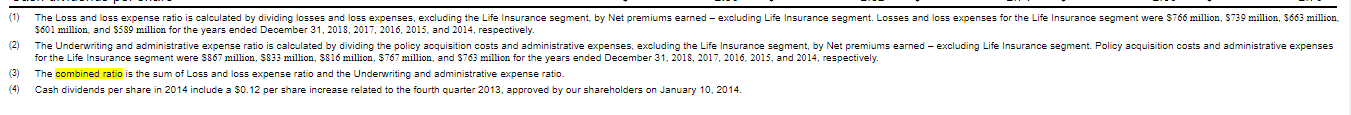

Normally the commission paid to the reinsurance company as an offset against its agent’s commission, premium taxes and other costs of doing business; Acquisition costs those costs that are primarily related to the acquisition of new or renewal of insurance contracts, e.g.

How the Combined Ratio Reveals Profitable Insurance

Munich will hold 49% stake in the merged entity.

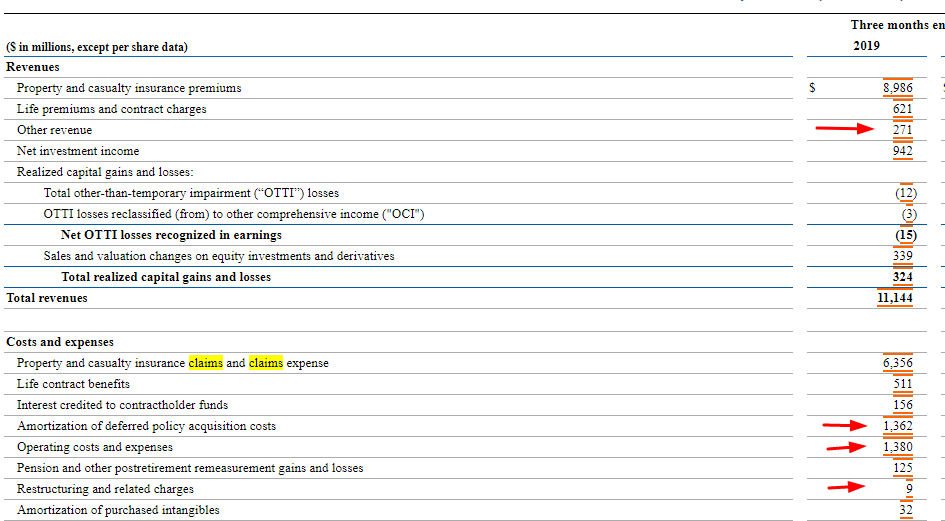

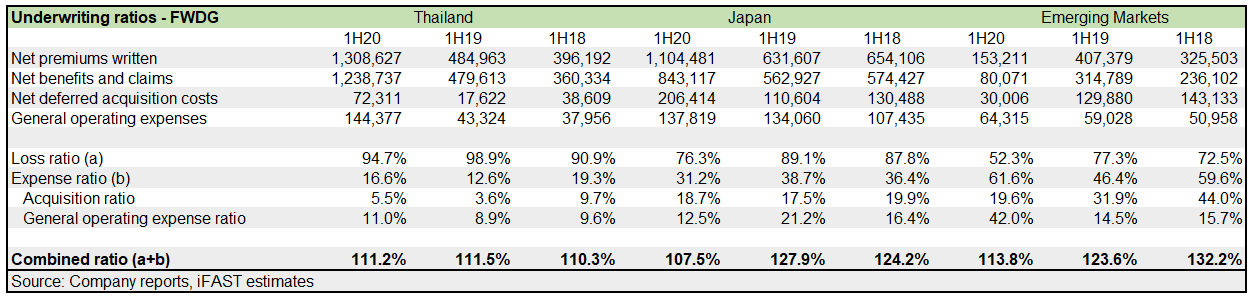

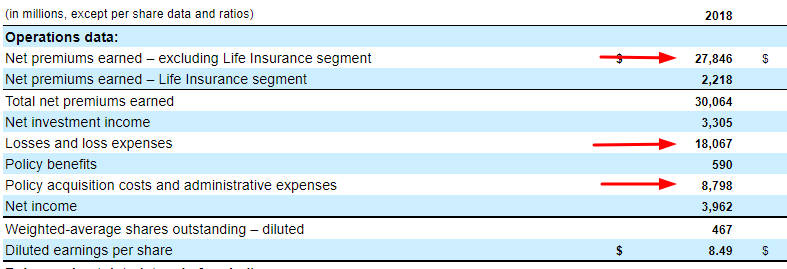

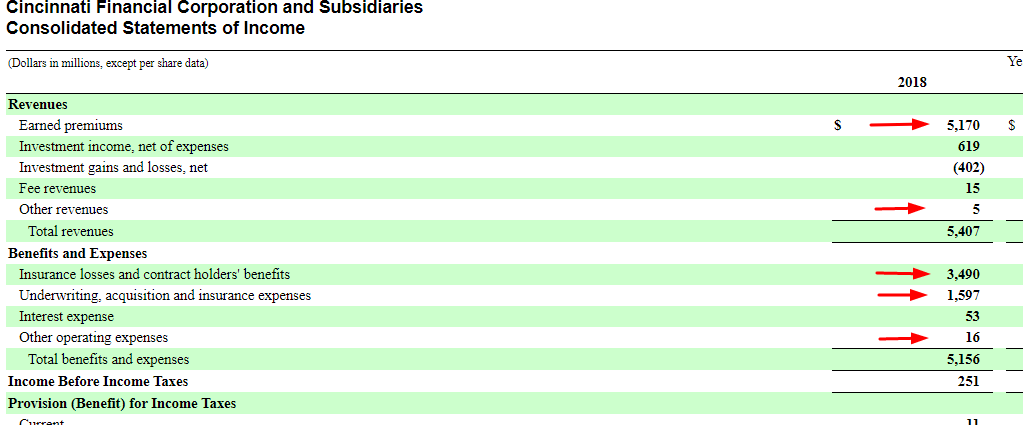

Acquisition ratio insurance. A combined operating ratio below 100% indicates profitable underwriting results. These costs are required to be expensed in the same ratio as the premiums to which they relate are earned. For example, from 2000 to 2016, the acquisition cost ratio in german life insurance fell by 10 percent, and the administration cost ratio fell by 34 percent.

Measurement of the liability for future policy benefits In the insurance industry, deferred acquisition costs are the accumulated costs of acquiring new insurance contracts and amortizing them over the duration of the contracts. Amortization of deferred acquisition costs (dac) presentation and disclosures;

It combines corporate finance, the economics of p/c insurers, and actuarial versus financial views. Acquisition costs are often expressed as a percentage of earned premium and referred to as the acquisition cost ratio. According to vertafore, the industry average expense ratio is 36.5%.

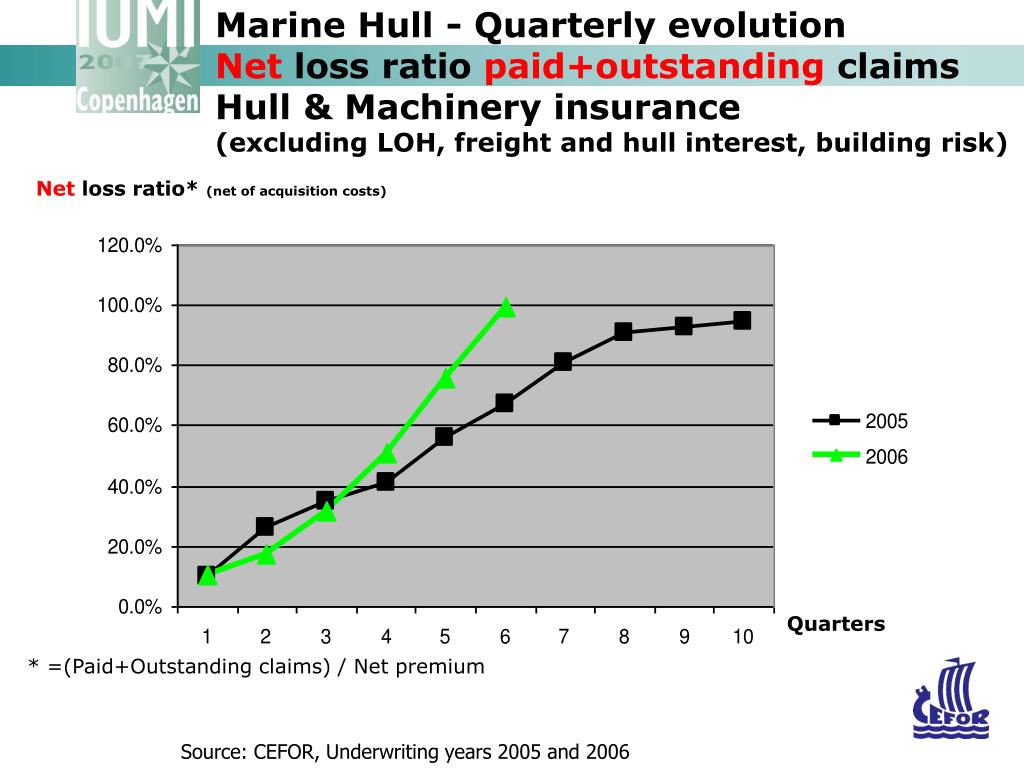

The insurance industry from a financial perspective in calendar year 2020. What is combined ratio used for? Notice the numerator is expressed as an annualized number.

A combined operating ratio over 100% indicates unprofitable underwriting results. The price to earnings ratio is calculated by taking the latest closing price and dividing it by the most recent earnings per share (eps) number. Includes reinsurance brokers commission where applicable.

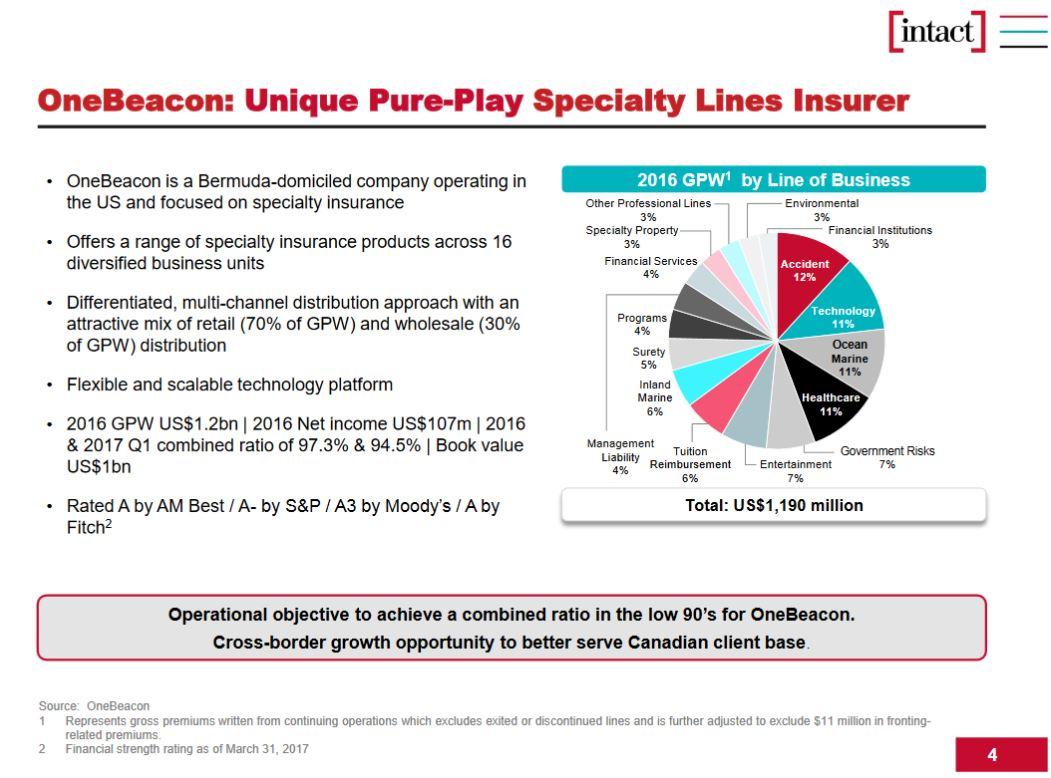

Italy has experienced a similar decline in life insurance, while countries such as france, spain, and the united kingdom have experienced an increase in cost ratios. On june 19, 2019, hdfc had announced the acquisition of 51.16% equity stake of apollo munich health insurance for rs 1,495.81 crore (includes 0.36% of employees stake for rs 10.67 crore). Combined ratio is perhaps the most useful way to determine the profitability of an underwriting operation.

In the current session, insurance acquisition inc. Packaged products and contracts with different rights and obligations 4. This ratio is calculated to ascertain the soundness of the long term financial policies of the firm.

We do this for a couple of reasons. The percentage of premium used to pay all the costs of acquiring, writing, and servicing insurance and reinsurance. For a calendar year policy, acquisition costs are expensed evenly each month, with the.

Insu) is trading at $14.35, after a 22.40% increase. The sustained low interest rate environment The company's ability to improve its combined ratio, retain business and achieve synergies and maintain market position arising from successful integration plans relating to the acquisition, as well as management's estimates and expectations in relation to future economic and business conditions and other factors in relation to the acquisition and resulting impact.

This is because net income is rising each. We focus on nine key areas that could have the biggest impact on i nance systems, processes and operations: Acquisition costs — direct costs an insurer incurs to acquire the premium—for example, commissions paid to a broker or fronting company.

Boosting customer acquisition for p&c insurers with insights. Here is the formula for calculating your cac ratio: The trade basis combined ratio of insurance company xyz is 0.93, or 93% = ($15 million / $25 million + $10 million / $30 million).

Increased granularity of accounting 3. The sum of the claims ratio, commission ratio and expense ratio. The pe ratio is a simple way to assess whether a stock is over or under valued and is the most widely used valuation measure.

In the example above, we can see that the retention ratio for alice’s business is going down each year. Using the formula above, we can calculate the retention ratio for each period: Acquisition costs all expenses directly related to acquiring insurance or reinsurance accounts;

Insurance industry was able to maintain its financial health in 2020. This section provides an overview of the insurance industry’s financial performance and condition in 2020. Eligibility for the paa 2.

Combined ratio is a measure of performance used by underwriters/insurance companies. Current and historical p/e ratio for delwinds insurance acquisition (dwin) from 2021 to 2021. How to calculate your cac ratio.

The average close ratio across the p&c insurance industry is 55%, which means 45% of prospects were missed during the process. Challenges the general insurance industry faces in implementing ifrs 17. The paper balances the theoretical and practical aspects.

The german insurer will pay rs 294 crore to apollo hospitals enterprise and apollo energy for terminating. Quoting and underwriting are the key phases within the policy life cycle to acquire a new customer. Although the primary purpose of the paper is to investigate the acquisition valuation of p/c insurers, its conclusions are applicable to other areas as well.

This ratio is calculated to assess the ability of. Over the past month, the stock increased by 42.31%, and in the past year, by 45.63%. If the premium is stated gross of acquisition costs, or brokerage, then it is likely that the expense ratio is.

How the Combined Ratio Reveals Profitable Insurance

loss ratio Archives Insurance Thought Leadership

Blog CoreData Research Australia

PPT Global Marine Insurance Report 2007 PowerPoint

How the Combined Ratio Reveals Profitable Insurance

Mass Home Insurance Adjusted Combined Ratio 2018 Agency

Credit update 07 Jan 21 FWD Group Ltd continues

Acquisition and administrative costs ratio in motor

How the Combined Ratio Reveals Profitable Insurance

Compute the capital acquisition ratio What does the ratio

Delwinds Insurance Acquisition Corp. Wt, DWIN.WT Quick

Insurance Analysis SNL Financial LC

Zurich Insurance Underwriting And Policy Acquisition Costs

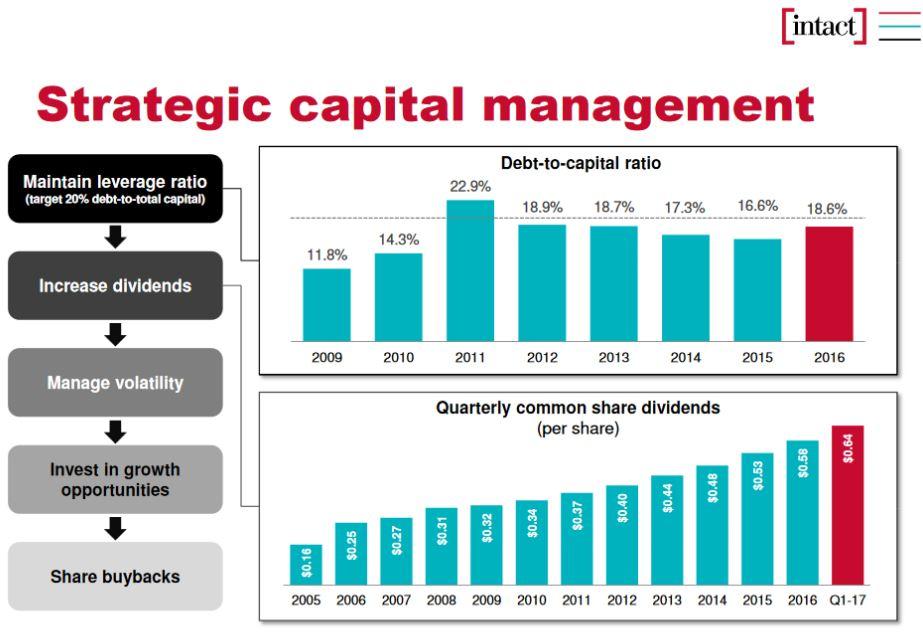

Intact Financial Great Growth Potential In The U.S

Aviva plc reports combined ratio of 98.9 for Canada in H1

Intact Financial Great Growth Potential In The U.S

How the Combined Ratio Reveals Profitable Insurance

Impact of P/NAV ratios on acquisitions and rights issues

Intact Financial Stock Analysis Great Growth Potential