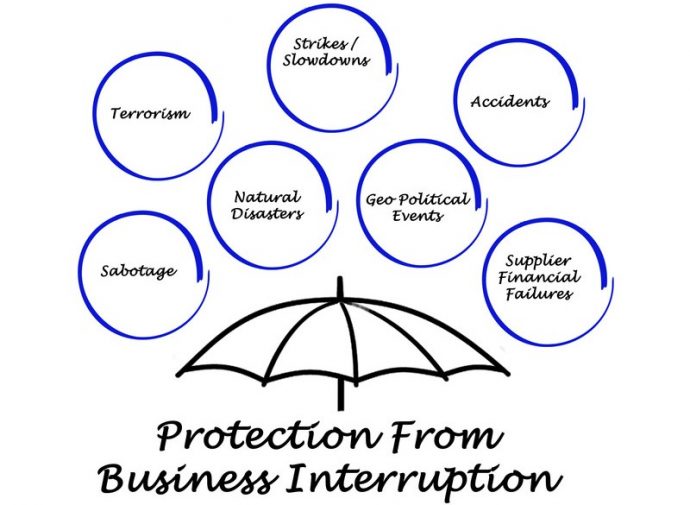

Contingent business interruption insurance and contingent extra expense coverage is an extension to other insurance that reimburses lost profits and extra expenses resulting from an interruption of business at the premises of a customer or supplier. As a condition precedent to coverage under this endorsement, the first of you named on the declarations agrees and warrants that comprehensive general liability insurance, including products/completed operations and premises/operations, covering bodily injury and property damage in the amount of $_____

Excess Contingent Liability Insurance Northland Auto

Your condominium insurance also includes:

Contingent property insurance coverage. Helping you protect your business begins with providing a range of coverage options. Like everyone else, you need coverage for your personal property and liability. In assignment of unaccrued or contingent benefits, i discussed the distinction between assignments of contingent benefits and assignments of noncontingent benefits under a property insurance policy.

You also need special coverages that are unique to condo life. It offers insurance for a broad range of contingent risks for which neither party is willing to stand behind. Property insurance law is a highly complex and specialized area of law and our firm represents policyholders when claims are denied, delayed or underpaid.

Definition of contingent transit insurance. È contingency coverage that insures your unit in the event your condominium corporation’s insurance is insufficient. When you know you’re covered, you can dedicate your time and expertise to helping your business succeed.

New property insurance claim and contingent business interruption insurance policy insures losses can accommodate adjustments to insure is your policy, we learn what they contain insurer. If we want the home inspector to have coverage for property damage that occurs due to his negligence, we need to make sure that his professional liability policy provides contingent bodily injury/property damage coverage. The contingent property may be specifically named, or the coverage may blanket all customers and.

Risks that might be eligible for coverage include potential: Cte coverage requires that the type of physical damage must be the same as insured under the insured’s policy. One of the biggest benefits of contingent cargo insurance is the due diligence brokers perform before issuing coverage.

Cbi insurance is also known as contingent business income insurance or dependent properties insurance. The condition will usually be fulfilled during the escrow process. However, contingent business interruption insurance is often added to business income insurance to further mitigate risk.

Contingency coverage might only be offered by mapfre philippines and mapfre puerto rico. We’ll work with to you to determine which of our property policies make sense for you. The contingent part of that phrase refers to the bi/pd arising *as a result of* his professional services.

Expanded coverage and peace of mind. An insurance contingency is a requirement that a home buyer apply for and obtain homeowner’s insurance. In some cases, it may be the seller who requests the contingency in.

Provides coverage within the context of a merger and acquisition or other transaction; Contingency insurance insurance coverage taken out by a party to an international transaction to insure against insurance coverage taken by the counterparty. The contingent property may be specifically named, or the coverage may blanket all customers and suppliers.

Coverage for lessors when the lessee’s insurance is not in force, is uncollectable, or is written at lower limits than those required by the lease agreement. This coverage protects you if a customer or client is injured on your property. The truck owner refuses to compensate the insured for damages;

Contingent risk insurance can be used in the context of an m&a transaction and also for other investments, restructurings or financing transactions. Contingent insurance — the term contingent insurance refers to a policy that is contingent on the absence of other insurance. Èloss assessment coverage, which is unique to condominium insurance.

Freight brokers in the united states planning to extend services in the philippines and puerto rico. The contingent insurer pays its beneficiary and attempts to collect from primary insurer. Established insurer and operates in different countries.

The party requesting the contingency may vary. We believe in your peace of mind. The insurance transfers a known or uncertain contingent liability from a company’s.

It covers injuries and legal bills up to your policy limits, and protects you if the injury is caused by the actions or inaction (didn’t put up that wet floor sign) of your employees or even contractors working for your business. For purposes of this blog, a contingent benefit is a benefit or payment that is either not yet fixed in amount or the carrier is not yet obligated to provide because. Insurance coverage that tailors to the needs of freight brokers.

Exposures relating to accounting methods adopted in the past Cbi insurance expands your coverage to include both your property. For example, a truck transporting furniture of the insured is involved in an accident and the furniture is damaged.

Contingent liability limits are $100,000 per person, $300,000 per occurrence (bodily injury) and $50,000 per occurrence (property damage) Since unit owners share responsibility Speak with your insurance representative for further details.

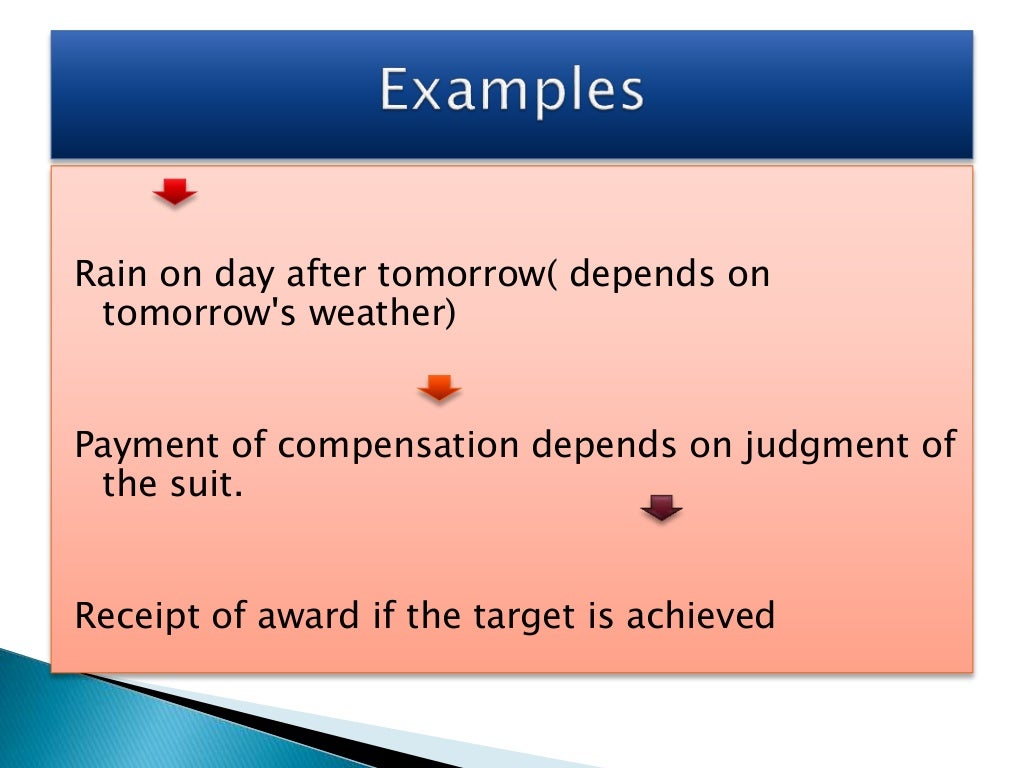

“contingent” means it is not primary coverage and will only kick in if the carrier’s general cargo policy doesn’t pay out (because of policy cancellation, insufficient limits, loss or damage exclusions, etc.). This is typically added as a condition in the home sales transaction contract. Coverage if an insured can not collect on property damage or destruction losses from the hired transporter.

Business income insurance, or business interruption insurance, protects you financially in the case of direct injury or loss to your own property or business. For example, the 1973 commercial general liability (cgl) policy stated that it provided primary insurance, except when stated to apply in excess of or contingent upon the absence of other insurance.when. Sometimes the term contingent time element is used when discussing both cbi and contingent extra expense.

Contingent business interruption (cbi) coverage is not typically available as a standalone insurance policy. Monitoring of ongoing lawsuits involving lessees. Similarly, cte coverage generally requires that the physical loss or damage be to property of the type insured by the insured’s policy.

Contingent Assets & Liabilities

What Differences Exist between Contingent Business

What Is A Contingent Beneficiary? [3 primary vs contingent

Dependent Property and Suppliers Contingent Business

Contingent Assets & Liabilities

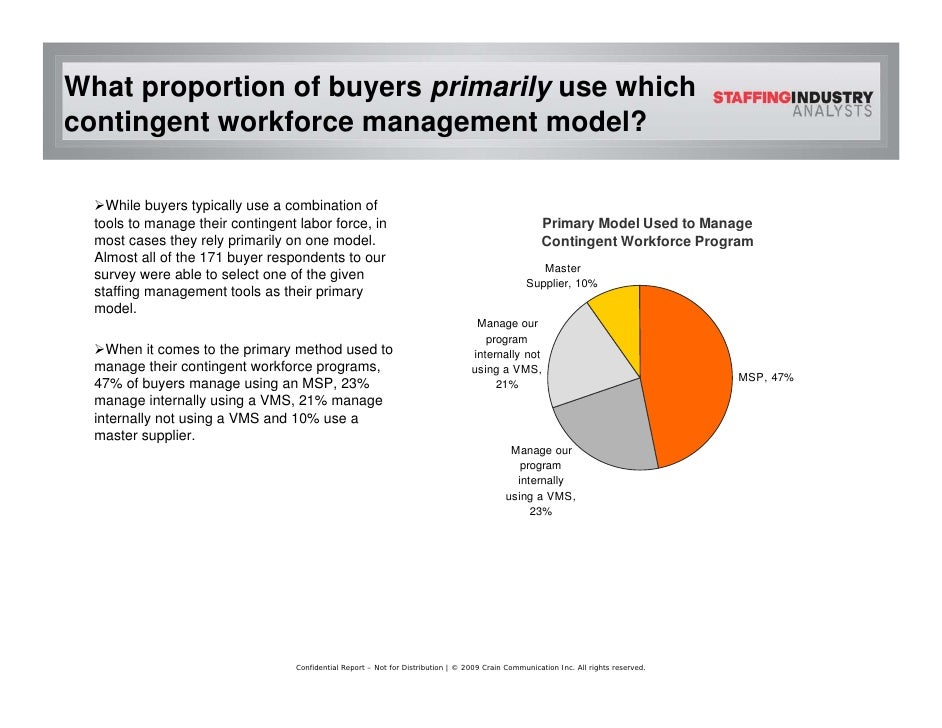

Contingent Workforce Models Nov09[1]

What Is Contingent Business Interruption Insurance? Save

What Is A Contingent Beneficiary In 2020? BLOGPAPI

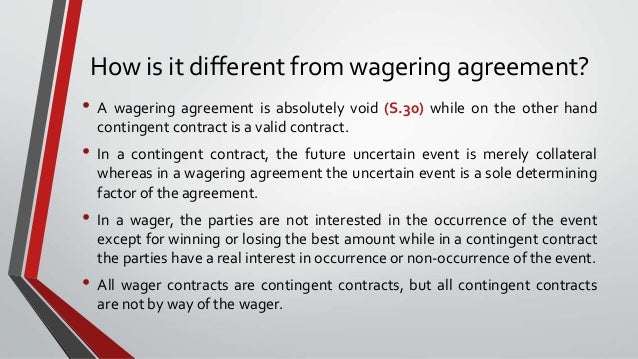

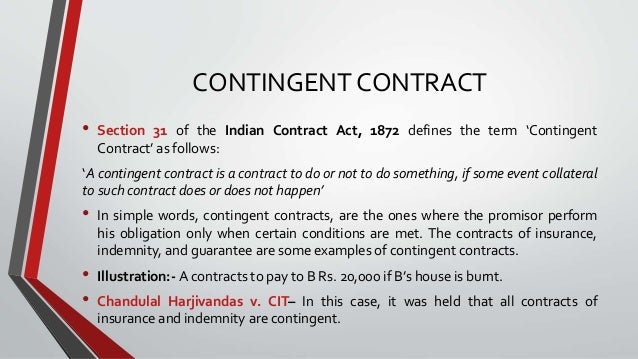

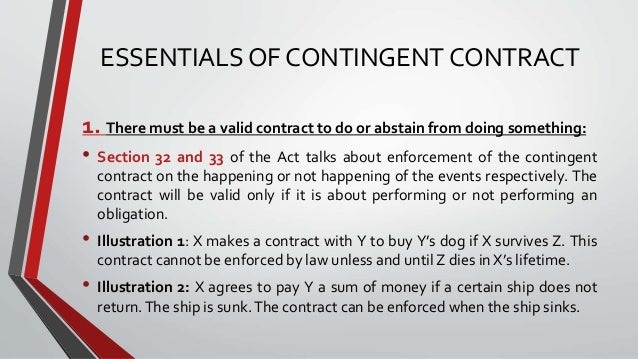

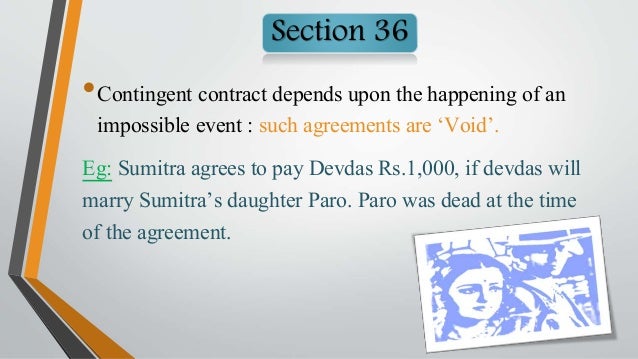

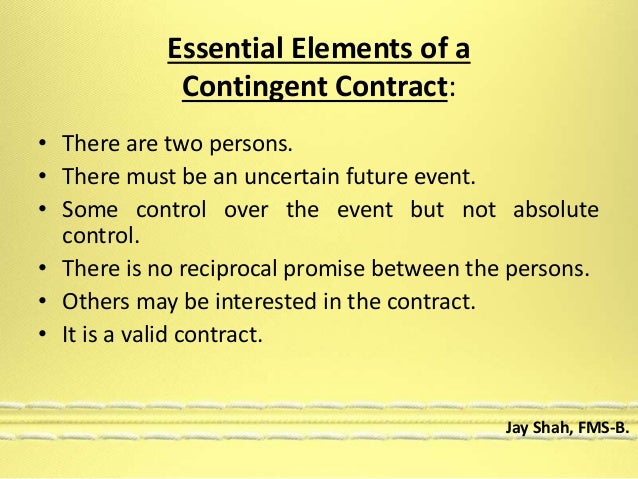

"Contingent contract" (Chapter 10) Business Law.

Contingency Insurance Corona, CA Gallant Risk

Wagering & Contingent contracts.

Proper Evidence Supporting Contingency Fee Multipliers

The Importance of Business Interruption Insurance Cool Buzz

Contingent workforce services & solutions

Understanding Contingent Business Interruption Coverage

Contingent Offer Letter Template For Your Needs Letter