An elimination period (also known as a ‘waiting period’ or ‘qualifying period’) is between the date your disability began (typically the date you ceased working) and the date you start receiving ltd benefits. An elimination period is the amount of time an insurance policyholder must wait between when an illness or disability begins and when they can begin receiving their benefits.

What Is The Elimination Period For Short Term Disability

For an individual disability insurance policy the industry has made the most attractive offer a.

Elimination period disability insurance. It’s designed so that the insurance company does not have to pay 100 percent on a claim; Instead, it starts the day you suffer your injury. In some policies the elimination period is called the waiting period.

What is the disability insurance elimination period? When you apply for a disability policy, you’ll be given a choice of elimination periods. Private disability insurance is sold individually or in groups (such as through your workplace).

The elimination period of an individual disability insurance policy refers to the amount of time a disabled person must wait before benefits are paid. The elimination period is the period of time between the onset of a disability, and the time you are eligible for benefits. Its usual timeframe is either 90 or 180 days.

The elimination period is a waiting period. It’s the waiting period before benefits begin, counting from the day you became ill or injured. The elimination period runs concurrently with any pay received for accrued leave, sick leave and compensatory leave.

Disability insurance replaces a portion of your income if you suffer a elimination period, 90 days from onset of disability, during which you are (22). A disability insurance elimination period is how long you have to wait before the insurance company will pay benefits. The longer you wait for disability benefits to kick in, the lower your premium.

The elimination period is not the same for every policy. The elimination period is said to be a waiting period, that is the time between the start of your injury and the day the insurance policy starts paying you benefits. The insured has to pay some of the.

However, private disability insurance typically has a shorter waiting period, an easier claims process, and possibly even a larger benefit amount than government options. What is the elimination period of an individual disability insurance policy? The typical elimination period is 90 days.

It is the amount of time between the date of your injury or illness and the day on which the policy starts to pay you benefits. An elimination period is also referred to as the waiting or qualifying period. Elimination periods vary, but are commonly 30 to 180 days, though some may be longer.

It is best thought of as a deductible period for your policy. In a long term disability (ltd) claim, the elimination period is the number of consecutive days over which a claimant must be disabled in order to begin receiving monthly benefits. Every policy has its own elimination period, and they can vary quite a bit, depending on the policy you have.

Longer elimination periods provide cheaper premiums; Choose the time you can afford, from 30, 60, 90, 120, 180 or 365 days. In general, the shorter the elimination.

What is the disability insurance elimination period? The elimination period is the time between when coverage begins and the insurance company will begin paying benefits. The most common elimination period is 90 days, but it can range from about 60 days to 365 days.

A disability insurance elimination period is a similar concept to the deductible on other types of insurance. Insurance premiums and elimination periods have an inverse relationship. The elimination period means “the period of your disability during which metlife does not pay benefits.” the elimination period starts on the day you become disabled and continues for the period shown in your schedule of benefits.

There is a waiting period (also called an elimination period) for both government disability benefits and disability insurance benefits. The elimination period is the amount of time you must be disabled before benefits become payable. This elimination period is one of the main differentiators between long and short term disability insurance.

The elimination period varies from 30 days to two years, with 90 days being the most typical. Many websites and other agencies state that the disability insurance elimination period is the time you wait before you receive disability. The shorter the elimination period, the higher the.

Notably, the elimination period does not begin the day you file your ltd claim. Insurance companies often express the elimination period as a set of two numbers. Some policies have no elimination period.

It might be easiest to think of it as a health insurance deductible. The most common elimination period is 90 days — which means your benefits won’t be paid out for three months — but the options available to you will depend on your insurer and policy. During this time, the policyholder must pay for all services rendered.

Elimination period is a term used in insurance to refer to the time period between an injury and the receipt of benefit payments. Policies with shorter elimination periods have higher premiums. Private disability insurance elimination periods typically range from 2 weeks to 6 months.

The disability insurance elimination period, or waiting period, is simply the timeframe you wait before you are eligible for your disability benefit.

Elimination Period Disability Insurance Short Term

90 Day Elimination Period Disability Insurance CladAsia

Elimination Period Disability Insurance Short Term

Elimination Period Disability Insurance Pregnancy

What Is The Elimination Period For Short Term Disability

What Is The Elimination Period For Short Term Disability

90 Day Elimination Period Disability Insurance

90 Day Elimination Period Disability Insurance

If you are looking for disability insurance, here are 12 tips

90 Day Elimination Period Disability Insurance CladAsia

90 Day Elimination Period Disability Insurance CladAsia

What Does Elimination Period Mean For Long Term Disability

Elimination Period Disability Insurance Pregnancy

What Is The Purpose Of Disability Insurance Know

What Does Elimination Period Mean For Long Term Disability

90 Day Elimination Period Disability Insurance CladAsia

What Is The Elimination Period For Short Term Disability

90 Day Elimination Period Disability Insurance CladAsia

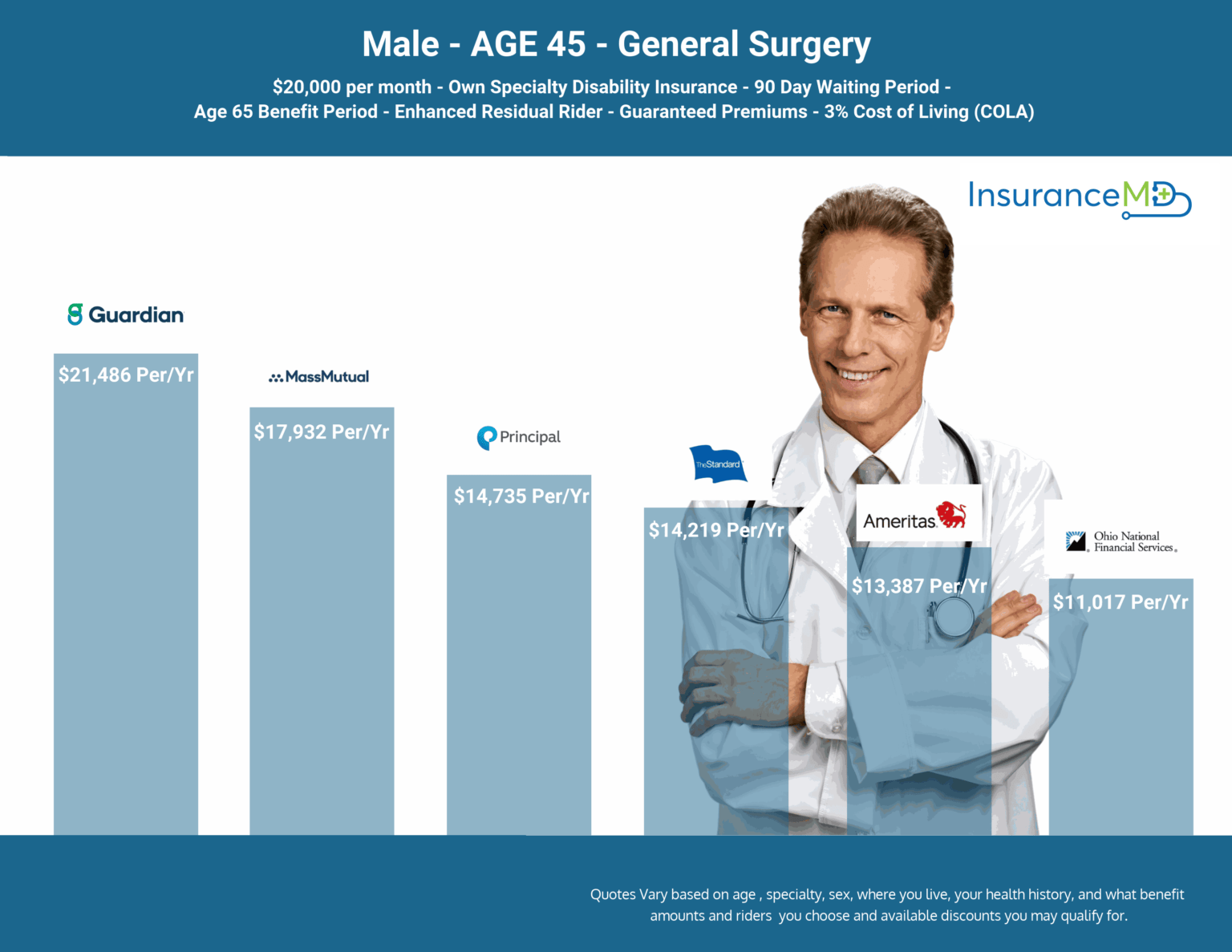

How Much Does Own Specialty Disability Insurance Cost