That is, the institution invests its endowment and helps finance its activities with the profit from the investments. Legal definition of endowment insurance.

The big difference is that it pays a death benefit unlike a certificate of deposit.

Define endowment insurance. Endowment insurance products are often marketed as a savings plan to help you meet a specific financial goal, such as paying for your children’s education, or building up a pool of savings over a fixed term. 1971, 1988 © harpercollins publishers 1992, 1993, 1996, 1997, 2000, 2003, 2005 This model of life insurance in actuarial mathematics is called capital endowment insurance.

But unlike deposits, you may not get back what you put in. Foundation chairwoman of the state's arts endowment. The policy matures on a fixed date and that is when the insured gets his or her payout.

A transfer, generally as a gift, of money or property to an institution for a particular purpose. Life insurance for a specified amount which is payable to the insured person at the expiration of a certain period of time or to a designated beneficiary immediately upon the death of the insured. It should be emphasized that this is the most popular and most

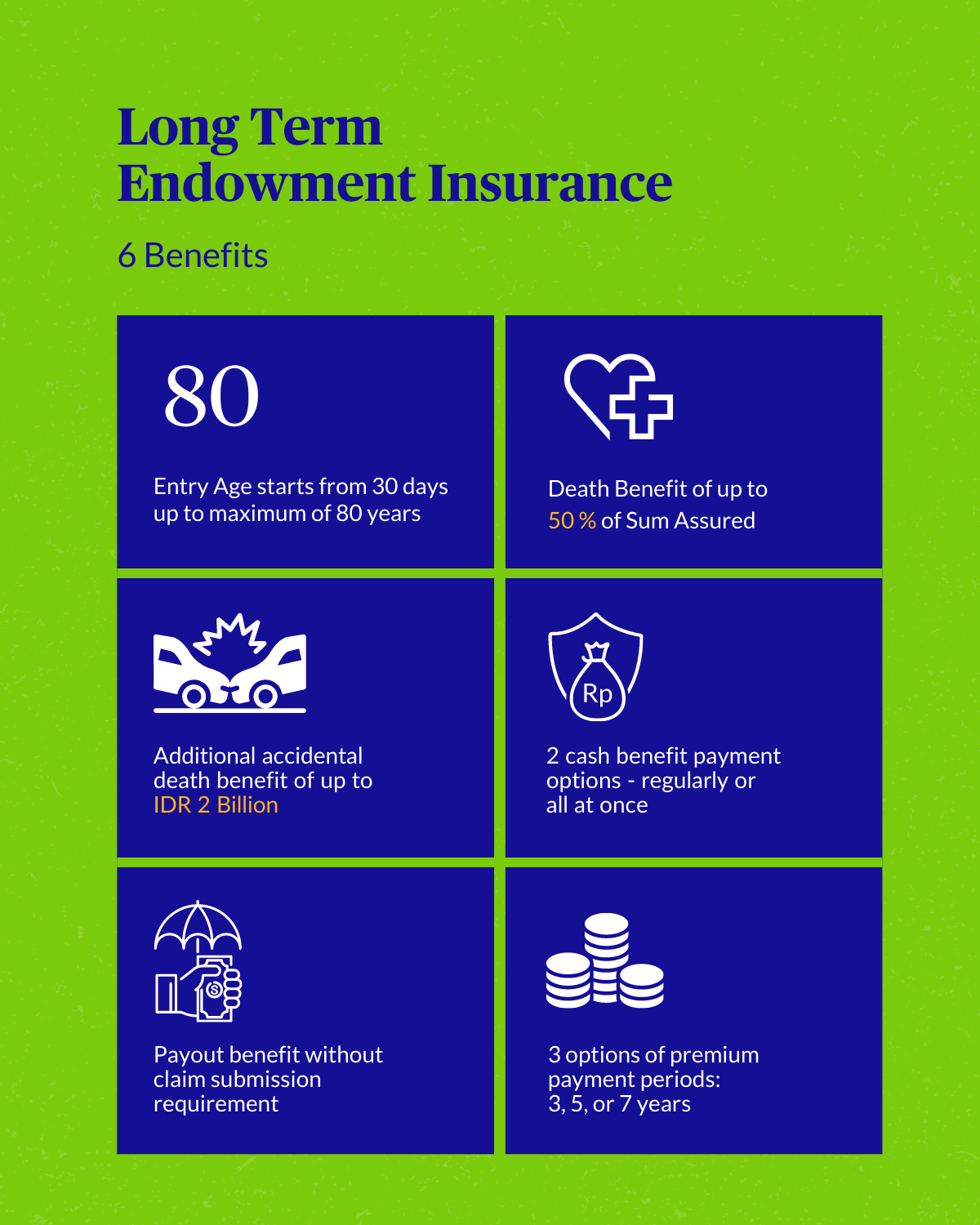

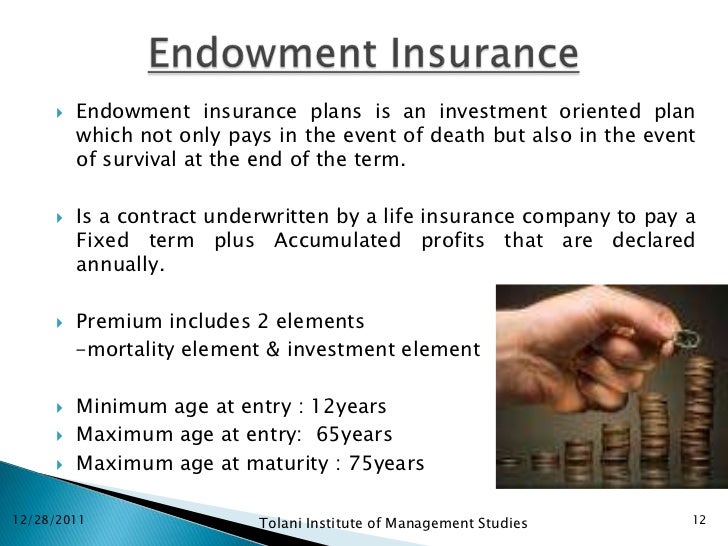

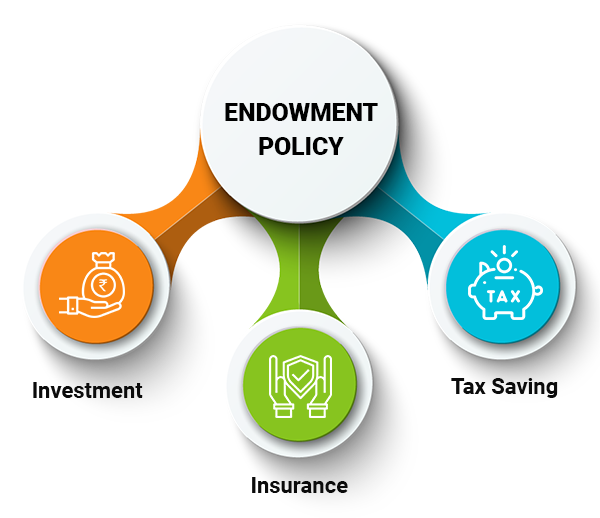

The definition of an endowment policy is an insurance policy where the policyholder receives money after a certain timef. Endowment insurance is a life insurance policy that pays an assured sum on a fixed date or upon the death of the insured, whichever is earlier. Endowment life insurance policies, by coupling term life insurance with a savings program, offer a lump sum payment at maturity.

Endowment plan is a combination of insurance and investment. An endowment is a nonprofit's investable assets, which are used for operations or programs that are consistent with the wishes of the donor(s). These payments are usually made as a lump sum.

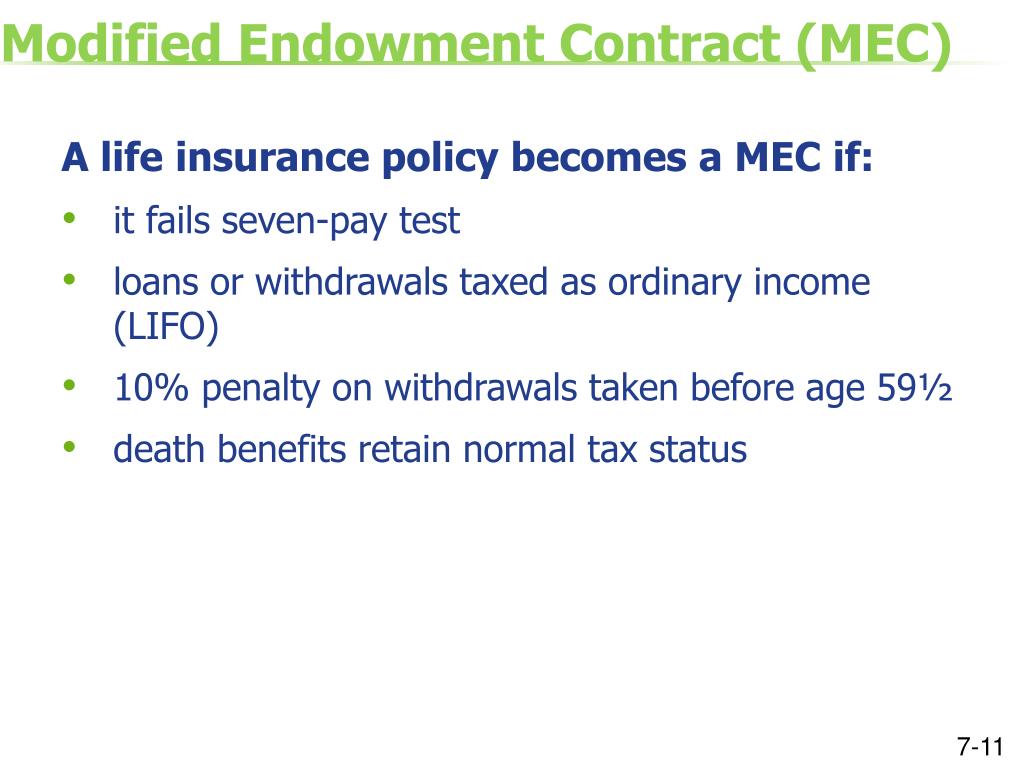

Life insurance in which the benefit is paid to the policyowner if he or she is still living at the end of the policy's term (as 20 years) For example, when we design proposals for clients which involve flexible premium products such as universal life and its variations, we tend to solve for premiums based on conservative interest projections and aim at growing the cash value to endow at age 100 meaning we want the cash to grow to equal. (endowment policy) a type of insurance in which you pay a regular amount of money over a particular period of time , or until you die , after which the insurance.

What does endowment insurance mean? This is in contrast to life insurance, which pays the face value only in the event of the insured's death. In term plan which is a pure insurance there is no maturity benefit.

Its premiums are more expensive compared to similar policies. The bestowal of money as a permanent fund, the income of which is to be used for the benefit of a charity, college, or other institution. For example, an endowment policy that provides benefits for 20 years until the insured is 65 pays its face value after 20.

The property (as a fund) donated to an institution or organization that is invested and producing income an endowment to maintain the gallery. Endowment funds are established to fund nonprofit organizations and activities, including universities, hospitals, and charities. An endowment life insurance is an insurance product that has similarities to a certificate of deposit.

Endowment insurance is a policy that aims to combine the features of a life insurance and a financial plan, usually a college education for the child of the insured. Endowment insurance definition, life insurance providing for the payment of a stated sum to the insured if he or she lives beyond the maturity date of the policy, or to a beneficiary if the insured dies before that date. They are typically structured with intact principals and investment income available for use.

Endowment insurance — a form of life insurance that pays the face value to the insured either at the end of the contract period or upon the insured's death. A classic example of an endowment is money collected in a fund by a college. Examples of institutions that commonly have endowments are charities.

An endowed organization or institution : A pure endowment is a type of life insurance policy in which an insurance company agrees to pay the insured a certain amount of money if the insured is still alive at the end of a specific time period. Endow, in the context of life insurance, can mean a few things.

The Person Who Receives Financial Protection From A Life

Modified Endowment Contract Life Insurance clipsbykelley

Articles Junction Types of Life Insurance Policies Life

Life Insurance Legal Definition Life Insurance

Modified Endowment Contract Life Insurance clipsbykelley

What is an endowment policy and when should you go for it

Security Insurance Brokers (India) Private Limited

5 Factors to Consider Before Purchasing an Endowment

Endowment Loan Definition Local Mortgage Insider

Principle of insurance ss 2 2 nd term

🎉 Endowment meaning in economics. Endowment. 20190116

Endowment Policy Saving Plans, Features & Benefits

The Difference between Endowments and Unit Trusts ⋆

What is a traded endowment policy

TYPES OF LIFE INSURANCE POLICIES IN INDIA

The Endowment Policy Was a Sure Thing • The Insurance Pro Blog

Endowment Insurance Plan A 360 Degree Analysis PlanMoneyTax

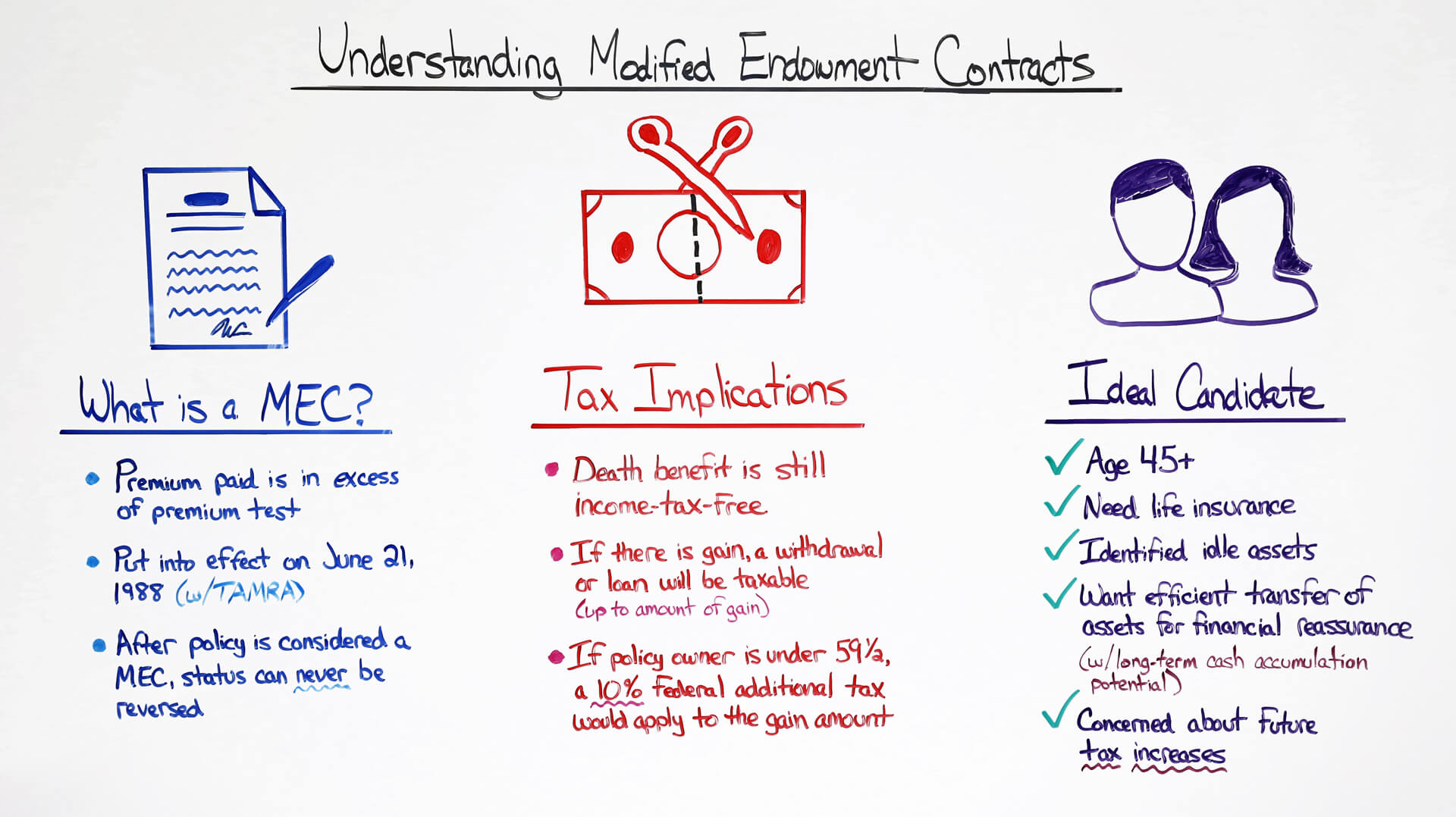

Understanding Modified Endowment Contracts (MEC)