policy will be more expensive and the dui conviction will also keep. Driving vehicle in intoxicated condition under the influence of alcohol/drugs.

Fr44 insurance must be kept current without lapse, in most cases, for three years. If your insurance cancels, your fr44 will become invalid and your. You can see in virginia the fr44 limits are double those of a driver without the fr44 requirement.

Generally speaking, you need the virginia fr44 filing for 3 years, but this can vary based on many factors, including your conviction date and other dates imposed by the virginia department of highway safety and motor vehicles (dmv). However fr44 is required if you are convicted of driving under the influence of drugs or other intoxicants(dui or dwi). To reinstate your license after a dui in florida or a dwi in virginia, you will need to file an fr44 certificate with the dmv.

If this is a second, third, or fourth. An insurance provider endorses the fr44 certificate to an insurance policy, which is filed with. Virginia and florida are the only states that mandate obtaining an fr44 certificate after a conviction for dui or.

As you can see below the requirements for fr44 insurance are much higher. As a broker that represents many auto insurance carriers, the insurance exchange of america has the ability to shop the best rate for your sr22 fr44. $50,000 bodily injury per person.

The virginia fr44 insurance filing is currently only required in virginia. The minimum coverage you can carry on an fr44 insurance policy in virginia beach is a 50/100/40 policy. Fr44 insurance is a guarantee of future insurance coverage and proof of financial responsibility.

Florida & virginia require fr44. But in virginia, different types of traffic violations can lead to requirement for filing fr44 certificate as are mentioned below: Farm bureau virginia insurance / careers with virginia from angelacarneeosso.blogspot.com.

An fr44 certificate is required by the court to verify you have double your state’s minimum liability requirements. Car insurance companies issue the fr44 certificate. It will obligate the insurance company to notify the dmv at policy inception and when it cancels or lapses.

This is a required field. Fr44 is a legal document of financial responsibility in virginia that proves you carry the minimum coverage needed on your car. Also, you're required to have the following minimum amounts of liability coverage in place on your car insurance:

Cheapest Fr44 Insurance Virginia Digitalflashnyc

SR22 Insurance Virginia FR44 Insurance in Virginia

Fr44 Insurance Virginia Geico Digitalflashnyc

Fr44 Insurance Virginia Geico Digitalflashnyc

Virginia SR22 FR44 Insurance Low SR22 FR44 & Non Owner Rates

Fr44 Insurance Virginia State Farm Awesome

Understanding Virginia FR44 Auto Insurance Filings YouTube

SR22 Insurance Virginia FR44 Insurance in Virginia

What is Virginia FR44 Auto Insurance YouTube

Fr44 Insurance Virginia Geico CladAsia

Cheapest FR44 Insurance in Florida & Virginia Free Quotes

Florida FR44 Insurance Same Day FR44 Insurance Filing

Fr44 Insurance Virginia State Farm Awesome

Fr44 Insurance Virginia Geico Digitalflashnyc

Fr44 Insurance Virginia Geico CladAsia

Fr44 Insurance Virginia State Farm Awesome

Short Quote Request Form Cheap SR22 & FR44 Virginia